Question: Task # Points Task Description 1 5 You are interested in purchasing a home. What will your monthly payment be if you take out a

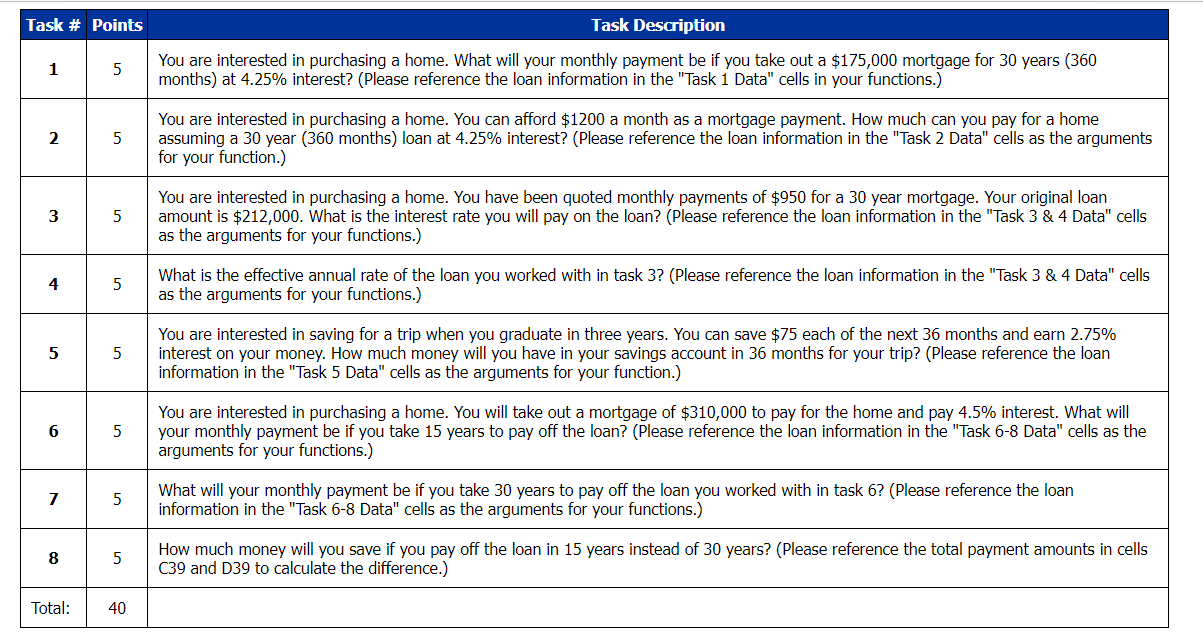

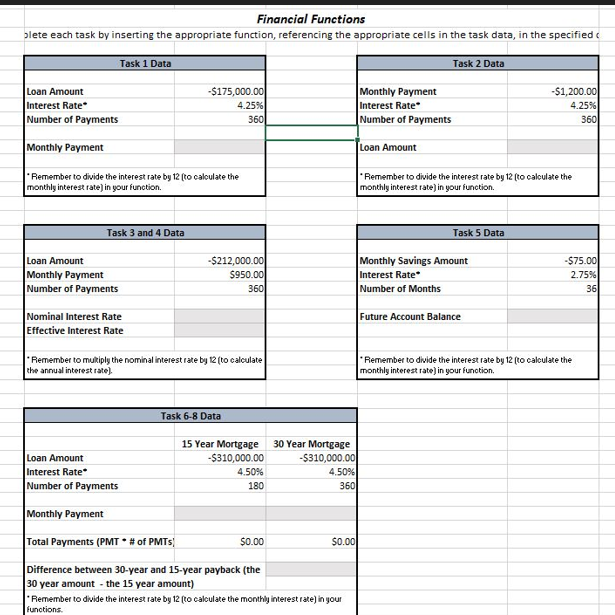

Task # Points Task Description 1 5 You are interested in purchasing a home. What will your monthly payment be if you take out a $175,000 mortgage for 30 years (360 months) at 4.25% interest? (Please reference the loan information in the "Task 1 Data" cells in your functions.) 2 5 5 You are interested in purchasing a home. You can afford $1200 a month as a mortgage payment. How much can you pay for a home assuming a 30 year (360 months) loan at 4.25% interest? (Please reference the loan information in the "Task 2 Data" cells as the arguments for your function.) 3 5 You are interested in purchasing a home. You have been quoted monthly payments of $950 for a 30 year mortgage. Your original loan amount is $212,000. What is the interest rate you will pay on the loan? (Please reference the loan information in the "Task 3 & 4 Data" cells as the arguments for your functions.) 4 5 What is the effective annual rate of the loan you worked with in task 3? (Please reference the loan information in the "Task 3 & 4 Data" cells as the arguments for your functions.) 5 5 You are interested in saving for a trip when you graduate in three years. You can save $75 each of the next 36 months and earn 2.75% interest on your money. How much money will you have in your savings account in 36 months for your trip? (Please reference the loan information in the "Task 5 Data" cells as the arguments for your function.) 6 5 You are interested in purchasing a home. You will take out a mortgage of $310,000 to pay for the home and pay 4.5% interest. What will your monthly payment be if you take 15 years to pay off the loan? (Please reference the loan information in the "Task 6-8 Data" cells as the arguments for your functions.) 7 5 What will your monthly payment be if you take 30 years to pay off the loan you worked with in task 6? (Please reference the loan information in the "Task 6-8 Data" cells as the arguments for your functions.) 8 5 How much money will you save if you pay off the loan in 15 years instead of 30 years? (Please reference the total payment amounts in cells C39 and D39 to calculate the difference.) Total: 40 Financial Functions blete each task by inserting the appropriate function, referencing the appropriate cells in the task data, in the specified Task 1 Data Task 2 Data Loan Amount Interest Rate Number of Payments -$175,000.00 4.25% 360 Monthly Payment Interest Rate Number of Payments -$1,200.00 4.25% 360 Monthly Payment Loan Amount * Remember to divide the interest rate by 12 (to calculate the monthly interest rate) in your function. Remember to divide the interest rate by 12 (to calculate the monthly interest rate) in your function. Task 3 and 4 Data Task 5 Data Loan Amount Monthly Payment Number of Payments -$212,000.00 $950.00 360 Monthly Savings Amount Interest Rate Number of Months -$75.00 2.75% 36 Nominal Interest Rate Effective Interest Rate Future Account Balance Remember to mukiply the nominal interest rate by 12(to calculate the annual interest rate) Remember to divide the interest rate by 12 (to calculate the monthly interest rate) in your function. Task 6-8 Data Loan Amount Interest Rate Number of Payments 15 Year Mortgage -$310,000.00 4.50% 180 30 Year Mortgage -$310,000.00 4.50% 360 Monthly Payment Total Payments (PMT * # of PMTS/ $0.00 $0.00 Difference between 30-year and 15-year payback (the 30 year amount - the 15 year amount) Remember to divide the interest rate by 12 (to calculate the monthly interest rate) in your functions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts