Question: TB MC GU . 8 4 Bob's is a retail chain of . . . Bob's is a retail chain of specialty hardware stores. The

TB MC GU Bob's is a retail chain of

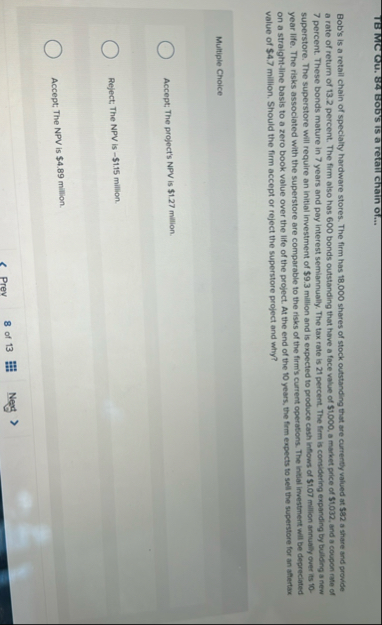

Bob's is a retail chain of specialty hardware stores. The firm has shares of stock outstanding that are currently valued at $ a share and provide a rate of return of percent. The firm also has bonds outstanding that have a face value of $ a market price of $ and a coupon rate of percent. These bonds mature in years and pay interest semiannually. The tax rate is percent. The firm is considering expanding by building a new superstore. The superstore will require an initial investment of $ million and is expected to produce cash inflows of $ million annualiy over its year life. The risks associated with the superstore are comparable to the risks of the firm's current operations. The intial investment will be depreciated on a straightline basis to a zero book value over the life of the project. At the end of the years, the firm expects to sell the superstore for an aftertax value of $ million. Should the firm accept or reject the superstore project and why?

Multiple Choice

Accept; The project's NPV is $ million.

Reject: The NPV is $ million.

Accept; The NPV is $ million.

Prev

of

Negt

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock