Question: Tax homework help - will rate! 3. Joyce is single, age 45, and had the following income and expenses during 2020: Income Salary $45,000 Rent

Tax homework help - will rate!

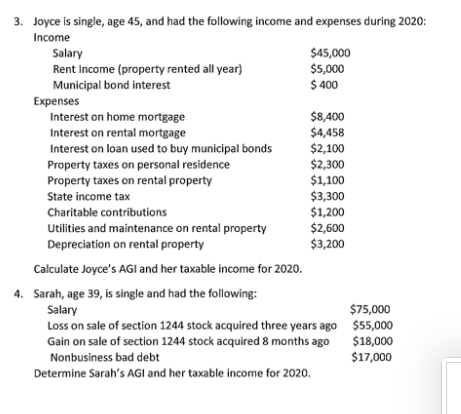

3. Joyce is single, age 45, and had the following income and expenses during 2020: Income Salary $45,000 Rent Income (property rented all year) $5,000 Municipal bond interest $ 400 $ Expenses Interest on home mortgage $8,400 Interest on rental mortgage $4,458 Interest on loan used to buy municipal bonds $2,100 Property taxes on personal residence $2,300 Property taxes on rental property $1,100 State income tax $3,300 Charitable contributions $1,200 Utilities and maintenance on rental property $2,600 Depreciation on rental property $3,200 Calculate Joyce's AG and her taxable income for 2020. 4. Sarah, age 39, is single and had the following: Salary $75,000 Loss on sale of section 1244 stock acquired three years ago $55,000 Gain on sale of section 1244 stock acquired 8 months ago $18,000 Nonbusiness bad debt $17,000 Determine Sarah's AGI and her taxable income for 2020. 3. Joyce is single, age 45, and had the following income and expenses during 2020: Income Salary $45,000 Rent Income (property rented all year) $5,000 Municipal bond interest $ 400 $ Expenses Interest on home mortgage $8,400 Interest on rental mortgage $4,458 Interest on loan used to buy municipal bonds $2,100 Property taxes on personal residence $2,300 Property taxes on rental property $1,100 State income tax $3,300 Charitable contributions $1,200 Utilities and maintenance on rental property $2,600 Depreciation on rental property $3,200 Calculate Joyce's AG and her taxable income for 2020. 4. Sarah, age 39, is single and had the following: Salary $75,000 Loss on sale of section 1244 stock acquired three years ago $55,000 Gain on sale of section 1244 stock acquired 8 months ago $18,000 Nonbusiness bad debt $17,000 Determine Sarah's AGI and her taxable income for 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts