Question: Task3: This task has been designed to assess your understanding and ability to perform, prepare and appraise e bank reconciliation. Use the given information in

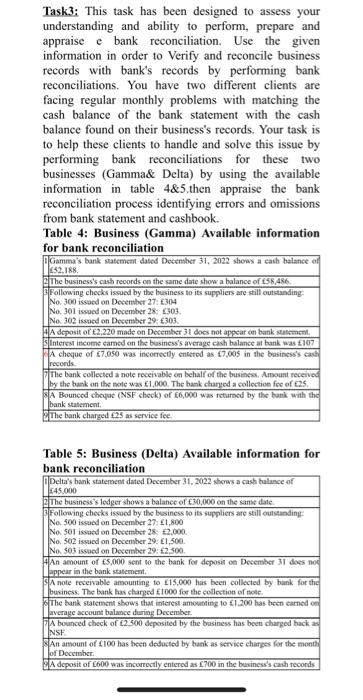

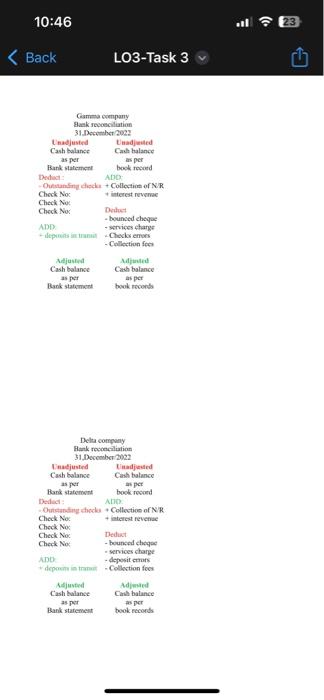

Task3: This task has been designed to assess your understanding and ability to perform, prepare and appraise e bank reconciliation. Use the given information in order to Verify and reconcile business records with bank's records by performing bank reconciliations. You have two different clients are facing regular monthly problems with matching the cash balance of the bank statement with the cash balance found on their business's records. Your task is to help these clients to handle and solve this issue by performing bank reconciliations for these two businesses (Gamma\& Delta) by using the available information in table 4&5, then appraise the bank reconciliation process identifying errors and omissions from bank statement and cashbook. Table 4: Business (Gamma) Available information for bank reconciliation Table 5: Business (Delta) Available information for bank reconciliation 10:46 .1123 Back LO3-Task 3 Gismena ceenpany glak recoecilutio 31.Dokwether 202? Linadjusted tuadjeiled Cash balance Cadh halance as per as per Fark stafemert boste requed Dedicat 4. [7c Duelanting Aveckin + Collection of N.R Cherk No: Check Nie if interest reverwes Check wos Nythet A7) - bounctd chayas AMP - services charep - Leprints an mann -. Chackar emurs - Ceillectiun foct Arlusinat Cash balanse as per llank stafkmort A.timite Cavh balance as pet houk recents. Delta compony Hark revoecilation 51 flececobr 2022 Winatjustind Cimiljestrd Cash balanee Cash balance as fer at pet Fank stafomert bock robuent idedich NIT) - Duruarater atocela + Colloctioe of NR Chack No. Check No Check Nos 4 isterest fevenae Check No: Dedus: - bourcht chaque ADT. - services sharpe * deporme in tranare - Lleposif ertufs - Collestion focs Asjuvtied. Cash bulance as per Ad matel Cak balance Bank starement as per book ecconds Appraise the bank reconciliation process identifying errors and omissions from a bank statement and cashbook Define Bank reconciliation Bank reconciliation purpose Why do the bank statement and cash book disagree? Omission Timing differences Errors

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts