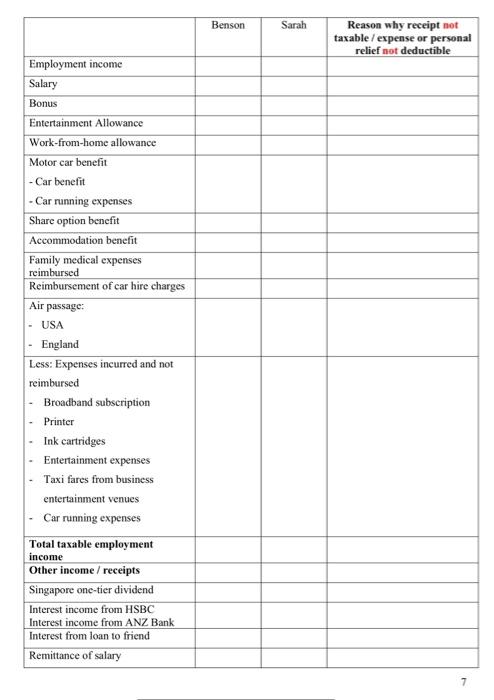

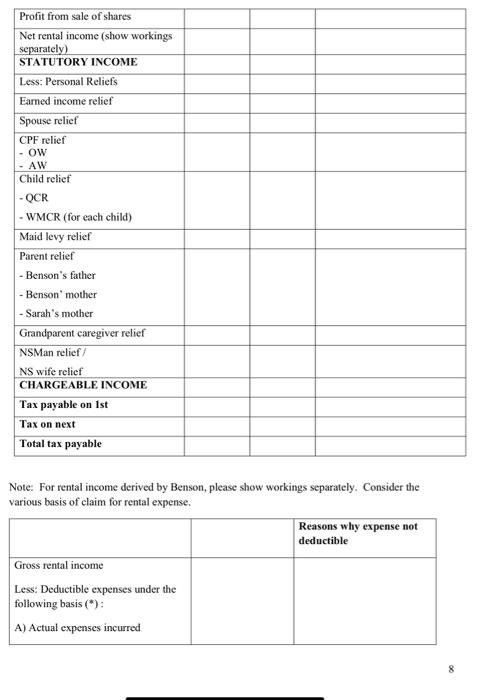

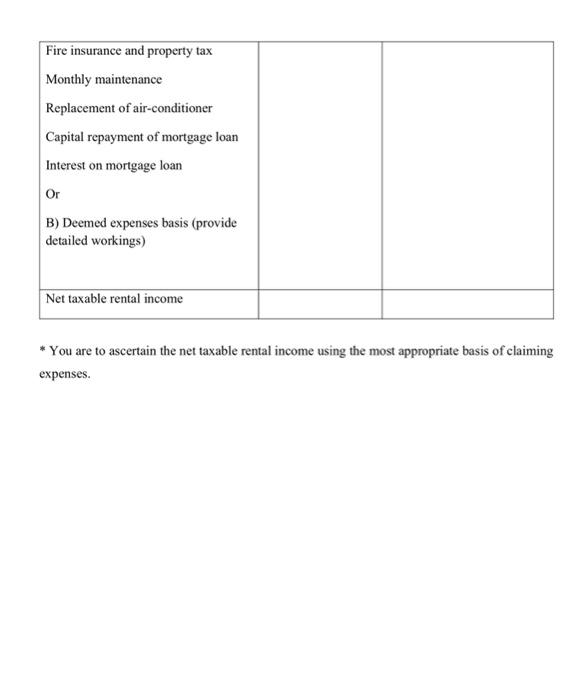

Question: Taxation Help for my homework assignment. All amounts provided in the information are in Singapore dollars) Benson Tan is a 53-year old Singaporean. He has

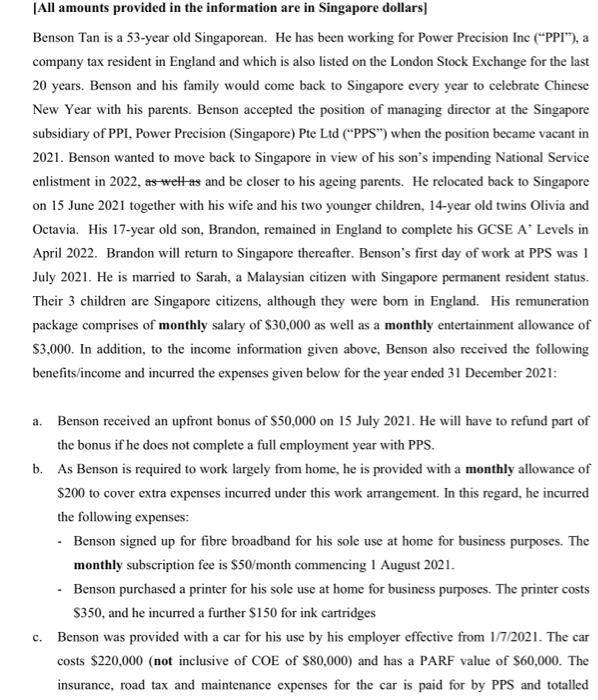

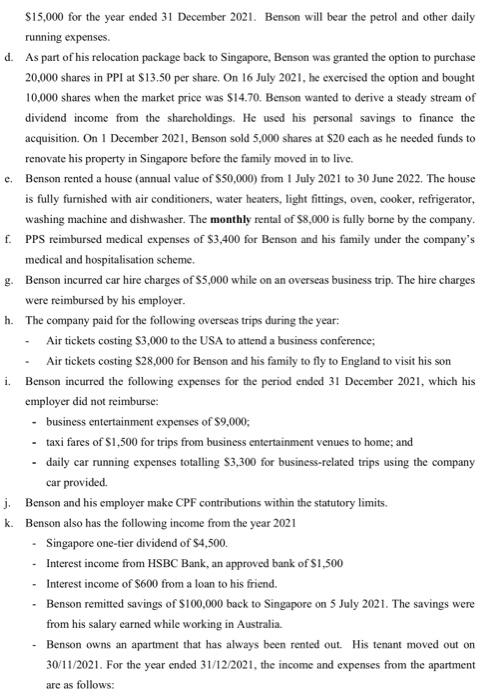

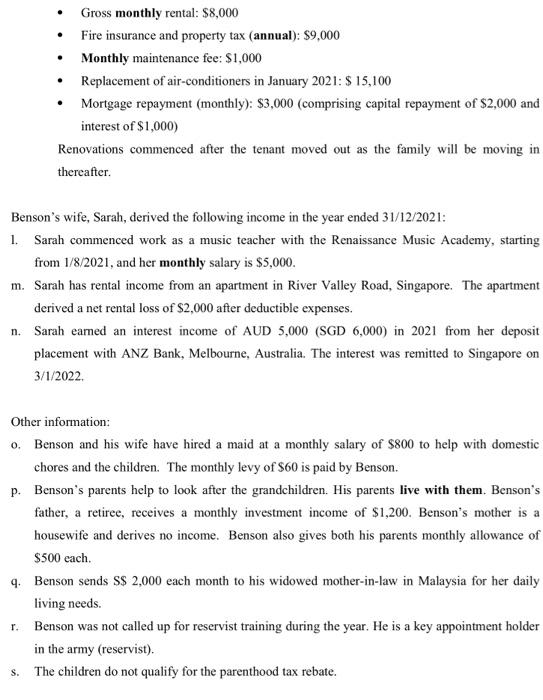

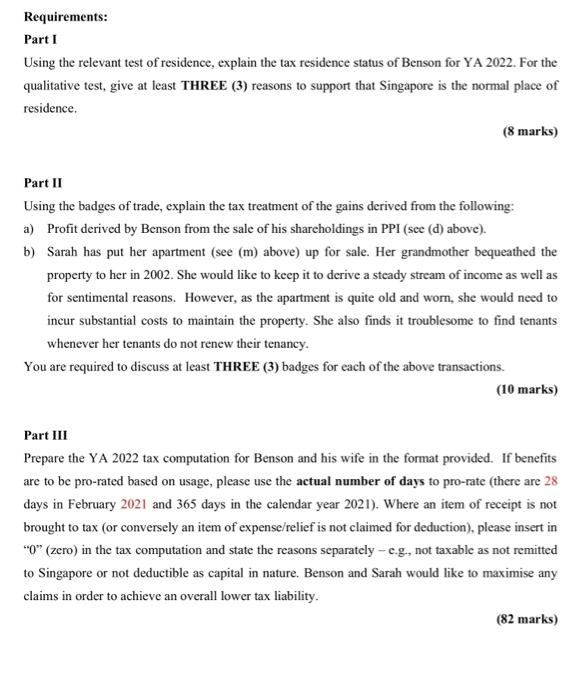

All amounts provided in the information are in Singapore dollars) Benson Tan is a 53-year old Singaporean. He has been working for Power Precision Inc (PPI"), a company tax resident in England and which is also listed on the London Stock Exchange for the last 20 years. Benson and his family would come back to Singapore every year to celebrate Chinese New Year with his parents. Benson accepted the position of managing director at the Singapore subsidiary of PPI, Power Precision (Singapore) Pte Ltd (PPS") when the position became vacant in 2021. Benson wanted to move back to Singapore in view of his son's impending National Service enlistment in 2022, as well as and be closer to his ageing parents. He relocated back to Singapore on 15 June 2021 together with his wife and his two younger children, 14-year old twins Olivia and Octavia. His 17-year old son, Brandon, remained in England to complete his GCSE A' Levels in April 2022. Brandon will return to Singapore thereafter. Benson's first day of work at PPS was 1 July 2021. He is married to Sarah, a Malaysian citizen with Singapore permanent resident status. Their 3 children are Singapore citizens, although they were bom in England. His remuneration package comprises of monthly salary of $30,000 as well as a monthly entertainment allowance of $3,000. In addition, to the income information given above, Benson also received the following benefits/income and incurred the expenses given below for the year ended 31 December 2021: a. Benson received an upfront bonus of $50,000 on 15 July 2021. He will have to refund part of the bonus if he does not complete a full employment year with PPS. b. As Benson is required to work largely from home, he is provided with a monthly allowance of $200 to cover extra expenses incurred under this work arrangement. In this regard, he incurred the following expenses: - Benson signed up for fibre broadband for his sole use at home for business purposes. The monthly subscription fee is $50/month commencing 1 August 2021. Benson purchased a printer for his sole use at home for business purposes. The printer costs $350, and he incurred a further $150 for ink cartridges c. Benson was provided with a car for his use by his employer effective from 1/7/2021. The car costs $220,000 (not inclusive of COE of $80,000) and has a PARF value of $60,000. The insurance, road tax and maintenance expenses for the car is paid for by PPS and totalled $15,000 for the year ended 31 December 2021. Benson will bear the petrol and other daily running expenses. d. As part of his relocation package back to Singapore, Benson was granted the option to purchase 20,000 shares in PPI at $13.50 per share. On 16 July 2021, he exercised the option and bought 10,000 shares when the market price was $14.70. Benson wanted to derive a steady stream of dividend income from the shareholdings. He used his personal savings to finance the acquisition. On 1 December 2021. Benson sold 5,000 shares at $20 each as he needed funds to renovate his property in Singapore before the family moved in to live. c. Benson rented a house (annual value of $50,000) from 1 July 2021 to 30 June 2022. The house is fully furnished with air conditioners, water heaters, light fittings, oven, cooker, refrigerator, washing machine and dishwasher. The monthly rental of $8,000 is fully borne by the company. f. PPS reimbursed medical expenses of $3,400 for Benson and his family under the company's medical and hospitalisation scheme. g. Benson incurred car hire charges of $5,000 while on an overseas business trip. The hire charges were reimbursed by his employer. h. The company paid for the following overseas trips during the year: Air tickets costing $3,000 to the USA to attend a business conference; Air tickets costing $28,000 for Benson and his family to fly to England to visit his son i. Benson incurred the following expenses for the period ended 31 December 2021, which his employer did not reimburse: business entertainment expenses of 89,000 taxi fares of S1,500 for trips from business entertainment venues to home; and - daily car running expenses totalling $3,300 for business-related trips using the company car provided j. Benson and his employer make CPF contributions within the statutory limits. k Benson also has the following income from the year 2021 - Singapore one-tier dividend of $4,500. Interest income from HSBC Bank, an approved bank of S1,500 - Interest income of $600 from a loan to his friend. Benson remitted savings of $100,000 back to Singapore on 5 July 2021. The savings were from his salary earned while working in Australia - Benson owns an apartment that has always been rented out. His tenant moved out on 30/11/2021. For the year ended 31/12/2021, the income and expenses from the apartment are as follows: . . Gross monthly rental: $8,000 Fire insurance and property tax (annual): 89,000 Monthly maintenance fee: $1,000 Replacement of air-conditioners in January 2021: $ 15,100 Mortgage repayment (monthly): $3,000 (comprising capital repayment of $2,000 and interest of $1,000) Renovations commenced after the tenant moved out as the family will be moving in thereafter Benson's wife, Sarah, derived the following income in the year ended 31/12/2021: 1. Sarah commenced work as a music teacher with the Renaissance Music Academy, starting from 1/8/2021, and her monthly salary is $5,000. m. Sarah has rental income from an apartment in River Valley Road, Singapore. The apartment derived a net rental loss of $2,000 after deductible expenses. n. Sarah earned an interest income of AUD 5,000 (SGD 6,000) in 2021 from her deposit placement with ANZ Bank, Melbourne, Australia. The interest was remitted to Singapore on 3/1/2022 Other information: o. Benson and his wife have hired a maid at a monthly salary of $800 to help with domestic chores and the children. The monthly levy of $60 is paid by Benson. p. Benson's parents help to look after the grandchildren. His parents live with them. Benson's father, a retiree, receives a monthly investment income of $1,200. Benson's mother is a housewife and derives no income. Benson also gives both his parents monthly allowance of $500 each. 4. Benson sends S$ 2,000 each month to his widowed mother-in-law in Malaysia for her daily living needs. Benson was not called up for reservist training during the year. He is a key appointment holder in the army (reservist). The children do not qualify for the parenthood tax rebate. r. S. Requirements: Part 1 Using the relevant test of residence, explain the tax residence status of Benson for YA 2022. For the qualitative test, give at least THREE (3) reasons to support that Singapore is the normal place of residence. (8 marks) Part II Using the badges of trade, explain the tax treatment of the gains derived from the following: a) Profit derived by Benson from the sale of his shareholdings in PPI (see (d) above). b) Sarah has put her apartment (see (m) above) up for sale. Her grandmother bequeathed the property to her in 2002. She would like to keep it to derive a steady stream of income as well as for sentimental reasons. However, as the apartment is quite old and wom, she would need to incur substantial costs to maintain the property. She also finds it troublesome to find tenants whenever her tenants do not renew their tenancy. You are required to discuss at least THREE (3) badges for each of the above transactions. (10 marks) Part III Prepare the YA 2022 tax computation for Benson and his wife in the format provided. If benefits are to be pro-rated based on usage, please use the actual number of days to pro-rate (there are 28 days in February 2021 and 365 days in the calendar year 2021). Where an item of receipt is not brought to tax (or conversely an item of expense/relief is not claimed for deduction), please insert in "0" (zero) in the tax computation and state the reasons separately - e.g., not taxable as not remitted to Singapore or not deductible as capital in nature. Benson and Sarah would like to maximise any claims in order to achieve an overall lower tax liability. (82 marks) Benson Sarah Reason why receipt not taxable / expense or personal relief not deductible Employment income Salary Bonus Entertainment Allowance Work-from-home allowance Motor car benefit - Car benefit - Car running expenses Share option benefit Accommodation benefit Family medical expenses reimbursed Reimbursement of car hire charges Air passage: - USA England Less: Expenses incurred and not reimbursed Broadband subscription Printer Ink cartridges Entertainment expenses Taxi fares from business entertainment venues Car running expenses Total taxable employment income Other income / receipts Singapore one-tier dividend Interest income from HSBC Interest income from ANZ Bank Interest from loan to friend Remittance of salary 7 Profit from sale of shares Net rental income (show workings separately) STATUTORY INCOME Less: Personal Reliefs Eamed income relief Spouse relief CPF relief - OW - AW Child relief - QCR - WMCR (for each child) Maid levy relief Parent relief - Benson's father - Benson" mother - Sarah's mother Grandparent caregiver relief NSMan relief NS wife relief CHARGEABLE INCOME Tax payable on ist Tax on next Total tax payable Note: For rental income derived by Benson, please show workings separately. Consider the various basis of claim for rental expense. Reasons why expense not deductible Gross rental income Less: Deductible expenses under the following basis (*): A) Actual expenses incurred 8 Fire insurance and property tax Monthly maintenance Replacement of air-conditioner Capital repayment of mortgage loan Interest on mortgage loan Or B) Deemed expenses basis (provide detailed workings) Net taxable rental income * You are to ascertain the net taxable rental income using the most appropriate basis of claiming expenses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts