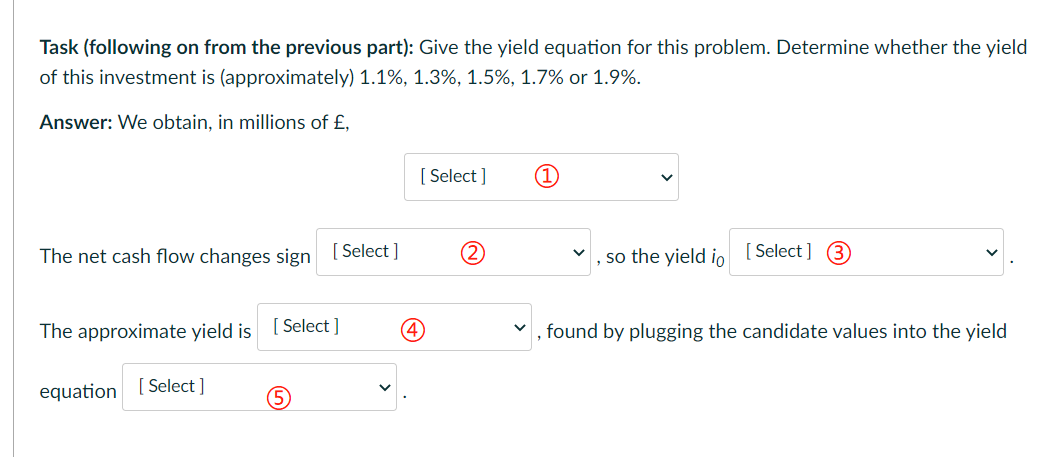

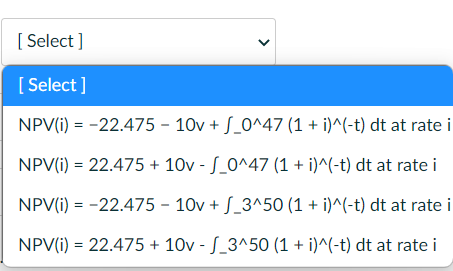

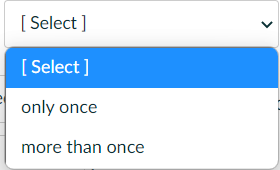

Question: Task (following on from the previous part): Give the yield equation for this problem. Determine whether the yield of this investment is (approximately) 1.1%, 1.3%,

![, [Select] 1 The net cash flow changes sign [Select] 2 ,](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66ee9b400ba56_34366ee9b3fb24df.jpg)

![so the yield io [ Select ] 3 The approximate yield is](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66ee9b40cae6e_34466ee9b406b739.jpg)

![[ Select] 4 found by plugging the candidate values into the yield](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66ee9b4175904_34566ee9b4127d31.jpg)

Task (following on from the previous part): Give the yield equation for this problem. Determine whether the yield of this investment is (approximately) 1.1%, 1.3%, 1.5%, 1.7% or 1.9%. Answer: We obtain, in millions of , [Select] 1 The net cash flow changes sign [Select] 2 , so the yield io [ Select ] 3 The approximate yield is [ Select] 4 found by plugging the candidate values into the yield equation [Select ] 5 [ Select ] > [ Select] NPV(i) = -22.475 - 10v+S_0447 (1 + i)^(-t) dt at rate i NPV(i) = 22.475 + 10v - S_0^47 (1 + i)^(-t) dt at rate i NPV(i) = -22.475 - 10v + S_3150 (1 + i)^(-t) dt at rate i NPV(i) = 22.475 + 10v - S_3450 (1 + i)^(-t) dt at rate i [ Select] V [ Select] only once more than once [ Select] [ Select] exists does not exist L [ Select] [ Select] 1.1% 1.3% 1.5% 1.7% 1.9% [ Select] [Select ] NPV(i) = 0 NPV(i) = T A(i) = 0 A(i) = T Task (following on from the previous part): Give the yield equation for this problem. Determine whether the yield of this investment is (approximately) 1.1%, 1.3%, 1.5%, 1.7% or 1.9%. Answer: We obtain, in millions of , [Select] 1 The net cash flow changes sign [Select] 2 , so the yield io [ Select ] 3 The approximate yield is [ Select] 4 found by plugging the candidate values into the yield equation [Select ] 5 [ Select ] > [ Select] NPV(i) = -22.475 - 10v+S_0447 (1 + i)^(-t) dt at rate i NPV(i) = 22.475 + 10v - S_0^47 (1 + i)^(-t) dt at rate i NPV(i) = -22.475 - 10v + S_3150 (1 + i)^(-t) dt at rate i NPV(i) = 22.475 + 10v - S_3450 (1 + i)^(-t) dt at rate i [ Select] V [ Select] only once more than once [ Select] [ Select] exists does not exist L [ Select] [ Select] 1.1% 1.3% 1.5% 1.7% 1.9% [ Select] [Select ] NPV(i) = 0 NPV(i) = T A(i) = 0 A(i) = T

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts