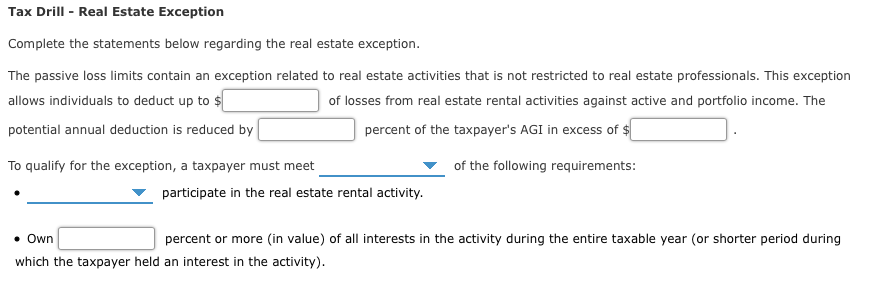

Question: Tax Drill - Real Estate Exception Complete the statements below regarding the real estate exception. The passive loss limits contain an exception related to real

Tax Drill - Real Estate Exception Complete the statements below regarding the real estate exception. The passive loss limits contain an exception related to real estate activities that is not restricted to real estate professionals. This exception allows individuals to deduct up to $ of losses from real estate rental activities against active and portfolio income. The potential annual deduction is reduced by percent of the taxpayer's AGI in excess of $ of the following requirements: To qualify for the exception, a taxpayer must meet participate in the real estate rental activity. Own percent or more in value) of all interests in the activity during the entire taxable year (or shorter period during which the taxpayer held an interest in the activity)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts