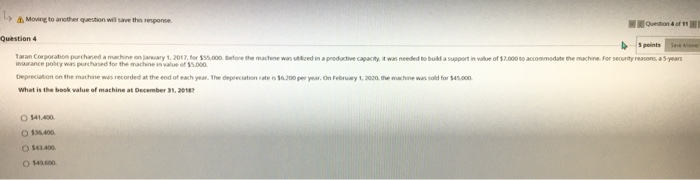

Question: Tave Moving to another question will save this response Question of Question 4 5 points Taran Corporation purchased a machine on awary 1, 2017 for

Tave Moving to another question will save this response Question of Question 4 5 points Taran Corporation purchased a machine on awary 1, 2017 for $55,000. Before the machine wasted in a productive capacity, it was needed to build a support in value of 2000 to accommodate the machine. For security reasons, a 5 years insurance policy was purchased for the machine in value of $5.000 Depreciation on the machine was recorded at the end of each year. The depreciation rate 16.00 per year. On by 1, 2000. the machine was sold for 55.000 What is the book value of machine at December 1, 2017 O 141.400 5.400 541400 149

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts