Question: TAX FORM/RETURN PREPARATION PROBLEMS Dave Stevens, age 34, is a self-employed physical therapist. His wife Sarah, age 31 teaches English as a Second Language at

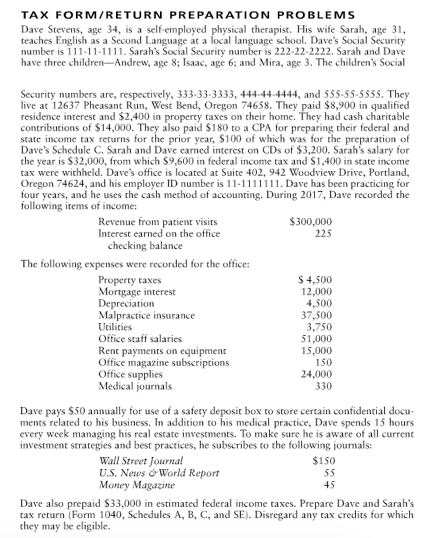

TAX FORM/RETURN PREPARATION PROBLEMS Dave Stevens, age 34, is a self-employed physical therapist. His wife Sarah, age 31 teaches English as a Second Language at a local language school. Dave's Social Security number is 111-11-1111. Sarah's Social Security number is 222-22-2222. Sarah and Dave have three children-Andrew, age 8; Isaac, age 6; and Mira, age 3. The children's Social Security numbers are, respectively, 333-33-3333, 444-44-4444, and SS5-55-5555. They live at 12637 Pheasant Run, West Bend, Oregon 74658. They paid $8,900 in qualified residence interest and $2,400 in property taxes on their home. contributions of $14,000. They also paid $180 to a CPA for preparing their federal and state income tax returns for the prior year, $100 of which was for the preparation of Dave's Schedule C. Sarah and Dave carned interest on CDs of $3,200. Sarah's salary for the year is $32,000, from which $9,600 in federal income tax and S1,400 in state income tax were withheld. Dave's office is located at Suite 402, 942 Woodview Drive, Portland, Oregon 74624, and his employer ID number is 11-1111111. Dave has been practicing for four years, and he uses the cash method of accounting. During 2017, Dave recorded the had cash charitable Revenue from patient visits Interest earned on the office $300,000 225 checking balance The following expenses were recorded for the office: $4,500 12,000 4,500 37,500 3,750 51,000 15,000 150 24,000 Property taxes Mortgage interest Depreciation Malpractice insurance Office staff salaries Rent payments on equipment Office magazine subscriptions Medical journals Dave pays $50 annually for use of a safery deposit box to store certain confidential docu ments related to his business. In addition to his medical practice, Dave spends 15 hours every week managing his real estate investments. To make sure he is aware of all current investment strategies and best practices, he subscribes to the following journals: Wall Street Journal U.S. News &World Report Money Magazine 150 Dave also prepaid S33,000 in estimated federal income taxes. Prepare Dave and Sarah's tax return (Form 1040, Schedules A, B, C, and SE). Disregard any tax credits for which they may be eligible

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts