Question: TASK: Find a multi - family ( 8 or more units ) property online currently for sale located in Texas. Any number of units and

TASK: Find a multifamily or more units property online currently for sale located in Texas. Any number of units and price is okay as long as it is multifamily and units or more.

PLEASE WORK ON THIS PROPERTY:

Roseland Ave, Dallas, TX

Show on Map

Date Added:

November

Days on Market:

days

Time Since Last Update:

days

Details:

Property Type: Multifamily

Subtype: Apartment Building

Investment Type: Core

Class: A

Square Footage:

Occupancy:

ProForma NOI: $

Units:

Year Built:

Buildings:

Stories:

Zoning: MF

Lot Size: sq ft

Broker CoOp: Yes

Question Buyers Perspective Answer to be placed on Page answer sheet You are the investor and are analyzing the purchase of the property you found online. Find or calculate the expected NOIs for your subject property. Use the Ch reading and Ch excel to calculate the most you should pay for the property.

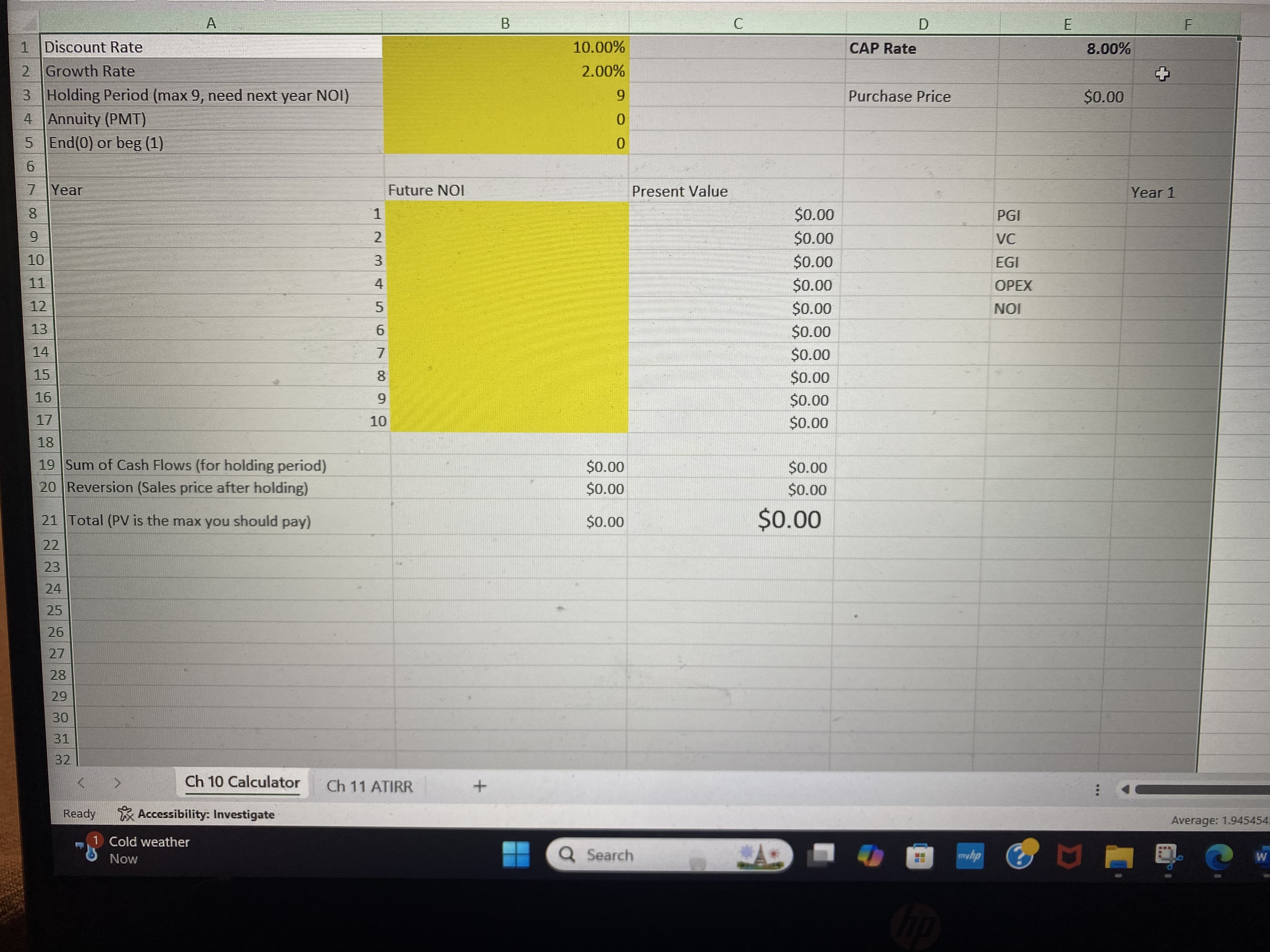

Part A Paste screenshot of your Ch excel calculations of the Future NOI, PV Sum of cash flows, reversion and total should be cells A through CHERE IS THE Ch excel: Discount Rate

CAP Rate

Growth Rate

Holding Period max need next year NOI

Purchase Price

$

Annuity PMT

End or beg

Year

Future NOI

Present Value

Year

$

PGI

$

VC

$

EGI

$

OPEX

$

NOI

$

$

$

$

$

Sum of Cash Flows for holding period

$

$

Reversion Sales price after holding

$

$

Total PV is the max you should pay

$

$

Part B List specific and real differences between the purchase assumptions for Part A and the property you found. Dont make this up research your property and area. Do not put general answers that could apply to any property.

Part C Modify your calculation with your specific and real differences and explain how it impacts what you are willing to pay.

PURCHASE ASSUMPTIONS for Part A

Listed Price online Sales Price

st year Total Annual Rent of Sales Price

Longrun Rent Growth Annual

Vacancy and Collection losses $

Operating Expenses of Total Annual Rent

Your Required Rate of Return

Holding Period years

PLEASE USE THIS EXCEL SHEET AND SHOW THE EXCEL CALCULATION FOR ME:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock