Question: Taxation question #2 Based on Exhibit 6-9 (Schedule A; Itemized deductions), Also attached: .2017 Schedule A (same as Exhibit 6-9) .2018 Schedule A (draft) 2018

Taxation question #2

Taxation question #2

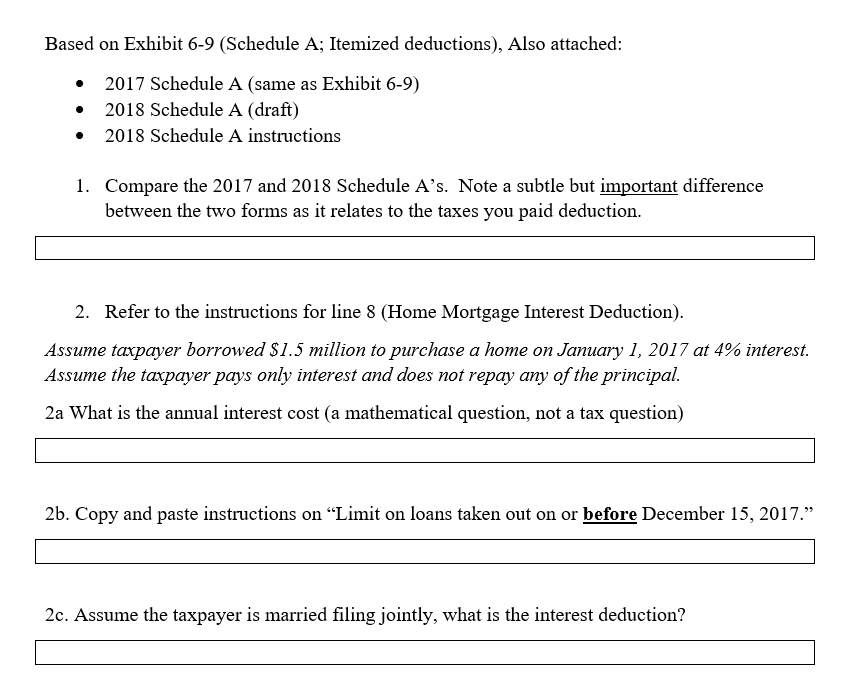

Based on Exhibit 6-9 (Schedule A; Itemized deductions), Also attached: .2017 Schedule A (same as Exhibit 6-9) .2018 Schedule A (draft) 2018 Schedule A instructions Compare the 2017 and 2018 Schedule A's. Note a subtle but important difference between the two forms as it relates to the taxes you paid deduction 1. 2. Refer to the instructions for line 8 (Home Mortgage Interest Deduction). Assume taxpayer borrowed $1.5 million to purchase a home on January 1, 2017 at 4% interest. Assume the taxpayer pays only interest and does not repay any of the principal. 2a What is the annual interest cost (a mathematical question, not a tax question) 2b. Copy and paste instructions on "Limit on loans taken out on or before December 15, 2017." 2c. Assume the taxpayer is married filing jointly, what is the interest deduction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts