Question: Tax Rate Schedules 2019: https://www.bankrate.com/finance/taxes/tax-brackets.aspx Tax Tables. 2019: https://www.irs.gov/pub/irs-pdf/i1040tt.pdf Find The Average tax rate and The Marginal Tax Rate for A to H Determine the

Tax Rate Schedules 2019:

https://www.bankrate.com/finance/taxes/tax-brackets.aspx

Tax Tables. 2019:

https://www.irs.gov/pub/irs-pdf/i1040tt.pdf

Find The Average tax rate and The Marginal Tax Rate for A to H

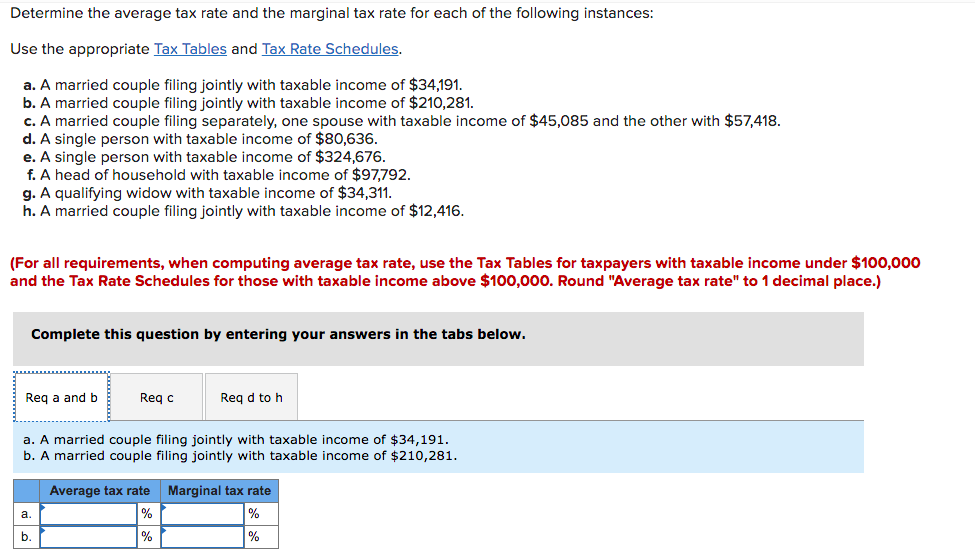

Determine the average tax rate and the marginal tax rate for each of the following instances: Use the appropriate Tax Tables and Tax Rate Schedules. a. A married couple filing jointly with taxable income of $34,191. b. A married couple filing jointly with taxable income of $210,281. c. A married couple filing separately, one spouse with taxable income of $45,085 and the other with $57,418. d. A single person with taxable income of $80,636. e. A single person with taxable income of $324,676. f. A head of household with taxable income of $97,792. g. A qualifying widow with taxable income of $34,311. h. A married couple filing jointly with taxable income of $12,416. (For all requirements, when computing average tax rate, use the Tax Tables for taxpayers with taxable income under $100,000 and the Tax Rate Schedules for those with taxable income above $100,000. Round "Average tax rate" to 1 decimal place.) Complete this question by entering your answers in the tabs below. Req a and b Reqc Req d to h a. A married couple filing jointly with taxable income of $34,191. b. A married couple filing jointly with taxable income of $210,281. Average tax rate % Marginal tax rate % a. b. % % Determine the average tax rate and the marginal tax rate for each of the following instances: Use the appropriate Tax Tables and Tax Rate Schedules. a. A married couple filing jointly with taxable income of $34,191. b. A married couple filing jointly with taxable income of $210,281. c. A married couple filing separately, one spouse with taxable income of $45,085 and the other with $57,418. d. A single person with taxable income of $80,636. e. A single person with taxable income of $324,676. f. A head of household with taxable income of $97,792. g. A qualifying widow with taxable income of $34,311. h. A married couple filing jointly with taxable income of $12,416. (For all requirements, when computing average tax rate, use the Tax Tables for taxpayers with taxable income under $100,000 and the Tax Rate Schedules for those with taxable income above $100,000. Round "Average tax rate" to 1 decimal place.) Complete this question by entering your answers in the tabs below. Req a and b Reqc Req d to h a. A married couple filing jointly with taxable income of $34,191. b. A married couple filing jointly with taxable income of $210,281. Average tax rate % Marginal tax rate % a. b. % %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts