Question: Tax Return Problem 2 During 2 0 2 3 , Cassandra Albright, who is single, worked part - time at a doctor's office and received

Tax Return Problem

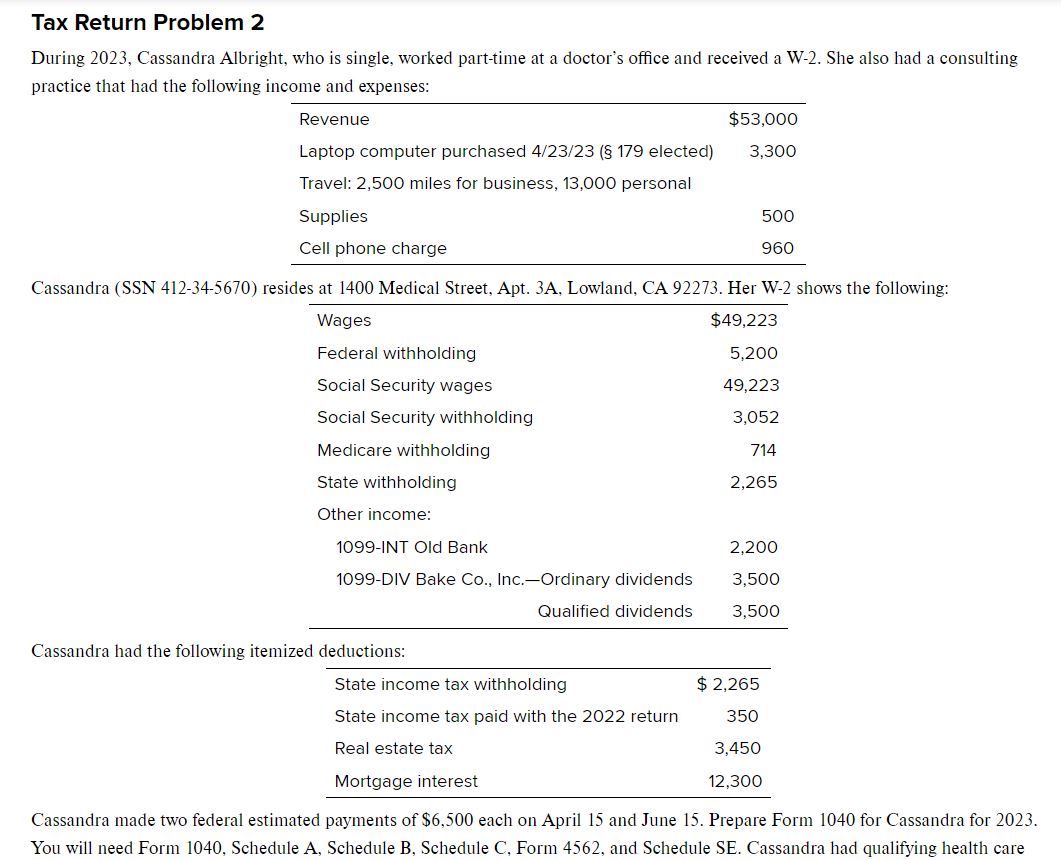

During Cassandra Albright, who is single, worked parttime at a doctor's office and received a W She also had a consulting

practice that had the following income and expenses:

Cassandra SSN resides at Medical Street, Apt. A Lowland, CA Her W shows the following:

Cassandra had the following itemized deductions:

Cassandra made two federal estimated payments of $ each on April and June Prepare Form for Cassandra for

You will need Form Schedule A Schedule B Schedule C Form and Schedule SE Cassandra had qualifying health care COVERAGE AT ALL TIMES DURING THE TAX YEAR. Determine cassi's selfempoyment income and OBI deduction. prepare schedule c and schedule SE Section expense is elected on all eligible assets.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock