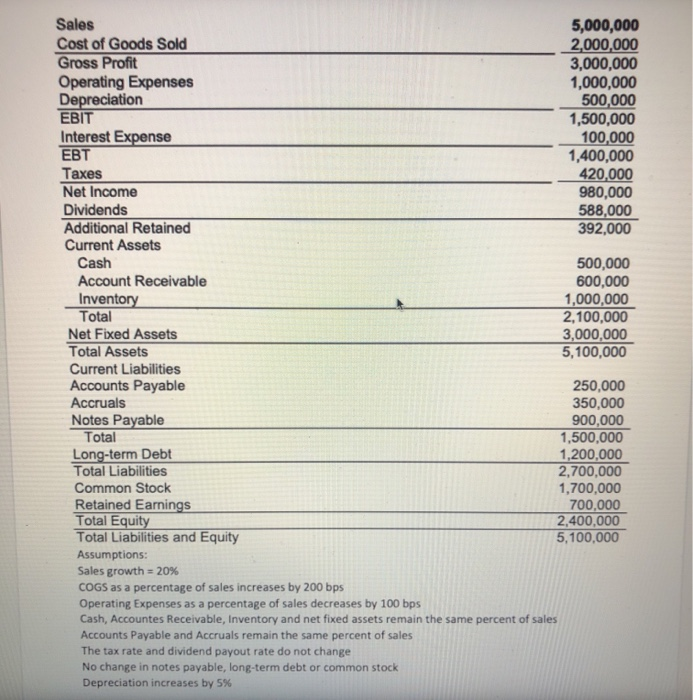

Question: Task: You are to use this information to create a proforma balance sheet and income statement; and use them to estimate external funds needed. Sales

Sales 5,000,000 Cost of Goods Sold 2,000,000 Gross Profit 3,000,000 Operating Expenses 1,000,000 Depreciation 500,000 EBIT 1,500,000 Interest Expense 100,000 EBT 1,400,000 Taxes 420,000 Net Income 980,000 Dividends 588,000 Additional Retained 392,000 Current Assets Cash 500,000 Account Receivable 600,000 Inventory 1,000,000 Total 2,100,000 Net Fixed Assets 3,000,000 Total Assets 5,100,000 Current Liabilities Accounts Payable 250,000 Accruals 350,000 Notes Payable 900,000 Total 1,500,000 Long-term Debt 1,200,000 Total Liabilities 2,700,000 Common Stock 1,700,000 Retained Earnings 700.000 Total Equity 2,400,000 Total Liabilities and Equity 5,100,000 Assumptions: Sales growth = 20% COGS as a percentage of sales increases by 200 bps Operating Expenses as a percentage of sales decreases by 100 bps Cash, Accountes Receivable, Inventory and net fixed assets remain the same percent of sales Accounts Payable and Accruals remain the same percent of sales The tax rate and dividend payout rate do not change No change in notes payable, long-term debt or common stock Depreciation increases by 5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts