Question: Tasks As CFO you are responsible for dealing with the accounting treatment of the scenarios outlined in the case study. Revaluation using the gross method

Tasks

As CFO you are responsible for dealing with the accounting treatment of the scenarios outlined in the case study.

Revaluation using the gross method

i) Provide a journal entry at 31 March 2022 for the revaluation of the equipment using the gross method. Show your workings.

Impairment

Showing all workings:

i) Prepare journal entries at 31 March 2019 to account for the revaluation of the equipment only.

ii) Prepare journal entries at 31 March 2021 to account for all transactions relating to the impaired equipment. Assume that management intends to continue using the equipment for its remaining useful life. Show all your workings.

iii) Prepare journal entries at 31 March 2022 to account for all transactions relating to the equipment.

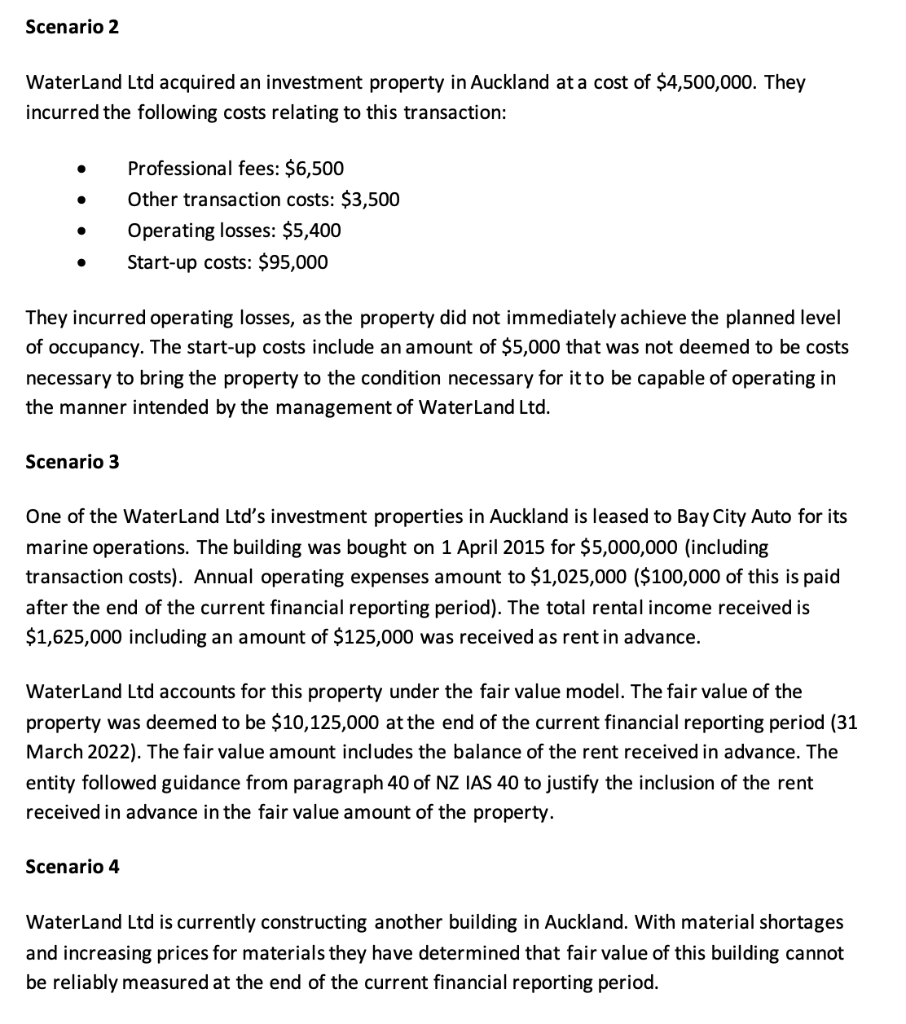

Read the scenario and complete the tasks that follow. Scenario: Bay City Auto Bay City Auto is a luxury car dealership operating in Hawkes Bay. They sell new and used cars and have a service and parts division. They hold the sole dealership for one luxury European brand and two mid-range brands. One of the mid-range brands has totally electric vehicles (EVs). They have a marine division based in both Hawkes Bay and Auckland which sells and services leisure craft. Bay City Auto owns the Hawkes Bay land and buildings and leases the Auckland buildings. The Hawkes Bay site has an adjacent investment property which houses a separate warehouse. This is on a separate title and is leased out. In order to hold the dealership for the EVs, Bay City Auto had to buy specialised equipment and alter the workshop so the new equipment would fit in, as well as install an EV charging station. This was a requirement from the brand owner. They have specified a quick charging station and require all EVs in for servicing to be charged before the cars are returned to the customer. They also had to retrain half of their technicians so servicing could be completed on the EVs. This new equipment meant that management is now making decisions about where and when to dispose of the old equipment. Since Covid the supply of new vehicles has become uncertain. This is due to the global semiconductor shortage squeezing the supply of microchips necessary in car manufacture. Every manufacturer has faced delays in production and for two of Bay City Auto's brands, manufacturing has been temporarily shut down. The war in Ukraine has disrupted the global supply of neon gas, which is used to make semiconductors. This has resulted in a large reduction of new vehicles available for sale and has pushed up the price of used vehicles. New vehicle sales are far below forecast and the cost of stock holdings for used vehicles has reduced available cash. The Clean Car rebate came into effect on 1 July 2021 and until 31 March 2022, provided fixed rebates (for eligible new and used light electric vehicles (EVs) and plug-in hybrid electric vehicles (PHEVs) after they are registered in New Zealand for the first time. This meant an increase in demand for the EVs Bay City Auto sells. Bay City Auto has found it difficult to meet the demand because of global supply issues. Boat orders have been far in excess of original forecasts, but worldwide shipping delays have meant that customers are waiting up to 6 months for their boats to arrive. Bay City Auto has a 31 March financial year-end and uses a discount rate of 5%. You have been appointed as CFO and are responsible for dealing with the accounting treatment of the scenarios outlined in the case study. Fair value measurement Bay City Auto applies the revaluation model to disclose its assets at fair value. As the CFO, you recently made a presentation to your finance business partners explaining the requirements of NZ IFRS 13 Fair Value Measurement. Management intends to revalue all its assets at the end of the current financial reporting period (31 March 2022). After your presentation, you receive the following email from the team requesting some clarification: DearAndi Thank you for updating us on IFRS 13. You made it relevant to the current valuation issues we are trying to understand and resolve. Our understanding is that the process consists of several steps. We discussed your presentation and together we have summarised our questions. Can you please provide us with more information by addressing the following points? 1. You noted that we should measure the fair value of our assets based on exit prices. As the specialised equipment can only be used to service the EVs we are unsure how it should be valued. Can you please explain fair value and what you mean by exit price? 2. We have difficulty in agreeing to the fair value measurement of old workshop equipment based on the following two scenarios. Please indicate whether our understanding is correct. We have established fair value is equal to $567,500 based on the observable price in Market B, less transaction and transportation costs. Scenario 2 Market A (advantageous market): The selling price is $400,000, with transaction costs of $1,000 and transportation costs of $20,000. Market B (advantageous market): The selling price is $450,000, with transaction costs of $1,000 and transportation costs of $25,000. We have established fair value is equal to $425,000 based on the observable price in Market B, net of transportation costs. Our argument is because Market B provides the highest observable price for the asset. 3. For the specialised equipment purchased to service the EVs we have established that the valuation premise is stand-alone premise. Which valuation technique(s) should be used to determine the fair value of the asset? 4. You mentioned that in certain circumstances it is acceptable to use only one valuation technique. What are the circumstances that you were refring to? 5. Because of Covid there has been a significant decrease in the supply of new vehicles and boats, with used vehicle and boat prices increasing. What factors should we be considering when we value the vehicles we keep as loaner cars (not for sale) at March 2022? Looking forward to your reply Kind regards Finance Business Partners team Revaluation using the gross method Bay City Auto purchased specialised diagnostic equipment for the EVs at a cost of $4,500,000 on 1 April 2020. The equipment is depreciated using the straight-line method over a period of 10 years to a zero residual value. At the end of the current financial reporting period (31 March 2022 ), the fair value of the equipment is deemed to be $3,000,000. The equipment will be revalued using the gross method. Impairment On 1 April 2016, Bay City Auto acquired boat maintenance equipment that cost $2,000,000. It was depreciated using the straight-line method over a period of 10 years with a $200,000 residual value. On 31 March 2019, the equipment was revalued to $1,500,000 using the net method. At that time, it was decided to depreciate the equipment using the straight-line method over a period of five years to a zero residual value. On 31 March 2021, due to the dramatic drop off in the supply, and therefore the servicing of boats, an impairment loss was recognised. The decision was based on the following information: - Annual net cash flows as follows: o Financial reporting period ending 31 March 2022: $275,000 - Financial reporting period ending 31 March 2023: $175,000 - Financial reporting period ending 31 March 2024: $120,000 - Fair value: $605,000 - Cost of removing the equipment: $25,000 - Incremental cost to bring the equipment into a condition ready to sell: $30,000 - Costs associated with re-organising the business operations at Bay City Auto following expected disposal of the asset: $10,000. There was no change made to remaining useful life at the time of recognising the impairment loss. On 31 March 2022, management decided to reverse the impairment loss recognised on 31 March 2021, because a shipment of boats from a bankrupt seller in Australia was on its way. The recoverable amount for the equipment, calculated at 31 March 2022, is $635,000. Investment Property As CFO, you need to consider the following scenarios relating to the accounting treatment of investment properties held by both Bay City Auto and WaterLand Ltd who own the Auckland premises Bay City Auto leases for its marine operations. Scenario 1 The Bay City Auto land in Hawkes Bay with the warehouse is leased to Tasman Enterprises. It is measured under the fair value model as described in NZ IAS 40. At present, the fair value of this building is deemed to be reliably measurable. Bay City Auto has a 60% interest in Tasman Enterprises. WaterLand Ltd acquired an investment property in Auckland at a cost of $4,500,000. They incurred the following costs relating to this transaction: - Professional fees: $6,500 - Other transaction costs: $3,500 - Operating losses: $5,400 - Start-up costs: $95,000 They incurred operating losses, as the property did not immediately achieve the planned level of occupancy. The start-up costs include an amount of $5,000 that was not deemed to be costs necessary to bring the property to the condition necessary for it to be capable of operating in the manner intended by the management of WaterLand Ltd. Scenario 3 One of the WaterLand Ltd's investment properties in Auckland is leased to Bay City Auto for its marine operations. The building was bought on 1 April 2015 for $5,000,000 (including transaction costs). Annual operating expenses amount to $1,025,000($100,000 of this is paid after the end of the current financial reporting period). The total rental income received is $1,625,000 including an amount of $125,000 was received as rent in advance. WaterLand Ltd accounts for this property under the fair value model. The fair value of the property was deemed to be $10,125,000 at the end of the current financial reporting period ( 31 March 2022). The fair value amount includes the balance of the rent received in advance. The entity followed guidance from paragraph 40 of NZ IAS 40 to justify the inclusion of the rent received in advance in the fair value amount of the property. Scenario 4 WaterLand Ltd is currently constructing another building in Auckland. With material shortages and increasing prices for materials they have determined that fair value of this building cannot be reliably measured at the end of the current financial reporting period. Read the scenario and complete the tasks that follow. Scenario: Bay City Auto Bay City Auto is a luxury car dealership operating in Hawkes Bay. They sell new and used cars and have a service and parts division. They hold the sole dealership for one luxury European brand and two mid-range brands. One of the mid-range brands has totally electric vehicles (EVs). They have a marine division based in both Hawkes Bay and Auckland which sells and services leisure craft. Bay City Auto owns the Hawkes Bay land and buildings and leases the Auckland buildings. The Hawkes Bay site has an adjacent investment property which houses a separate warehouse. This is on a separate title and is leased out. In order to hold the dealership for the EVs, Bay City Auto had to buy specialised equipment and alter the workshop so the new equipment would fit in, as well as install an EV charging station. This was a requirement from the brand owner. They have specified a quick charging station and require all EVs in for servicing to be charged before the cars are returned to the customer. They also had to retrain half of their technicians so servicing could be completed on the EVs. This new equipment meant that management is now making decisions about where and when to dispose of the old equipment. Since Covid the supply of new vehicles has become uncertain. This is due to the global semiconductor shortage squeezing the supply of microchips necessary in car manufacture. Every manufacturer has faced delays in production and for two of Bay City Auto's brands, manufacturing has been temporarily shut down. The war in Ukraine has disrupted the global supply of neon gas, which is used to make semiconductors. This has resulted in a large reduction of new vehicles available for sale and has pushed up the price of used vehicles. New vehicle sales are far below forecast and the cost of stock holdings for used vehicles has reduced available cash. The Clean Car rebate came into effect on 1 July 2021 and until 31 March 2022, provided fixed rebates (for eligible new and used light electric vehicles (EVs) and plug-in hybrid electric vehicles (PHEVs) after they are registered in New Zealand for the first time. This meant an increase in demand for the EVs Bay City Auto sells. Bay City Auto has found it difficult to meet the demand because of global supply issues. Boat orders have been far in excess of original forecasts, but worldwide shipping delays have meant that customers are waiting up to 6 months for their boats to arrive. Bay City Auto has a 31 March financial year-end and uses a discount rate of 5%. You have been appointed as CFO and are responsible for dealing with the accounting treatment of the scenarios outlined in the case study. Fair value measurement Bay City Auto applies the revaluation model to disclose its assets at fair value. As the CFO, you recently made a presentation to your finance business partners explaining the requirements of NZ IFRS 13 Fair Value Measurement. Management intends to revalue all its assets at the end of the current financial reporting period (31 March 2022). After your presentation, you receive the following email from the team requesting some clarification: DearAndi Thank you for updating us on IFRS 13. You made it relevant to the current valuation issues we are trying to understand and resolve. Our understanding is that the process consists of several steps. We discussed your presentation and together we have summarised our questions. Can you please provide us with more information by addressing the following points? 1. You noted that we should measure the fair value of our assets based on exit prices. As the specialised equipment can only be used to service the EVs we are unsure how it should be valued. Can you please explain fair value and what you mean by exit price? 2. We have difficulty in agreeing to the fair value measurement of old workshop equipment based on the following two scenarios. Please indicate whether our understanding is correct. We have established fair value is equal to $567,500 based on the observable price in Market B, less transaction and transportation costs. Scenario 2 Market A (advantageous market): The selling price is $400,000, with transaction costs of $1,000 and transportation costs of $20,000. Market B (advantageous market): The selling price is $450,000, with transaction costs of $1,000 and transportation costs of $25,000. We have established fair value is equal to $425,000 based on the observable price in Market B, net of transportation costs. Our argument is because Market B provides the highest observable price for the asset. 3. For the specialised equipment purchased to service the EVs we have established that the valuation premise is stand-alone premise. Which valuation technique(s) should be used to determine the fair value of the asset? 4. You mentioned that in certain circumstances it is acceptable to use only one valuation technique. What are the circumstances that you were refring to? 5. Because of Covid there has been a significant decrease in the supply of new vehicles and boats, with used vehicle and boat prices increasing. What factors should we be considering when we value the vehicles we keep as loaner cars (not for sale) at March 2022? Looking forward to your reply Kind regards Finance Business Partners team Revaluation using the gross method Bay City Auto purchased specialised diagnostic equipment for the EVs at a cost of $4,500,000 on 1 April 2020. The equipment is depreciated using the straight-line method over a period of 10 years to a zero residual value. At the end of the current financial reporting period (31 March 2022 ), the fair value of the equipment is deemed to be $3,000,000. The equipment will be revalued using the gross method. Impairment On 1 April 2016, Bay City Auto acquired boat maintenance equipment that cost $2,000,000. It was depreciated using the straight-line method over a period of 10 years with a $200,000 residual value. On 31 March 2019, the equipment was revalued to $1,500,000 using the net method. At that time, it was decided to depreciate the equipment using the straight-line method over a period of five years to a zero residual value. On 31 March 2021, due to the dramatic drop off in the supply, and therefore the servicing of boats, an impairment loss was recognised. The decision was based on the following information: - Annual net cash flows as follows: o Financial reporting period ending 31 March 2022: $275,000 - Financial reporting period ending 31 March 2023: $175,000 - Financial reporting period ending 31 March 2024: $120,000 - Fair value: $605,000 - Cost of removing the equipment: $25,000 - Incremental cost to bring the equipment into a condition ready to sell: $30,000 - Costs associated with re-organising the business operations at Bay City Auto following expected disposal of the asset: $10,000. There was no change made to remaining useful life at the time of recognising the impairment loss. On 31 March 2022, management decided to reverse the impairment loss recognised on 31 March 2021, because a shipment of boats from a bankrupt seller in Australia was on its way. The recoverable amount for the equipment, calculated at 31 March 2022, is $635,000. Investment Property As CFO, you need to consider the following scenarios relating to the accounting treatment of investment properties held by both Bay City Auto and WaterLand Ltd who own the Auckland premises Bay City Auto leases for its marine operations. Scenario 1 The Bay City Auto land in Hawkes Bay with the warehouse is leased to Tasman Enterprises. It is measured under the fair value model as described in NZ IAS 40. At present, the fair value of this building is deemed to be reliably measurable. Bay City Auto has a 60% interest in Tasman Enterprises. WaterLand Ltd acquired an investment property in Auckland at a cost of $4,500,000. They incurred the following costs relating to this transaction: - Professional fees: $6,500 - Other transaction costs: $3,500 - Operating losses: $5,400 - Start-up costs: $95,000 They incurred operating losses, as the property did not immediately achieve the planned level of occupancy. The start-up costs include an amount of $5,000 that was not deemed to be costs necessary to bring the property to the condition necessary for it to be capable of operating in the manner intended by the management of WaterLand Ltd. Scenario 3 One of the WaterLand Ltd's investment properties in Auckland is leased to Bay City Auto for its marine operations. The building was bought on 1 April 2015 for $5,000,000 (including transaction costs). Annual operating expenses amount to $1,025,000($100,000 of this is paid after the end of the current financial reporting period). The total rental income received is $1,625,000 including an amount of $125,000 was received as rent in advance. WaterLand Ltd accounts for this property under the fair value model. The fair value of the property was deemed to be $10,125,000 at the end of the current financial reporting period ( 31 March 2022). The fair value amount includes the balance of the rent received in advance. The entity followed guidance from paragraph 40 of NZ IAS 40 to justify the inclusion of the rent received in advance in the fair value amount of the property. Scenario 4 WaterLand Ltd is currently constructing another building in Auckland. With material shortages and increasing prices for materials they have determined that fair value of this building cannot be reliably measured at the end of the current financial reporting period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts