Question: tax1501 ASSIGNMENT 2: FIRST SEMESTER 2020 QUESTION 1 (40 marks, 48 minutes) PART A (30 marks, 36 minutes) Lilly (35 years old) is the manager

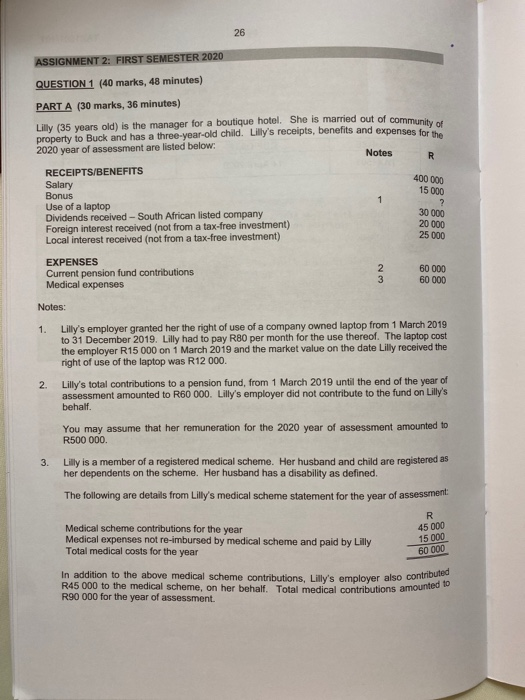

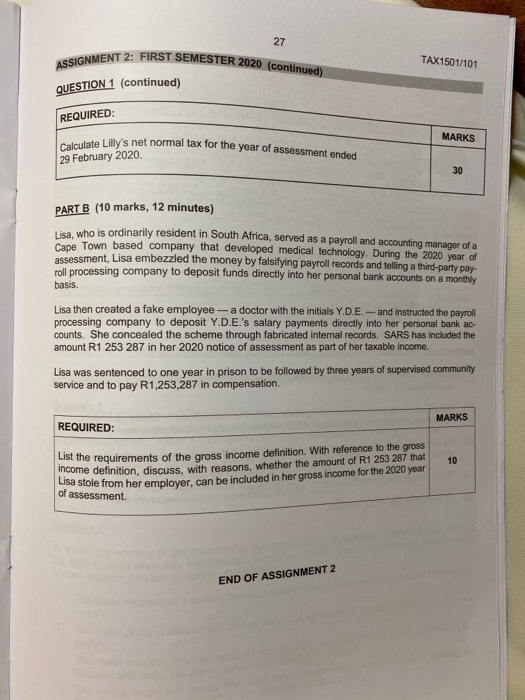

ASSIGNMENT 2: FIRST SEMESTER 2020 QUESTION 1 (40 marks, 48 minutes) PART A (30 marks, 36 minutes) Lilly (35 years old) is the manager for a boutique hotel. She is married out of commu property to Buck and has a three-year-old child. Lilly's receipts, benefits and expenses 2020 year of assessment are listed below: Notes RECEIPTS/BENEFITS 400 000 Salary Bonus 15 000 Use of a laptop Dividends received - South African listed company 30 000 Foreign interest received (not from a tax-free investment) 20 000 Local interest received (not from a tax-free investment) 25 000 EXPENSES Current pension fund contributions Medical expenses 60 000 60 000 Notes: 1. Lilly's employer granted her the right of use of a company owned laptop from 1 March 2019 to 31 December 2019. Lilly had to pay R80 per month for the use thereof. The laptop cost the employer R15 000 on 1 March 2019 and the market value on the date Lilly received the right of use of the laptop was R12 000 Lilly's total contributions to a pension fund, from 1 March 2019 until the end of the year of assessment amounted to R60 000. Lilly's employer did not contribute to the fund on Lilly's behalf. You may assume that her remuneration for the 2020 year of assessment amounted to R500 000 Lilly is a member of a registered medical scheme. Her husband and child are registered as her dependents on the scheme. Her husband has a disability as defined. The following are details from Lilly's medical scheme statement for the year of assessment Medical scheme contributions for the year Medical expenses not re-imbursed by medical scheme and paid by Lilly Total medical costs for the year 45 000 15 000 60 000 In addition to the above medical scheme contributions. Lilly's employer also conto R45 000 to the medical scheme, on her behalf. Total medical contributions amount R90 000 for the year of assessment. medical contributions amounted to ENT 2: FIRST SEMESTER 2020 (continued ASSIGNMENT 2: FI TAX1501/01 QUESTION 1 (continued) REQUIRED: Jste Lilly's net normal tax for the year of assessment ended MARKS Calculate Lilly's net normal tax for 29 February 2020. PART B (10 marks, 12 minutes) fisa who is ordinarily resident in South Africa, served as a payroll and accounting manager of a Cape Town based company that developed medical technology. During the 2020 year of assessment, Lisa embezzled the money by falsifying payroll records and telling a third-party pay- roll processing company to deposit funds directly into her personal bank accounts on a monthly basis. Lisa then created a fake employee - a doctor with the initials Y.D.E. - and instructed the payroll processing company to deposit Y.D.E.'s salary payments directly into her personal bank ac counts. She concealed the scheme through fabricated internal records. SARS has included the amount R1 253 287 in her 2020 notice of assessment as part of her taxable income. Lisa was sentenced to one year in prison to be followed by three years of supervised community service and to pay R1,253,287 in compensation. MARKS REQUIRED: List the requirements of the gross income definition. With reference to the gross income definition, discuss with reasons, whether the amount of R1 253 287 that sa stole from her emplover, can be included in her gross income for the 2020 year of assessment END OF ASSIGNMENT 2 ASSIGNMENT 2: FIRST SEMESTER 2020 QUESTION 1 (40 marks, 48 minutes) PART A (30 marks, 36 minutes) Lilly (35 years old) is the manager for a boutique hotel. She is married out of commu property to Buck and has a three-year-old child. Lilly's receipts, benefits and expenses 2020 year of assessment are listed below: Notes RECEIPTS/BENEFITS 400 000 Salary Bonus 15 000 Use of a laptop Dividends received - South African listed company 30 000 Foreign interest received (not from a tax-free investment) 20 000 Local interest received (not from a tax-free investment) 25 000 EXPENSES Current pension fund contributions Medical expenses 60 000 60 000 Notes: 1. Lilly's employer granted her the right of use of a company owned laptop from 1 March 2019 to 31 December 2019. Lilly had to pay R80 per month for the use thereof. The laptop cost the employer R15 000 on 1 March 2019 and the market value on the date Lilly received the right of use of the laptop was R12 000 Lilly's total contributions to a pension fund, from 1 March 2019 until the end of the year of assessment amounted to R60 000. Lilly's employer did not contribute to the fund on Lilly's behalf. You may assume that her remuneration for the 2020 year of assessment amounted to R500 000 Lilly is a member of a registered medical scheme. Her husband and child are registered as her dependents on the scheme. Her husband has a disability as defined. The following are details from Lilly's medical scheme statement for the year of assessment Medical scheme contributions for the year Medical expenses not re-imbursed by medical scheme and paid by Lilly Total medical costs for the year 45 000 15 000 60 000 In addition to the above medical scheme contributions. Lilly's employer also conto R45 000 to the medical scheme, on her behalf. Total medical contributions amount R90 000 for the year of assessment. medical contributions amounted to ENT 2: FIRST SEMESTER 2020 (continued ASSIGNMENT 2: FI TAX1501/01 QUESTION 1 (continued) REQUIRED: Jste Lilly's net normal tax for the year of assessment ended MARKS Calculate Lilly's net normal tax for 29 February 2020. PART B (10 marks, 12 minutes) fisa who is ordinarily resident in South Africa, served as a payroll and accounting manager of a Cape Town based company that developed medical technology. During the 2020 year of assessment, Lisa embezzled the money by falsifying payroll records and telling a third-party pay- roll processing company to deposit funds directly into her personal bank accounts on a monthly basis. Lisa then created a fake employee - a doctor with the initials Y.D.E. - and instructed the payroll processing company to deposit Y.D.E.'s salary payments directly into her personal bank ac counts. She concealed the scheme through fabricated internal records. SARS has included the amount R1 253 287 in her 2020 notice of assessment as part of her taxable income. Lisa was sentenced to one year in prison to be followed by three years of supervised community service and to pay R1,253,287 in compensation. MARKS REQUIRED: List the requirements of the gross income definition. With reference to the gross income definition, discuss with reasons, whether the amount of R1 253 287 that sa stole from her emplover, can be included in her gross income for the 2020 year of assessment END OF ASSIGNMENT 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts