Question: Task - Based on the information provided, determine the impact of the impairment analysis on goodwill as of and for the year ended 1 2

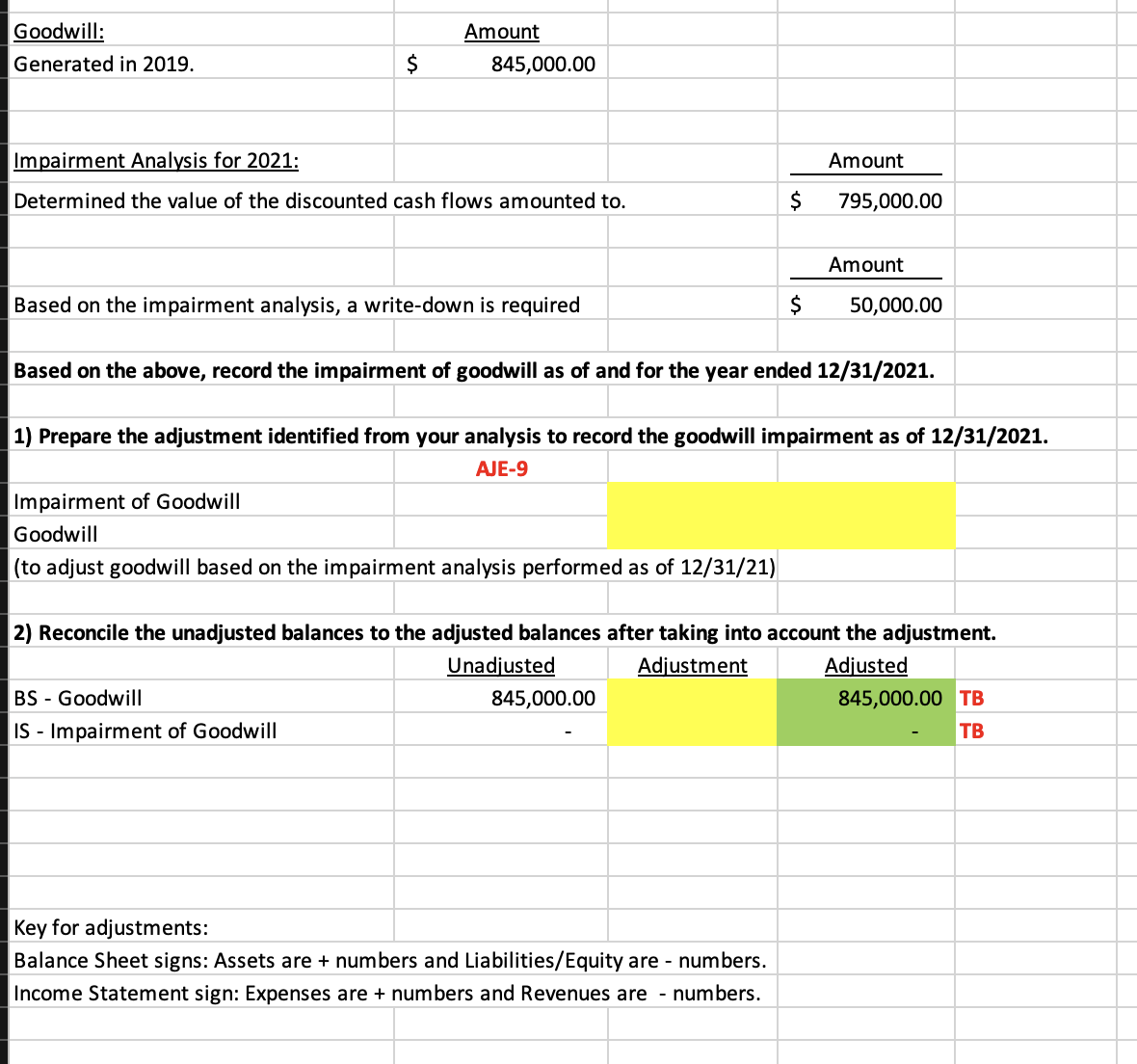

Task Based on the information provided, determine the impact of the impairment analysis on goodwill as of and for the year ended If there is an impairment of goodwill as of the balance sheet date, there will be a write down of the recorded goodwill to expense during the year the impairment occurred. The writedown amount is given. Determine the adjustment required to properly state goodwill as of and the related impairment of goodwill expense for the year ended based on the information presented.

Based on the above, record the impairment of goodwill as of and for the year ended

Prepare the adjustment identified from your analysis to record the goodwill impairment as of

ANE Impairment of Goodwill Goodwill

to adjust goodwill based on the impairment analysis performed as of

Reconcile the unadjusted balances to the adjusted balances after taking into account the adjustment.

Unadjusted Adjustment Adjusted BS Goodwill TB IS Impairment of Goodwill TB Key for adjustments: Balance Sheet signs: Assets are numbers and LiabilitiesEquity are numbers. Income Statement sign: Expenses are numbers and Revenues are numbers.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock