Question: Tax Drill - Section 1 2 5 3 Tndicate whether the following statements are True or False regarding the tax treatment of franchises, trademarks, and

Tax Drill Section

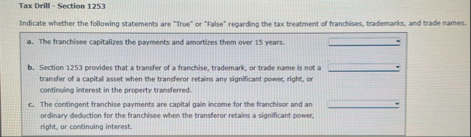

Tndicate whether the following statements are "True" or "False" regarding the tax treatment of franchises, trademarks, and trade names.

a The franchisee capitalizes the payments and amortizes them over years.

b Section provides that a transfer of a franchise, trademark, or trade name is not a transfer of a capital asset when the transferor retains any significant powec, right, or continuing interest in the property transferred.

c The contingent franchise payments are capital gain income for the franchisor and an

ordinary deduction for the franchisee when the transferor retains a significant power, right, or coekinuing interest.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock