Question: Tax Return Assignment 1 0 0 Points Possible Purpose: This assignment will assess your ability to calculate the net refund or tax liability given a

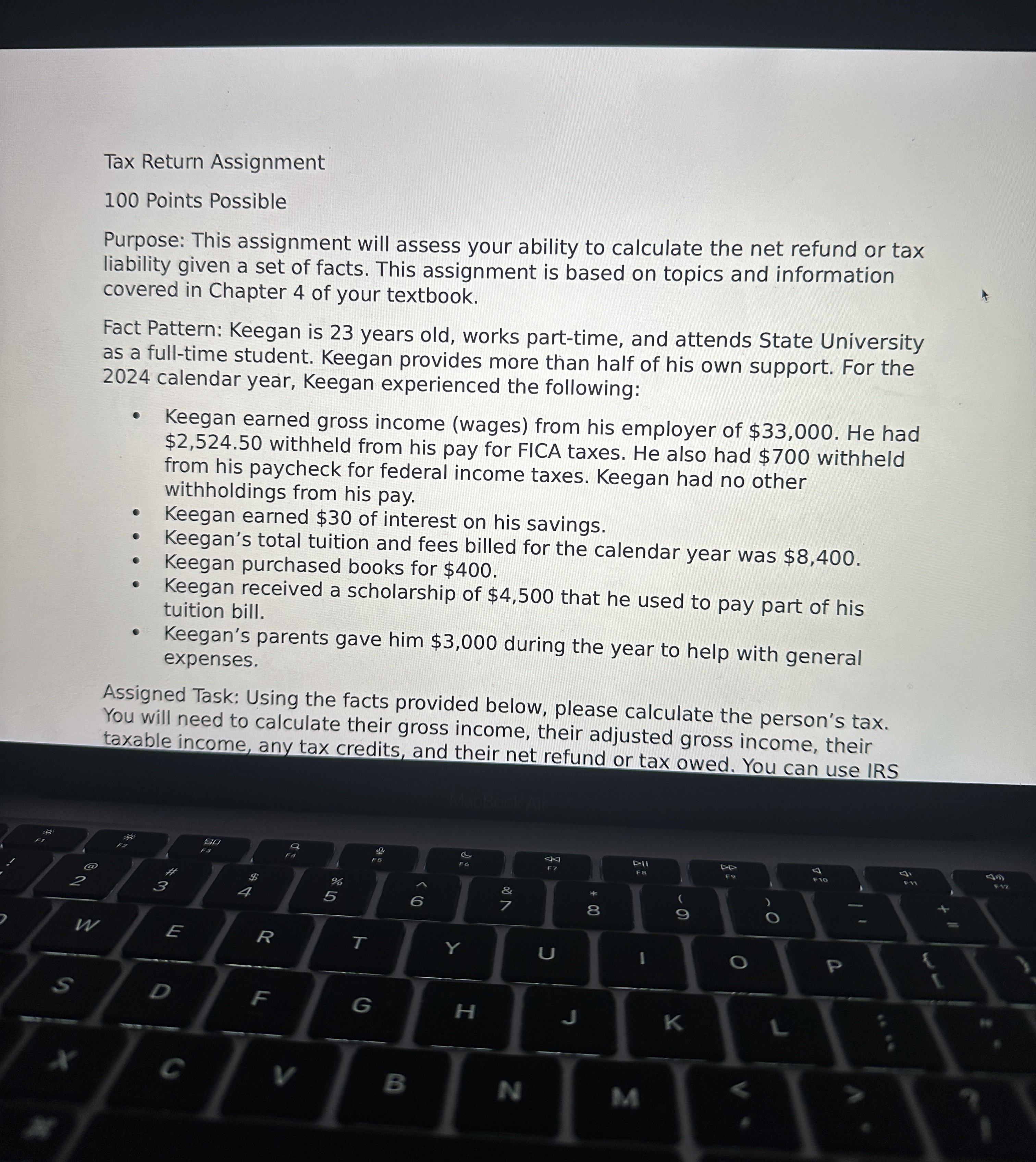

Tax Return Assignment

Points Possible

Purpose: This assignment will assess your ability to calculate the net refund or tax

liability given a set of facts. This assignment is based on topics and information

covered in Chapter of your textbook.

Fact Pattern: Keegan is years old, works parttime, and attends State University

as a fulltime student. Keegan provides more than half of his own support. For the

calendar year, Keegan experienced the following:

Keegan earned gross income wages from his employer of $ He had

$ withheld from his pay for FICA taxes. He also had $ withheld

from his paycheck for federal income taxes. Keegan had no other

withholdings from his pay.

Keegan earned $ of interest on his savings.

Keegan's total tuition and fees billed for the calendar year was $

Keegan purchased books for $

Keegan received a scholarship of $ that he used to pay part of his

tuition bill.

Keegan's parents gave him $ during the year to help with general

expenses.

Assigned Task: Using the facts provided below, please calculate the person's tax.

You will need to calculate their gross income, their adjusted gross income, their

taxable income, any tax credits, and their net refund or tax owed. You can use IRS

Assigned Task: Using the facts provided below, please calculate the person's tax.

You will need to calculate their gross income, their adjusted gross income, their

taxable income, any tax credits, and their net refund or tax owed. You can use IRS

tax forms or the federal income tax formula found in module A quiz will be

opened in elc with questions about specific amounts from the tax calculations. You

will need to have completed the tax return to answer these questions. Items that

could be asked for include:

Gross income

Adjusted gross income

Filing status

Standard deduction

Qualified education expenses

American Opportunity Credit

Refundable portion of the American Opportunity Credit

Taxable income

Tax

Net tax refund or liability

Using this information and either IRS tax forms or the federal income tax formula,

please calculate Keegan's net tax refund or liability.

How to turn it in A quiz will be opened in ELC, and you can record your answers.

Tax Return Assignment

Points Possible

Purpose: This assignment will assess your ability to calculate the net refund or tax

liability given a set of facts. This assignment is based on topics and information

covered in Chapter of your textbook.

Fact Pattern: Keegan is years old, works parttime, and attends State University

as a fulltime student. Keegan provides more than half of his own support. For the

calendar year, Keegan experienced the following:

Keegan earned gross income wages from his employer of $ He had

$ withheld from his pay for FICA taxes. He also had $ withheld

from his paycheck for federal income taxes. Keegan had no other

withholdings from his pay.

Keegan earned $ of interest on his savings.

Keegan's total tuition and fees billed for the calendar year was $

Keegan purchased books for $

Keegan received a scholarship of $ that he used to pay part of his

tuition bill.

Keegan's parents gave him $ during the year to help with general

expenses.

Assigned Task: Using the facts provided below, please calculate the person's tax.

You will need to calculate their gross income, their adjusted gross income, their

taxable income, any tax credits, and their net refund or tax owed. You can use IRS

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock