Question: Tax return problem Tax Return Problem 3 Kathy and Rob Wright obtained a divorce effective May 1, 2017. In accordance with the divorce decree, Rob

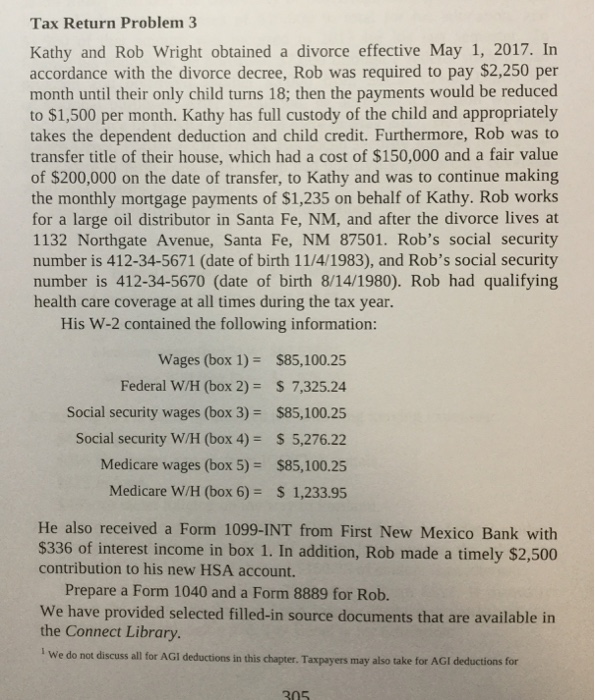

Tax Return Problem 3 Kathy and Rob Wright obtained a divorce effective May 1, 2017. In accordance with the divorce decree, Rob was required to pay $2,250 per month until their only child turns 18; then the payments would be reduced to $1,500 per month. Kathy has full custody of the child and appropriately takes the dependent deduction and child credit. Furthermore, Rob was to transfer title of their house, which had a cost of $150,000 and a fair value of $200,000 on the date of transfer, to Kathy and was to continue making the monthly mortgage payments of $1,235 on behalf of Kathy. Rob works for a large oil distributor in Santa Fe, NM, and after the divorce lives at 1132 Northgate Avenue, Santa Fe, NM 87501. Rob's social security number is 412-34-5671 (date of birth 11/4/1983), and Rob's social security number is 412-34-5670 (date of birth 8/14/1980). Rob had qualifying health care coverage at all times during the tax year. His W-2 contained the following information: Wages (box 1)- $85,100.25 Federal W/H (box 2)- S 7,325.24 Social security wages (box 3) $85,100.25 Social security W/H (box 4)S 5,276.22 Medicare wages (box 5)$85,100.25 Medicare W/H (box 6) 1,233.95 He also received a Form 1099-INT from First New Mexico Bank with $336 of interest income in box 1. In addition, Rob made a timely $2,500 contribution to his new HSA account. Prepare a Form 1040 and a Form 8889 for Rob. We have provided selected filled-in source documents that are available in the Connect Library. We do not discuss all for AGI deductions in this chapter. Taxpayers may also take for AGI deductions for 205 Tax Return Problem 3 Kathy and Rob Wright obtained a divorce effective May 1, 2017. In accordance with the divorce decree, Rob was required to pay $2,250 per month until their only child turns 18; then the payments would be reduced to $1,500 per month. Kathy has full custody of the child and appropriately takes the dependent deduction and child credit. Furthermore, Rob was to transfer title of their house, which had a cost of $150,000 and a fair value of $200,000 on the date of transfer, to Kathy and was to continue making the monthly mortgage payments of $1,235 on behalf of Kathy. Rob works for a large oil distributor in Santa Fe, NM, and after the divorce lives at 1132 Northgate Avenue, Santa Fe, NM 87501. Rob's social security number is 412-34-5671 (date of birth 11/4/1983), and Rob's social security number is 412-34-5670 (date of birth 8/14/1980). Rob had qualifying health care coverage at all times during the tax year. His W-2 contained the following information: Wages (box 1)- $85,100.25 Federal W/H (box 2)- S 7,325.24 Social security wages (box 3) $85,100.25 Social security W/H (box 4)S 5,276.22 Medicare wages (box 5)$85,100.25 Medicare W/H (box 6) 1,233.95 He also received a Form 1099-INT from First New Mexico Bank with $336 of interest income in box 1. In addition, Rob made a timely $2,500 contribution to his new HSA account. Prepare a Form 1040 and a Form 8889 for Rob. We have provided selected filled-in source documents that are available in the Connect Library. We do not discuss all for AGI deductions in this chapter. Taxpayers may also take for AGI deductions for 205

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts