Question: Tax Return Problem: Non Profit Organization Assignment: Submit a current federal 9 9 0 EZ , Return of Organization Exempt from Income Tax Facts: Equus

Tax Return Problem: Non Profit Organization

Assignment: Submit a current federal EZ Return of Organization Exempt from Income Tax

Facts:

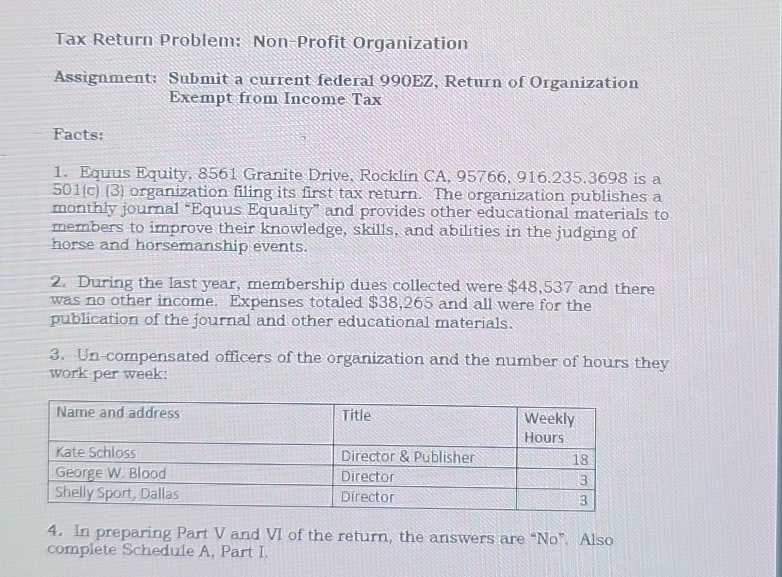

Equus Equity, Granite Drive, Rocklin CA is a c organization filing its first tax return. The organization publishes a monthly journal "Equus Equality" and provides other educational materials to members to improve their knowledge, skills, and abilities in the judging of horse and horsemanship events.

During the last year, membership dues collected were $ and there was no other income. Expenses totaled $ and all were for the publication of the journal and other educational materials.

Uncompensated officers of the organization and the number of hours they work per week:

tableName and address,Title,tableWeeklyHoursKate Schloss,Director & Publisher,George W Blood,Director,Shelly Sport, Dallas,Director,

In preparing Part V and VI of the return, the answers are No Also complete Schedule A Part I.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock