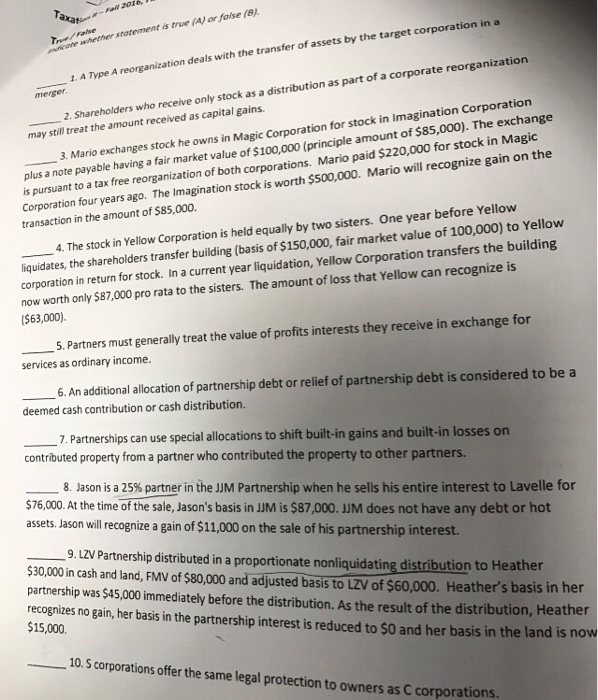

Question: Taxat icure whether statement is trve (A) or false (8 tion in a deals with the transfer of assets by the target corpora 1. A

Taxat icure whether statement is trve (A) or false (8 tion in a deals with the transfer of assets by the target corpora 1. A Type A reorganization bution as part of a corporate reorsanization 2. Shareholders who receive only stock as a distri may still treat the amount received as capital gains. ration for stock in Imagination Corporation 000). The exchange 3. Mario exchanges stock he owns in Magic Corpo plus a note payable having a fair market value of $100,000 (principle amount of S85 Corporation four years ago. The Imagination stock is worth $500,000. Mario will recognize gain on the transaction in the amount of $85,000. ax free reorganization of both corporations. Mario paid $220,000 for stock in Magic 4. The stock in Yellow Corporation is held equally by two sisters. One year before Yellow liquidates, the shareholders transfer building (basis of $150,000, fair market value of 100,000) to Yellow corporation in return for stock. In a current year liquidation, Yellow Corporation transfers the building now worth only $87,000 pro rata to the sisters. The amount of loss that Yellow can recognize is $63,000) 5.Partners must generally treat the value of profits interests they receive in exchange for 6. An additional allocation of partnership debt or relief of partnership debt is considered to be a 7. Partnerships can use special allocations to shift built-in gains and built-in losses on 8. Jason is a 25% partner in the JJM Partnership when he sells his entire interest to Lavelle for services as ordinary income. deemed cash contribution or cash distribution. contributed property from a partner who contributed the property to other partners. $76,000. At the time of the sale, Jason's basis in JJM is $87,000. UM does not have any debt or hot assets. Jason will recognize a gain of $11,000 on the sale o 9. LZV Partnership distributed in a proportionate nonliquidating distribution to Heather $30000 in cash and land, FMV of $80,000 and adjusted basis to LZV of $60,000. Heather's basis in her partnership was $45,000 immediately before the distribution. As the result of the distribution, Heather recognizes no gain, her basis in the partnership interest is reduced to $0 and her basis in the land is now $15,000. 10.S corporations offer the same legal protection to owners as C corporations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts