Question: Tax Return Problem 6 - Individual (after Chapter 14) Instructions: Please complete the 2018 federal income tax return for Carlos and Maria Gomez. Ignore the

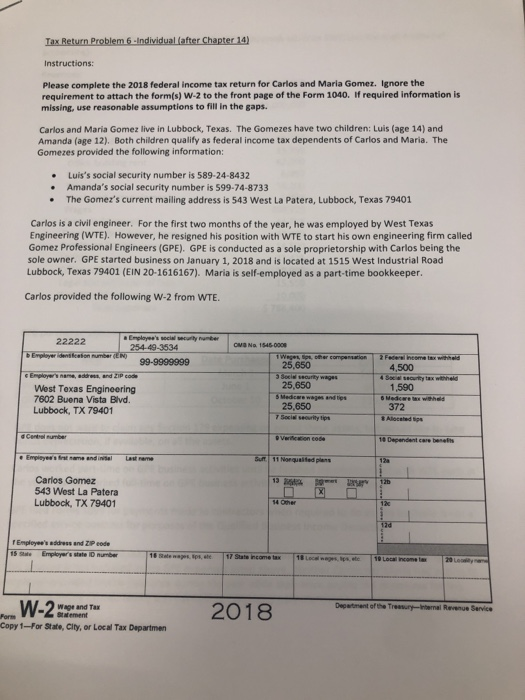

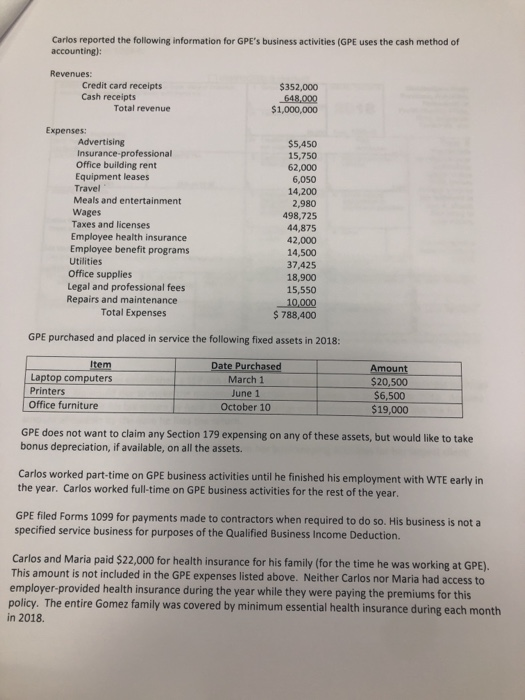

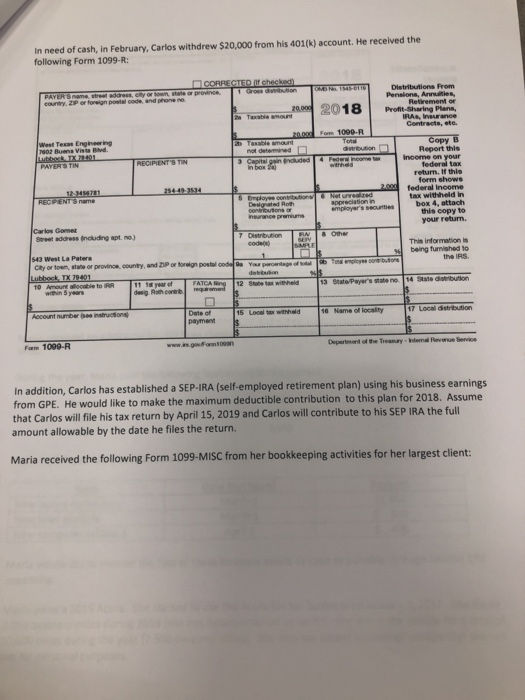

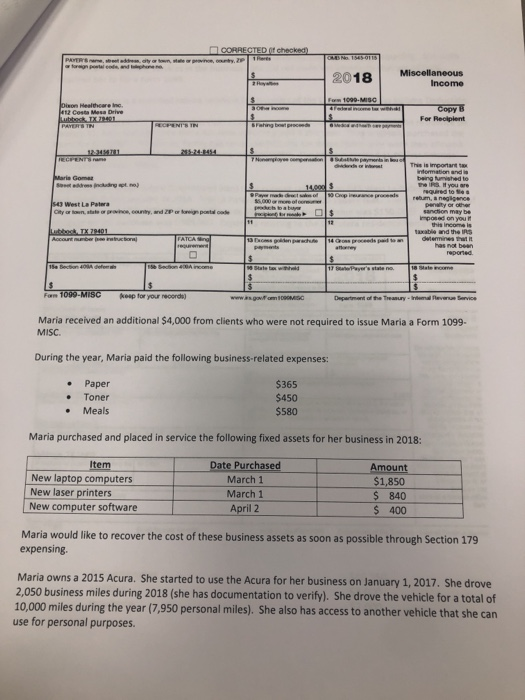

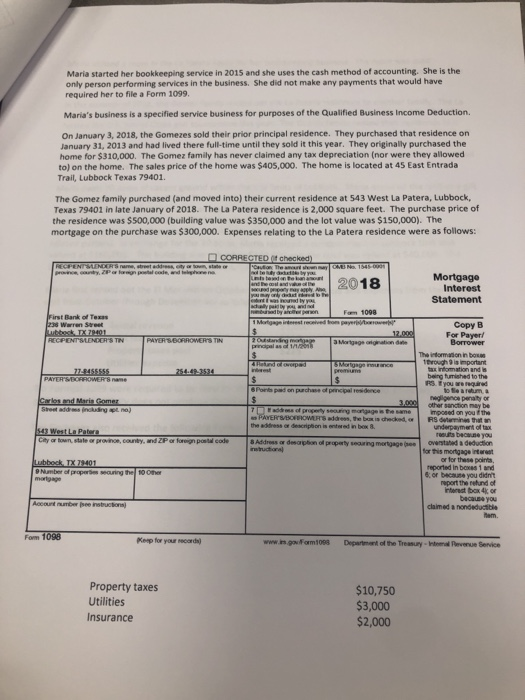

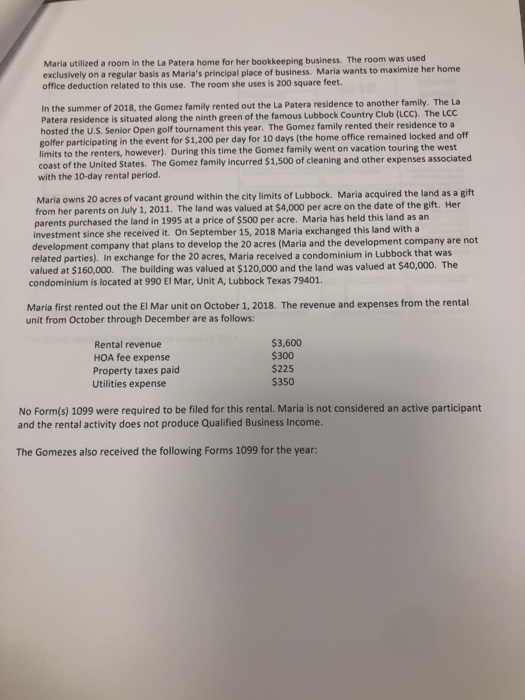

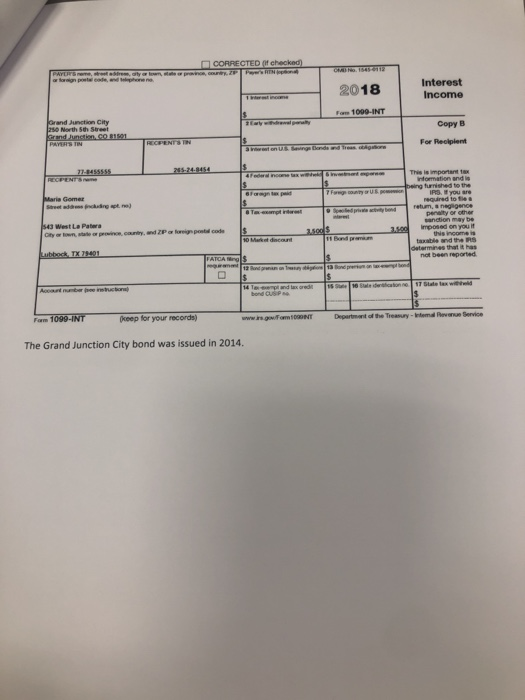

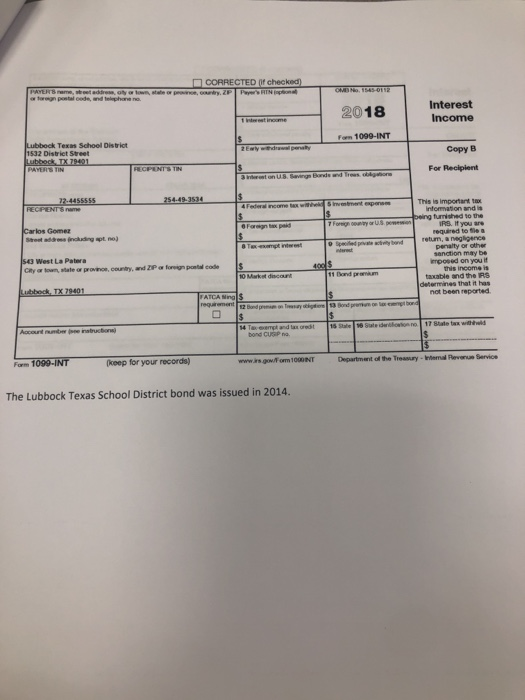

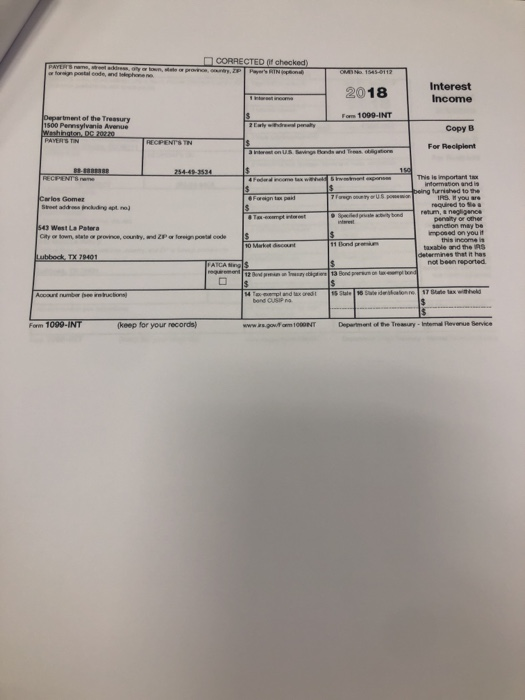

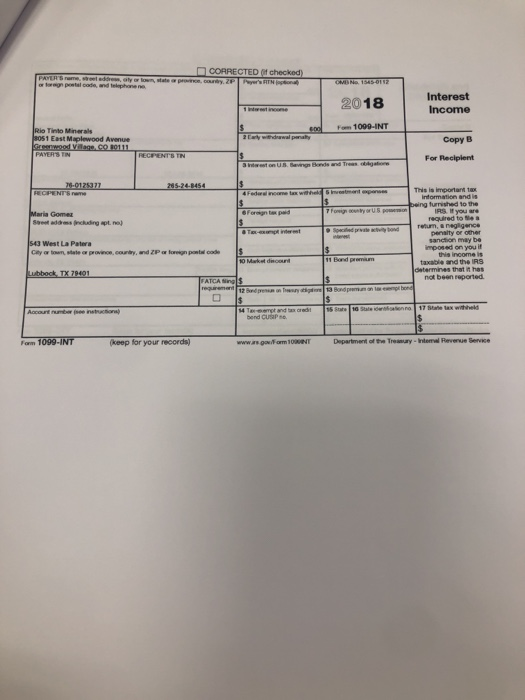

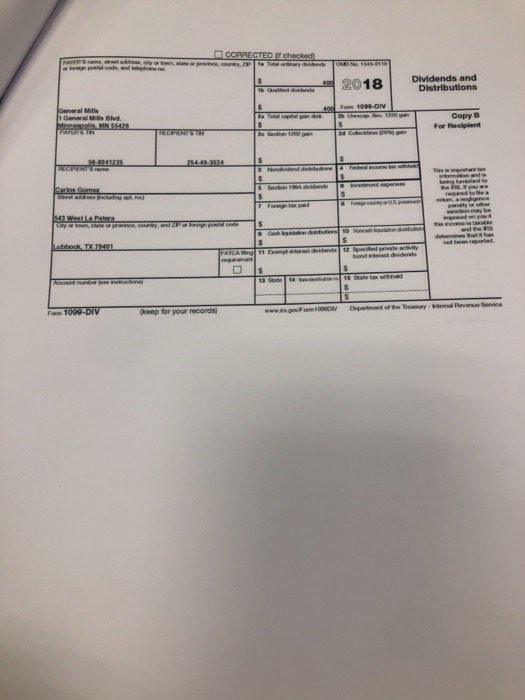

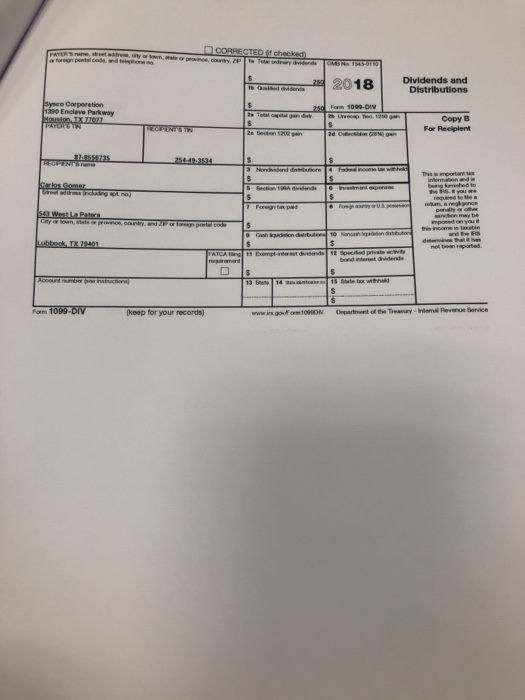

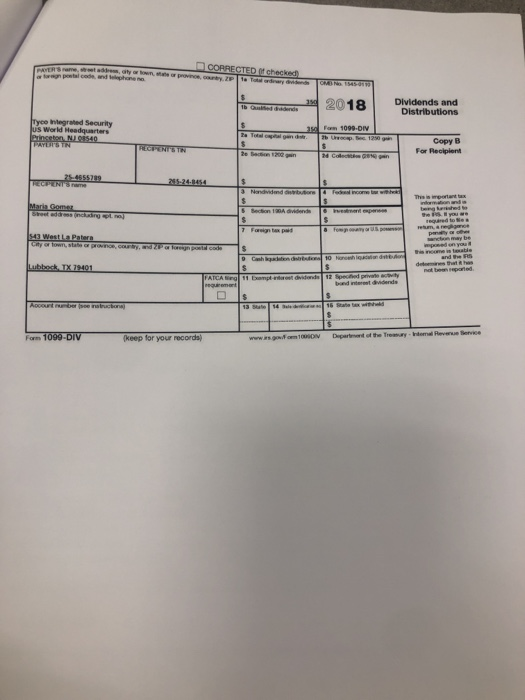

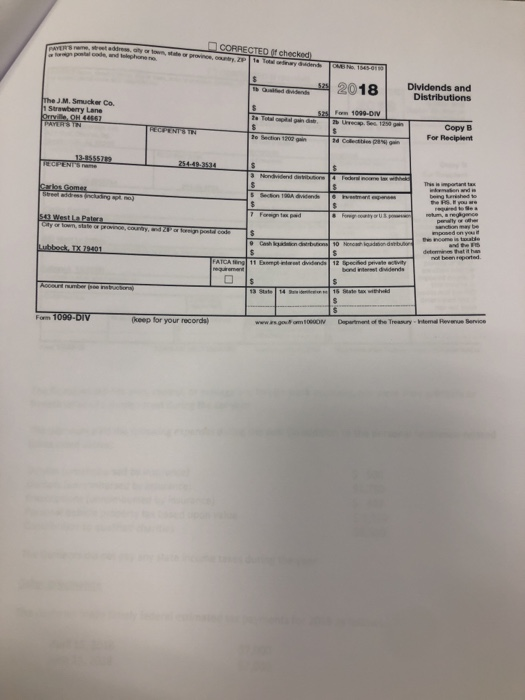

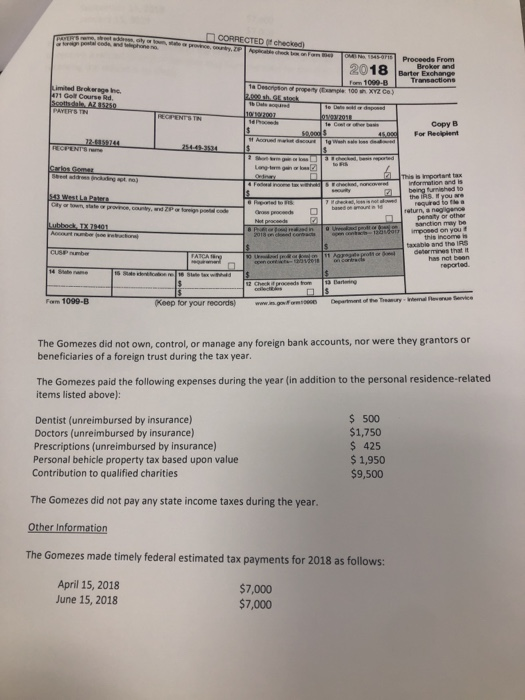

Tax Return Problem 6 - Individual (after Chapter 14) Instructions: Please complete the 2018 federal income tax return for Carlos and Maria Gomez. Ignore the requirement to attach the form(s) W-2 to the front page of the Form 1040. If required information is missing, use reasonable assumptions to fill in the gaps. Carlos and Maria Gomez live in Lubbock, Texas. The Gomezes have two children: Luis (age 14) and Amanda (age 12). Both children qualify as federal income tax dependents of Carlos and Maria. The Gomezes provided the following information: Luis's social security number is 589-24-8432 Amanda's social security number is 599-74-8733 The Gomez's current mailing address is 543 West La Patera, Lubbock, Texas 79401 Carlos is a civil engineer. For the first two months of the year, he was employed by West Texas Engineering (WTE). However, he resigned his position with WTE to start his own engineering firm called Gomez Professional Engineers (GPE). GPE is conducted as a sole proprietorship with Carlos being the sole owner. GPE started business on January 1, 2018 and is located at 1515 West Industrial Road Lubbock, Texas 79401 (EIN 20-1616167). Maria is self-employed as a part-time bookkeeper. Carlos provided the following W-2 from WTE. number O No 1545-000 b ution Employee's 22222 254.49-3534 erdendon number (N 0.000999 Employer's name, adress, and ZIP code West Texas Engineering 7602 Buena Vista Blvd. Lubbock, TX 79401 3 S 25,650 ecurity wages 25,650 Medicewand 25,650 security tips Federe. Income tax withheld 4,500 4 Society tax with 1.590 372 Ales Veecon code 10 Dependent care benefits Carlos Gomez 543 West La Patera Lubbock, TX 79401 Employee's dress and ZIP code 15 e Employer's state number tent of the Treewh for W-2 wag ng Ta ernal Revenue Service 2018 Copy 1-For State, City, or Local Tax Departmen In need of cash, in February, Carlos withdrew $20,000 from his 401(k) account. He received the following Form 1099-R: CORREGTE E checke 2018 Distributions from Pension Ares Memento Pro Sharing Plans RAS, Irance Contracts, ate Fm 1000-R not o Capital gain PATERTIN cluded Fe n core Copy B Report this Income on your federal tax retum. If this form shows federe Income tax witheld in box 4, attach this copy to your return. RECENT S name employer's securities Carlos Gomes inuing to S The formation is being furnished to the IRS e r posted only one buton 543 West La Patera City or to state or province, country, and IP or foreign post Lubbock TX 79001 er FALA 12 19 Persone 14 e uro Account number one Date of payment 10 Name of locality 17 Local distribution Fam 1000-R www. n o Department of Tre -Wedewe rs In addition, Carlos has established a SEP-IRA (self-employed retirement plan) using his business earnings from GPE. He would like to make the maximum deductible contribution to this plan for 2018. Assume that Carlos will file his tax return by April 15, 2019 and Carlos will contribute to his SEP IRA the full amount allowable by the date he files the return Maria received the following Form 1099-MISC from her bookkeeping activities for her largest client: CORRECTED Of checked . P re 2018 | Miscellaneous Income 12 Costa Mesa Drive Copy B For Recipient Maria Gomes West La Pele and the F 1000 MISC Neap for your records Maria received an additional $4,000 from clients who were not required to issue Maria a Form 1099. MISC During the year, Maria paid the following business related expenses Paper Toner Meals $365 $450 $580 Maria purchased and placed in service the following fixed assets for her business in 2018: Item New laptop computers New laser printers New computer software Date Purchased March 1 March 1 April 2 Amount $1,850 $ 840 $ 400 Maria would like to recover the cost of these business assets as soon as possible through Section 179 expensing. Maria owns a 2015 Acura. She started to use the Acura for her business on January 1, 2017. She drove 2,050 business miles during 2018 (she has documentation to verify). She drove the vehicle for a total of 10,000 miles during the year (7,950 personal miles). She also has access to another vehicle that she can use for personal purposes. CORRECTED (if checked) P RIN PAYURS 2018 Interest Income Form 1099-INT First Bank of Texas 235 Warren Street Lubbock, TX 79401 PAYERS TIN Copy B For Recipient not on US Saving Bonds and reaso n 37-54SSSSS RECIPENTS Foren d Maria Gomez Street address including plno) The important formation and is being furnished to the IRS you are required to be a retum, a negligence penalty or other sanction may be imposed on you this income is table and the RS determines that it has not been reported 15:43 West La Patera Cyrtow e or province, and ZIP foreign postcode 10 Market discount 1 Bond premium Lubbock, TX 79401 TATCASOS Account number nur bond US Form 1099-INT keep for your records) www.in.govim ODONT Department of the Treasury - Intemal Revenue Service CORRECTED (If checked) a p m oker low, tale or 2018 Interest Income Forn 1099-INT Lubbock Texas School District 1532 District Street Lubbock TX 79401 Copy B For Recipient Carlos Gomez Stra n king pt.no) This is important to Information and is pinguished to the 7 For Women RS. If you are required to be a retum, a negligence penalty or other sanction may be imposed on you 400 $ this income is taxable and the RS determines that it has not been reported Bond promote d 543 West La Patera Clyro state provocountry, and foreign postcode 10 Market discount Lubbock, TX 79401 12 Bond w 15 Se Weidenboto 17 teta w Account 14 Tax and tax red bond CUP no Department of the Treary Form 1099-INT www.swform 100 T emal Revenue Service keep for your records) The Lubbock Texas School District bond was issued in 2014. CORRECTED (If checked) ZPRINT 2018 Interest Income Form 1099-INT Department of the Treasury 1500 Pensylvania Avenue Washington DC 70220 PAYERS TIN Copy B For Recipient BERR RECENT Carlos Gomez Street da This is important noon and is being furnished to the required to retum, & negligence penalty or other g pl.no 543 West La Patera City or own, we province, country, and Polign poede imposed on you it 10 Mark discount Lubbock, TX 79401 table and the AS determines that it has not been reported 12 Body Woon17 wed Form 1099-INT (keep for your records www . om 1 NT Department of the Treasury - Inte r ne Service CORRECTED checked y, ZP Total y donde d o wn, tete er pro , 2018 Dividends and Distributions od Form 1090-DIV General Mills 1 General Mills Blvd Mines, MN 55425 For Peoplent 56.941235 Carlos Gomes 4Westla Patra Lubbock, TX 79401 Accoun c tion Fem 1099-DIV keep for your records CORRECTED. checked a non postal code, and more on state or pronos, 2018 Dividends and Distributions Tyco Integrated Security Us World Headquarters Princeton NIO540 Form 1099-DIV Copy B For Recipient 25.4555789 Maria Gomez Stresingle 443 WestlaPatera Lubbock TX 71401 Abo u chons Form 1099-DIV keep for your records www.gouf DV Depart of the Treatyhtml Revenue Service p t o odendechon CORRECTED (f checked wn, we province, Gry ZP T y dende 2018 Dividends and Distributions The J.M. Smucker Co. 11 Strawberry Lane Orry OH 44157 525 Form 1999-DIV 1. U p . Set 1890 Copy B For Recipient 54 Westla Paters bbock x 79401 $ Form 1009-OTV e ep for your records Tax Return Problem 6 - Individual (after Chapter 14) Instructions: Please complete the 2018 federal income tax return for Carlos and Maria Gomez. Ignore the requirement to attach the form(s) W-2 to the front page of the Form 1040. If required information is missing, use reasonable assumptions to fill in the gaps. Carlos and Maria Gomez live in Lubbock, Texas. The Gomezes have two children: Luis (age 14) and Amanda (age 12). Both children qualify as federal income tax dependents of Carlos and Maria. The Gomezes provided the following information: Luis's social security number is 589-24-8432 Amanda's social security number is 599-74-8733 The Gomez's current mailing address is 543 West La Patera, Lubbock, Texas 79401 Carlos is a civil engineer. For the first two months of the year, he was employed by West Texas Engineering (WTE). However, he resigned his position with WTE to start his own engineering firm called Gomez Professional Engineers (GPE). GPE is conducted as a sole proprietorship with Carlos being the sole owner. GPE started business on January 1, 2018 and is located at 1515 West Industrial Road Lubbock, Texas 79401 (EIN 20-1616167). Maria is self-employed as a part-time bookkeeper. Carlos provided the following W-2 from WTE. number O No 1545-000 b ution Employee's 22222 254.49-3534 erdendon number (N 0.000999 Employer's name, adress, and ZIP code West Texas Engineering 7602 Buena Vista Blvd. Lubbock, TX 79401 3 S 25,650 ecurity wages 25,650 Medicewand 25,650 security tips Federe. Income tax withheld 4,500 4 Society tax with 1.590 372 Ales Veecon code 10 Dependent care benefits Carlos Gomez 543 West La Patera Lubbock, TX 79401 Employee's dress and ZIP code 15 e Employer's state number tent of the Treewh for W-2 wag ng Ta ernal Revenue Service 2018 Copy 1-For State, City, or Local Tax Departmen In need of cash, in February, Carlos withdrew $20,000 from his 401(k) account. He received the following Form 1099-R: CORREGTE E checke 2018 Distributions from Pension Ares Memento Pro Sharing Plans RAS, Irance Contracts, ate Fm 1000-R not o Capital gain PATERTIN cluded Fe n core Copy B Report this Income on your federal tax retum. If this form shows federe Income tax witheld in box 4, attach this copy to your return. RECENT S name employer's securities Carlos Gomes inuing to S The formation is being furnished to the IRS e r posted only one buton 543 West La Patera City or to state or province, country, and IP or foreign post Lubbock TX 79001 er FALA 12 19 Persone 14 e uro Account number one Date of payment 10 Name of locality 17 Local distribution Fam 1000-R www. n o Department of Tre -Wedewe rs In addition, Carlos has established a SEP-IRA (self-employed retirement plan) using his business earnings from GPE. He would like to make the maximum deductible contribution to this plan for 2018. Assume that Carlos will file his tax return by April 15, 2019 and Carlos will contribute to his SEP IRA the full amount allowable by the date he files the return Maria received the following Form 1099-MISC from her bookkeeping activities for her largest client: CORRECTED Of checked . P re 2018 | Miscellaneous Income 12 Costa Mesa Drive Copy B For Recipient Maria Gomes West La Pele and the F 1000 MISC Neap for your records Maria received an additional $4,000 from clients who were not required to issue Maria a Form 1099. MISC During the year, Maria paid the following business related expenses Paper Toner Meals $365 $450 $580 Maria purchased and placed in service the following fixed assets for her business in 2018: Item New laptop computers New laser printers New computer software Date Purchased March 1 March 1 April 2 Amount $1,850 $ 840 $ 400 Maria would like to recover the cost of these business assets as soon as possible through Section 179 expensing. Maria owns a 2015 Acura. She started to use the Acura for her business on January 1, 2017. She drove 2,050 business miles during 2018 (she has documentation to verify). She drove the vehicle for a total of 10,000 miles during the year (7,950 personal miles). She also has access to another vehicle that she can use for personal purposes. CORRECTED (if checked) P RIN PAYURS 2018 Interest Income Form 1099-INT First Bank of Texas 235 Warren Street Lubbock, TX 79401 PAYERS TIN Copy B For Recipient not on US Saving Bonds and reaso n 37-54SSSSS RECIPENTS Foren d Maria Gomez Street address including plno) The important formation and is being furnished to the IRS you are required to be a retum, a negligence penalty or other sanction may be imposed on you this income is table and the RS determines that it has not been reported 15:43 West La Patera Cyrtow e or province, and ZIP foreign postcode 10 Market discount 1 Bond premium Lubbock, TX 79401 TATCASOS Account number nur bond US Form 1099-INT keep for your records) www.in.govim ODONT Department of the Treasury - Intemal Revenue Service CORRECTED (If checked) a p m oker low, tale or 2018 Interest Income Forn 1099-INT Lubbock Texas School District 1532 District Street Lubbock TX 79401 Copy B For Recipient Carlos Gomez Stra n king pt.no) This is important to Information and is pinguished to the 7 For Women RS. If you are required to be a retum, a negligence penalty or other sanction may be imposed on you 400 $ this income is taxable and the RS determines that it has not been reported Bond promote d 543 West La Patera Clyro state provocountry, and foreign postcode 10 Market discount Lubbock, TX 79401 12 Bond w 15 Se Weidenboto 17 teta w Account 14 Tax and tax red bond CUP no Department of the Treary Form 1099-INT www.swform 100 T emal Revenue Service keep for your records) The Lubbock Texas School District bond was issued in 2014. CORRECTED (If checked) ZPRINT 2018 Interest Income Form 1099-INT Department of the Treasury 1500 Pensylvania Avenue Washington DC 70220 PAYERS TIN Copy B For Recipient BERR RECENT Carlos Gomez Street da This is important noon and is being furnished to the required to retum, & negligence penalty or other g pl.no 543 West La Patera City or own, we province, country, and Polign poede imposed on you it 10 Mark discount Lubbock, TX 79401 table and the AS determines that it has not been reported 12 Body Woon17 wed Form 1099-INT (keep for your records www . om 1 NT Department of the Treasury - Inte r ne Service CORRECTED checked y, ZP Total y donde d o wn, tete er pro , 2018 Dividends and Distributions od Form 1090-DIV General Mills 1 General Mills Blvd Mines, MN 55425 For Peoplent 56.941235 Carlos Gomes 4Westla Patra Lubbock, TX 79401 Accoun c tion Fem 1099-DIV keep for your records CORRECTED. checked a non postal code, and more on state or pronos, 2018 Dividends and Distributions Tyco Integrated Security Us World Headquarters Princeton NIO540 Form 1099-DIV Copy B For Recipient 25.4555789 Maria Gomez Stresingle 443 WestlaPatera Lubbock TX 71401 Abo u chons Form 1099-DIV keep for your records www.gouf DV Depart of the Treatyhtml Revenue Service p t o odendechon CORRECTED (f checked wn, we province, Gry ZP T y dende 2018 Dividends and Distributions The J.M. Smucker Co. 11 Strawberry Lane Orry OH 44157 525 Form 1999-DIV 1. U p . Set 1890 Copy B For Recipient 54 Westla Paters bbock x 79401 $ Form 1009-OTV e ep for your records

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts