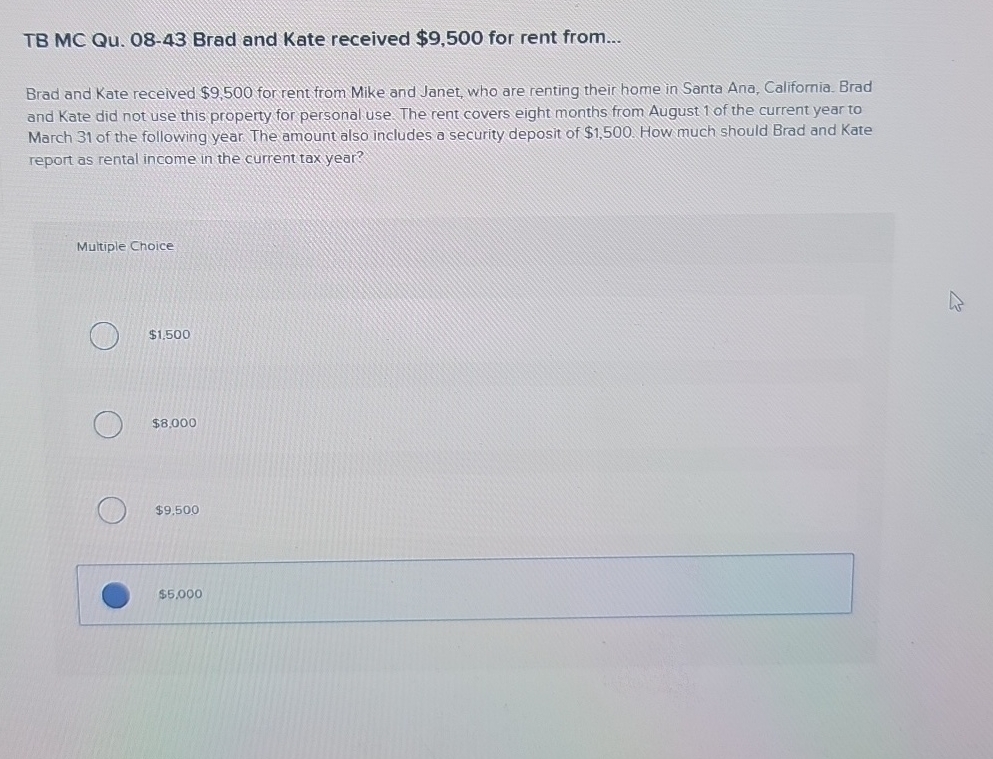

Question: TB MC Qu . 0 8 - 4 3 Brad and Kate received $ 9 , 5 0 0 for rent from... Brad and Kate

TB MC Qu Brad and Kate received $ for rent from...

Brad and Kate received $ for rent from Mike and Janet, who are renting their home in Santa Ana, California. Brad and Kate did not use this property for personal use. The rent covers eight months from August of the current year to March of the following year The amount also includes a security deposit of $ How much should Brad and Kate report as rental income in the current tax year?

Multiple Choice

$

$

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock