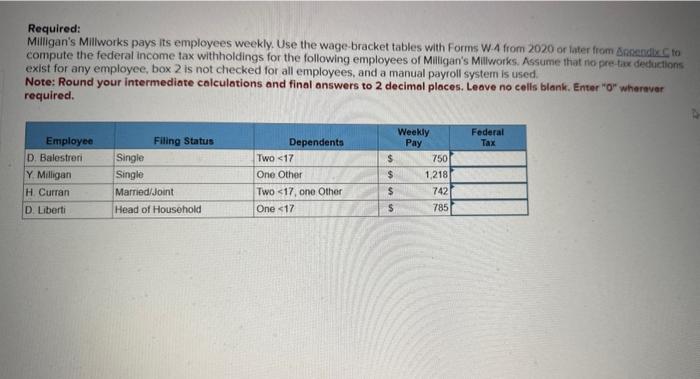

Question: Tax year 2020 or later from appendix c Required: Milligan's Millworks pays its employees weekly. Use the wage-bracket tables with Forms W. 4 from 2020

Required: Milligan's Millworks pays its employees weekly. Use the wage-bracket tables with Forms W. 4 from 2020 or later from Sinsendixe to compute the federal income tax withholdings for the following employees of Milligan's Millworks. Assume that no pre-fiax deductions exist for any employee, box 2 is not checked for all employees, and a manual payroll system is used. Note: Round your intermediate calculations and final answers to 2 decimal places. Leave no cells blank. Enter "O" wherever required. Required: Miligan's Milworks parys its employoes weekly. Use the wage-bracket tables with Forms W 4 from 2020 or iater from compute the federal income tax withholdings for the following employees of Malligan's Mallurorks. Assume that no pre tak tedeductlons exist for any employee, box 2 is not checked for all employees, and a manual payroll system is used Note: Round your intermediate calculations and final answers to 2 decimal ploces. Leave no cells blank. Enter "o" wherever required. Required: Milligan's Millworks pays its employees weekly. Use the wage-bracket tables with Forms W. 4 from 2020 or later from Sinsendixe to compute the federal income tax withholdings for the following employees of Milligan's Millworks. Assume that no pre-fiax deductions exist for any employee, box 2 is not checked for all employees, and a manual payroll system is used. Note: Round your intermediate calculations and final answers to 2 decimal places. Leave no cells blank. Enter "O" wherever required. Required: Miligan's Milworks parys its employoes weekly. Use the wage-bracket tables with Forms W 4 from 2020 or iater from compute the federal income tax withholdings for the following employees of Malligan's Mallurorks. Assume that no pre tak tedeductlons exist for any employee, box 2 is not checked for all employees, and a manual payroll system is used Note: Round your intermediate calculations and final answers to 2 decimal ploces. Leave no cells blank. Enter "o" wherever required

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts