Question: TB MC Qu . 1 3 - 1 9 ( Algo ) Assume a company is considering buying... Assume a company is considering buying 1

TB MC QuAlgo Assume a company is considering buying...

Assume a company is considering buying units of a component part rather than making them. A supplier has agreed to sell the company units for a price of $ per unit. The company's accounting system reports the following costs of making the part:

tablePer, UnitsUnit,per YearDirect materials,$$

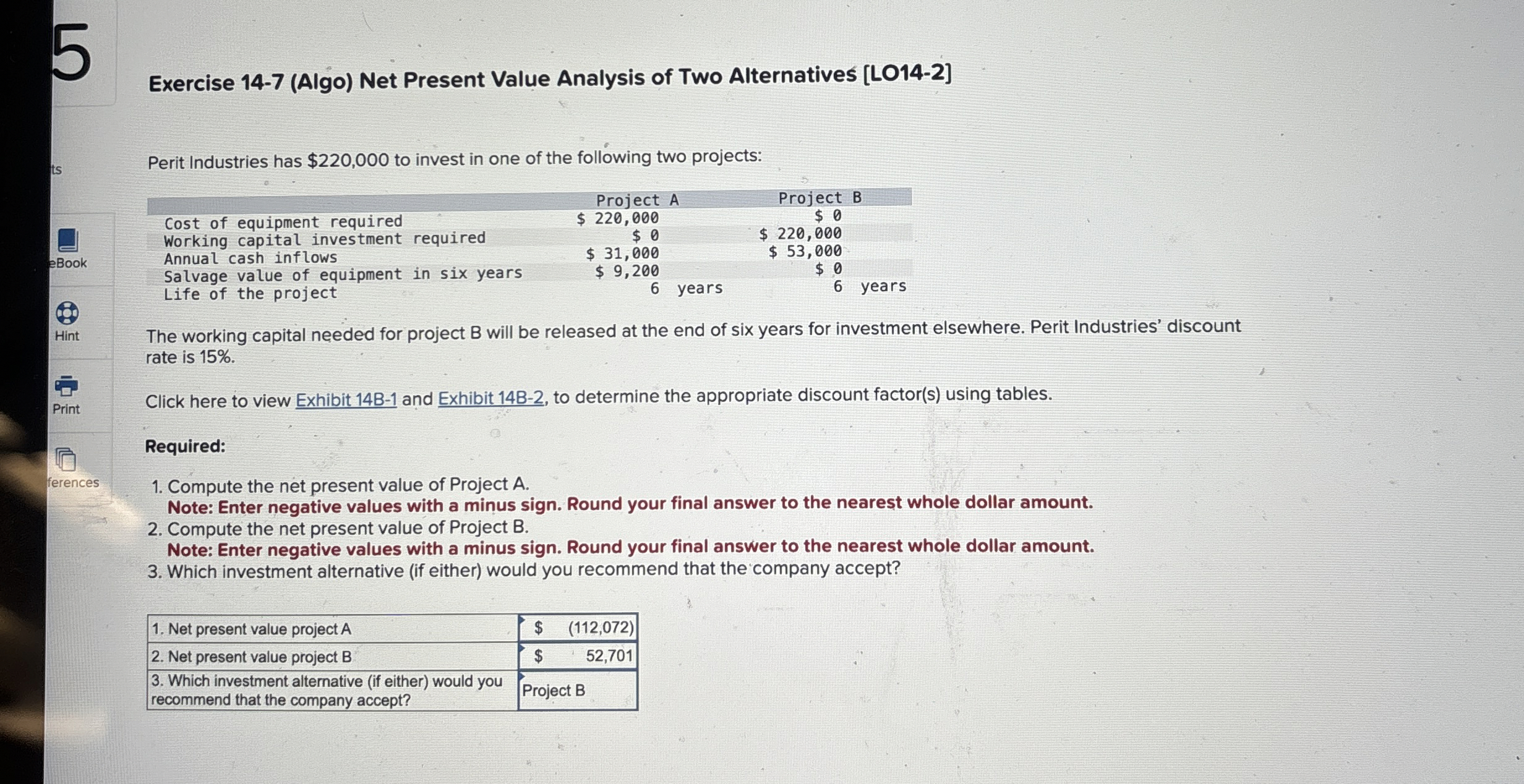

Exercise Algo Net Present Value Analysis of Two Alternatives LO

Perit Industries has $ to invest in one of the following two projects:

tableProject,AProject,BCost of equipment required,$ $Working capital investment required,$$ Annual cash inflows,$ $ Salvage value of equipment in six years,$ $ Life of the project,years,years

The working capital needed for project B will be released at the end of six years for investment elsewhere. Perit Industries' discount rate is

Click here to view Exhibit B and Exhibit B to determine the appropriate discount factors using tables.

Required:

Compute the net present value of Project

Note: Enter negative values with a minus sign. Round your final answer to the nearest whole dollar amount.

Compute the net present value of Project B

Note: Enter negative values with a minus sign. Round your final answer to the nearest whole dollar amount.

Which investment alternative if either would you recommend that the company accept?

table Net present value project A$ Net present value project B$table Which investment alternative if either would yourecommend that the company accept?Project B

Exercise Algo Net Present Value Analysis of Two Alternatives LO

Perit Industries has $ to invest in one of the following two projects:

tableProject,AProject,BCost of equipment required,$ $Working capital investment required,$$ Annual cash inflows,$ $ Salvage value of equipment in six years,$ $ Life of the project,years,years

The working capital needed for project B will be released at the end of six years for investment elsewhere. Perit Industries' discount rate is

Click here to view Exhibit B and Exhibit B to determine the appropriate discount factors using tables.

Required:

Compute the net present value of Project

Note: Enter negative values with a minus sign. Round your final answer to the nearest whole dollar amount.

Compute the net present value of Project B

Note: Enter negative values with a minus sign. Round your final answer to the nearest whole dollar amount.

Which investment alternative if either would you recommend that the company accept?

table Net present value project A$ Net present value project B$table Which investment alternative if either would yourecommend that the company accept?Project B

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock