Question: TAXATION ACCOUNTING Please answer with complete solution. Case D: Pedro is a tax operator. The following data were provided for taxable year 2018: Gross receipt

TAXATION ACCOUNTING

Please answer with complete solution.

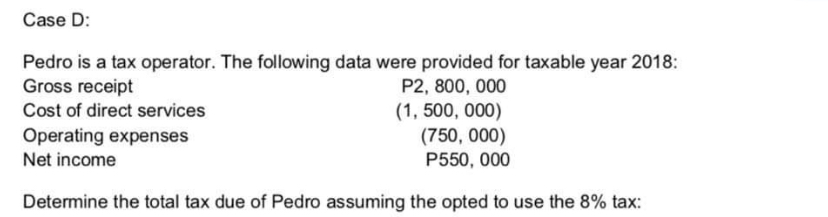

Case D: Pedro is a tax operator. The following data were provided for taxable year 2018: Gross receipt P2, 800, 000 Cost of direct services (1, 500, 000) Operating expenses (750, 000) Net income P550, 000 Determine the total tax due of Pedro assuming the opted to use the 8% tax

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts