Question: Task Question 40: If a subcontractor accepts an indemnification clause which provides that he is liable to the prime contractor for any reduction in the

Task

Question 40: If a subcontractor accepts an indemnification clause which provides that he is liable to the prime contractor for any reduction in the prime contract price arising out of defective data which he furnishes, the clause should contain provisions which: (a) Provide the subcontractor with a method of appeal (b) Disclaim any liability on the part of the subcontractor (c) Make the subcontractor who ultimately receives the contract liable (d) Provide for payment directly to the Government

Question 41: Which of the following is an indication of potential defective pricing fraud? (a) Failure to correct known system deficiencies which lead to defective pricing (b) Using a vendor other than the one proposed (c) Changed dates (d) Indications of falsification or alteration of supporting data (e) All of the above

Question 42: Pricing is a __________ process of accumulating cost data. (a) Static (b) Dynamic

Question 43: The __________ initiates the internal detail cost estimating process at the cost kick-off meeting. (a) Program manager (b) Proposal manager (c) Auditor (d) Both (a) and (b)

Question 44: Which of the following types of contracts represents the least cost responsibility for the contractor? (a) Cost plus fixed fee (b) Firm fixed price (c) Fixed price incentive (d) Fixed price redetermination

Question 45: A Cost Plus Fixed Fee Completion Form type of contract should be used when: (a) There is no confidence that the scope of work has been defined (b) There is no confidence in the cost estimate (c) No research and development work is contemplated (d) Hardware is being developed, or where a final report of research is required

Question 46: Contractors receive no fee under: (a) Fixed price incentive contracts (b) Performance incentive contracts (c) Cost contracts (d) CPFF Completion Form contracts

Question 47: __________ is most suitable for use in procurements of complex military weapons where there are substantial development goals or potentialities for improved performance which are of great importance to the government. (a) Firm fixed price (b) Fixed price incentive (c) Performance incentive (d) Fixed price with award fees

Question 48: If a change takes place because of a new Cost Accounting Standard, or a change in a disclosed accounting practice, the contractor: (a) Must agree to an equitable adjustment if a contract cost is affected (b) Must negotiate with the contracting officer the cost/price impact of the change (c) Must agree to an adjustment in the contract price or cost allowance if he fails to comply with Cost Accounting Standards and such failure results in increased costs paid by the United States (d) All of the above

Question 49: Only the __________ has authority to waive all or any part of the CAS clauses. (a) Contracting Officer (b) Secretary of Defense (c) Cost Accounting Standards Board (d) Comptroller General

Question 50: The auditor must review a Disclosure Statement for: (a) Adequacy (b) Allocability (c) Reasonableness (d) Mathematical errors (e) Allowability

Question 51: Which of the following statements about the Disclosure Statement is untrue? (a) It is a formal description of the contractor's accounting system (b) It is actually a benchmark for determining contract compliance (c) It describes the accounting system the contractor intends to use to account for costs on a contract (d) Once the Disclosure Statement is submitted by a contractor, it may not be changed

Question 52: Which of the following is an advantage of multiyear contracting? (a) Stabilization of work forces (b) Substantial continuity of production (c) Lower cost (d) All of the above

Question 53: The multiyear procurement system is compatible with: (a) Sealed bidding (b) Two-step sealed bidding (c) Negotiation (d) All of the above (e) Only (a) and (b) above

Question 54: If a multiyear contract is terminated for default, the Government's rights include: (a) The remaining items to be procured (b) The entire multiyear quantity (c) Only those items already procured (d) None of the above

Question 55: Under fixed-price-type contracts, the contractor is generally paid __________ as items are delivered. (a) Progress payments (b) Guaranteed loans (c) Advance payments (d) Partial payments (e) None of the above

Question 56: Partial payments may be used in conjunction with: (a) Progress payments (b) Guaranteed loans (c) Advance payments (d) All of the above (e) None of the above

Question 57: Under what circumstances may a subcontractor secure a guaranteed loan? (a) Under no circumstances (b) Generally, under the same circumstances as prime contractors (c) Up to 50% of receivables (d) Up to 50% of inventory and work in process (e) Up to 70% of receivables

Question 58: Which of the following statements is untrue about the Changes clause? (a) The right of the contracting officer to issue a "change order" is not a matter of implied right or statute (b) The Changes clause provides that the contracting officer may issue a "change order" without the consent of the contractor (c) The Changes clause provides for an equitable adjustment in the price or delivery schedule (d) Government prefers to issue unilateral changes rather than negotiate changes with the contractor

Question 59: The Changes clause provides that, "any claim by the contractor for adjustment under this clause must be asserted within __________ from the date of receipt by the contractor or notification of the change." (a) 24 hours (b) 10 days (c) 2 weeks (d) 30 days

Question 60: There are two basic types of cost-plus-fixed-fee contracts. __________ describes the scope of work to be done in general terms and which obligates the contractor to devote a specified level of effort for a stated period of time for the conduct of research and development activities. (a) Completion Form (b) Term Form

Question 61: The Government is normally required to purchase the initial supply of spare parts from the: (a) Original prime contractor (b) Manufacturer who actually fabricates the parts (c) Neither of the above

Question 62: __________ is an element to be considered in spare parts pricing but does not affect end item pricing. (a) Assembly labor (b) Start-up costs (c) Engineering documentation (d) Development engineering

Question 63: Production costs of contract data are largely: (a) Labor costs (b) Material and processing costs (c) Neither of the above

Question 64: When the contractor submits a termination inventory schedule, the most important factor which must be represented correctly is: (a) Quantity of items (b) Allocability (c) The acquisition cost of the items (d) An accurate description of the items

Question 65: Once a contract has been terminated, the contracting officer may not modify or rescind the notice without: (a) Approval of the Head of the Procuring Activity (b) The contractor's consent (c) Audit by the Government Accountability Office (d) Audit by the Defense Contract Audit Agency

Question 66: The plant clearance period begins: (a) On the effective date of contract termination (b) When the contractor submits acceptable inventory schedules (c) 24 hours after the contractor receives the Notice of Termination (d) When the contractor's personnel office receives notice of the termination

Question 67: Use of the __________ basis for settlement proposals is generally preferred by the Government. (a) Total cost (b) Inventory (c) Percentage of completion (d) None of the above

Question 68: A contractor may not request an amount in excess of the contract price in a termination claim except: (a) When he/she is operating on a loss and the contract is nearly completed (b) For settlement expenses (c) When authorized by the contracting officer (d) None of the above

Question 69: The contractor may charge storage costs for termination inventory starting from: (a) The date of termination (b) The beginning of the plant clearance period (c) The end of the plant clearance period (d) The date that he/she submits acceptable inventory schedules

Question 70: The established base used for measurement of contract performance is called the: (a) Contract Target Cost (b) Contract Budget Base (c) Performance Measurement Baseline (d) Control Account Performance Summary

Question 71: Earned value management is an integrative approach which brings together __________ to give the program or project manager an effective system for managing the program/project work. (a) Cost (b) Schedule (c) Technical planning and control (d) All of the above (e) Only (a) and (b) above

Question 72: The cost actually incurred and recorded in accomplishing the work within a given time period is called the: (a) Cost Variance. (b) Budget at Completion. (c) Actual Cost of Work Performed (ACWP). (d) Budgeted Cost for Work Performed (BCWP).

Question 73: To trigger a formal schedule or cost performance analysis, the program office establishes: (a) Variance thresholds (b) Scheduled review points (c) End of contract assessments (d) Periodic meetings depending on performance achievement

Question 74: The most important and critical part of earned value is: (a) The accurate determination of the actual cost of the work performed (b) A realistic approach to work package planning and BCWS values for milestones (c) The use of a computerized system for collecting data and calculating performance (d) The determination of cost performance compared to the originally developed plans

Question 75: __________ is responsible for evaluating the reasonableness of the offered prices. (a) Contracting officer (b) Price analyst (c) Engineer (d) Contract auditor (e) None of the above

Question 76: Cost estimates are submitted by contractors in connection with: (a) Modification and change proposals (b) Prices of spare parts (c) Rates for time and material contracts (d) Estimated and final costs of cost type contracts (e) All of the above

question 5.

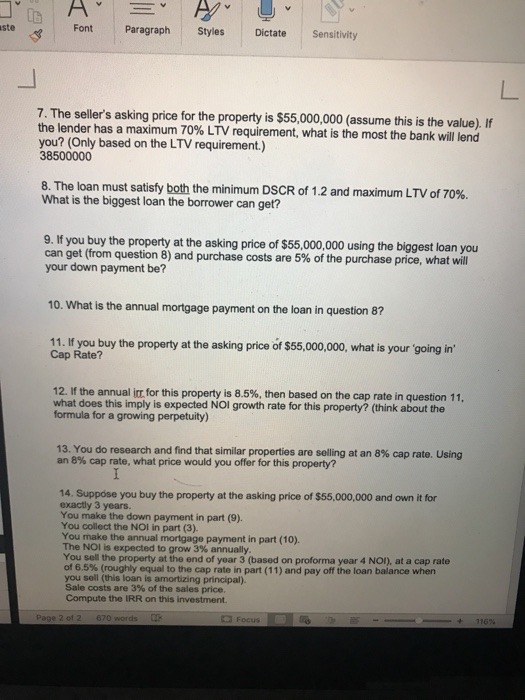

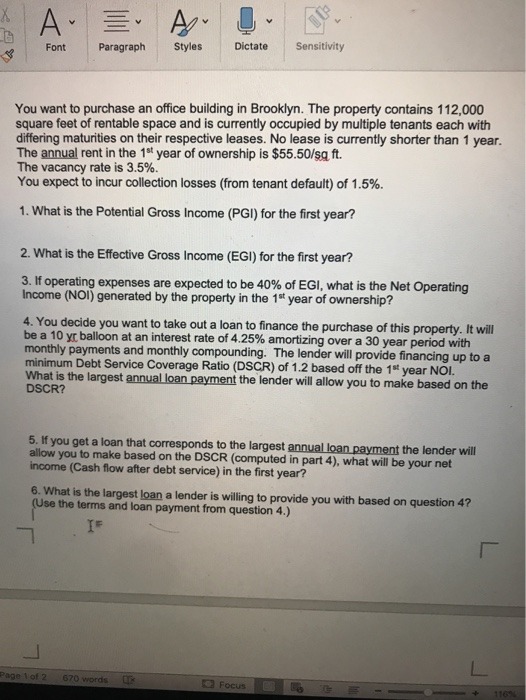

4. You decide you want to take out a loan to finance the purchase of this property. It will be a 10 yr balloon at an interest rate of 4.25% amortizing over a 30 year period with monthly payments and monthly compounding. The lender will provide financing up to a minimum Debt Service Coverage Ratio (DSCR) of 1.2 based off the 1st year NOI.

What is the largest annual loan payment the lender will allow you to make based on the DSCR?

5. If you get a loan that corresponds to the largest annual loan payment the lender will allow you to make based on the DSCR (computed in part 4), what will be your net income (Cash flow after debt service) in the first year?

6. What is the largest loan a lender is willing to provide you with based on question 4? (Use the terms and loan payment from question 4.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts