Question: taxation question PROBLEM THREE Maple Enterprises Ltd. has always claimed maximum CCA. The following information relates to the corporation's capital transactions: 1. The undepreciated capital

taxation question

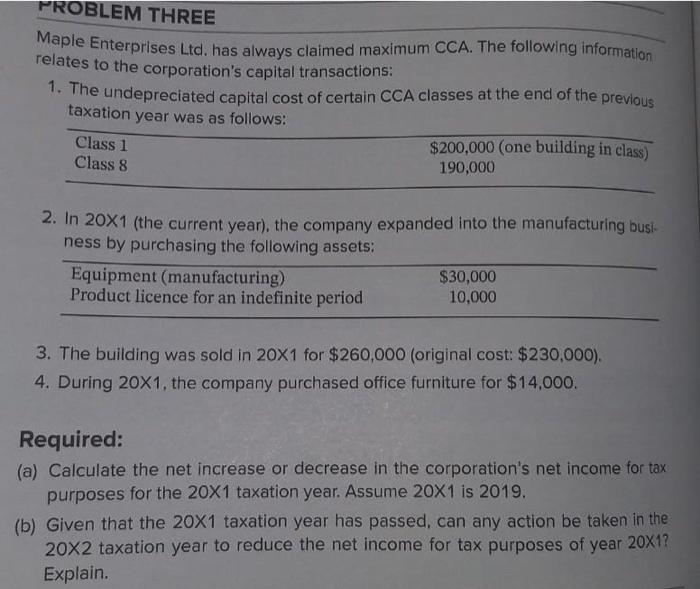

taxation question PROBLEM THREE Maple Enterprises Ltd. has always claimed maximum CCA. The following information relates to the corporation's capital transactions: 1. The undepreciated capital cost of certain CCA classes at the end of the previous taxation year was as follows: Class 1 $200,000 (one building in class) Class 8 190,000 2. In 20X1 (the current year), the company expanded into the manufacturing busi- ness by purchasing the following assets: Equipment (manufacturing) $30,000 Product licence for an indefinite period 10,000 3. The building was sold in 20x1 for $260,000 (original cost: $230,000). 4. During 20X1, the company purchased office furniture for $14,000. Required: (a) Calculate the net increase or decrease in the corporation's net income for tax purposes for the 20x1 taxation year. Assume 20x1 is 2019. (b) Given that the 20x1 taxation year has passed, can any action be taken in the 20x2 taxation year to reduce the net income for tax purposes of year 20X1? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts