Question: TASK DESCRIPTION Answer BOTH questions and provide the relevant references for your justification. 1. Withholding Tax (WHT) is an amount withheld by the party making

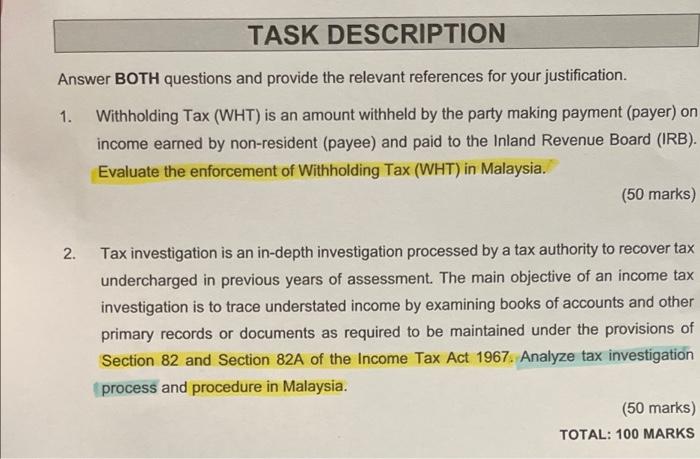

TASK DESCRIPTION Answer BOTH questions and provide the relevant references for your justification. 1. Withholding Tax (WHT) is an amount withheld by the party making payment (payer) on income earned by non-resident (payee) and paid to the Inland Revenue Board (IRB). Evaluate the enforcement of Withholding Tax (WHT) in Malaysia. (50 marks) 2. Tax investigation is an in-depth investigation processed by a tax authority to recover tax undercharged in previous years of assessment. The main objective of an income tax investigation is to trace understated income by examining books of accounts and other primary records or documents as required to be maintained under the provisions of Section 82 and Section 82A of the Income Tax Act 1967. Analyze tax investigation process and procedure in Malaysia. (50 marks) TOTAL: 100 MARKS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts