Question: TB MC Qu . 1 6 - 7 5 ( Static ) Poston Company uses an accelerated depreciation... Poston Company uses an accelerated depreciation method

TB MC QuStatic Poston Company uses an accelerated depreciation...

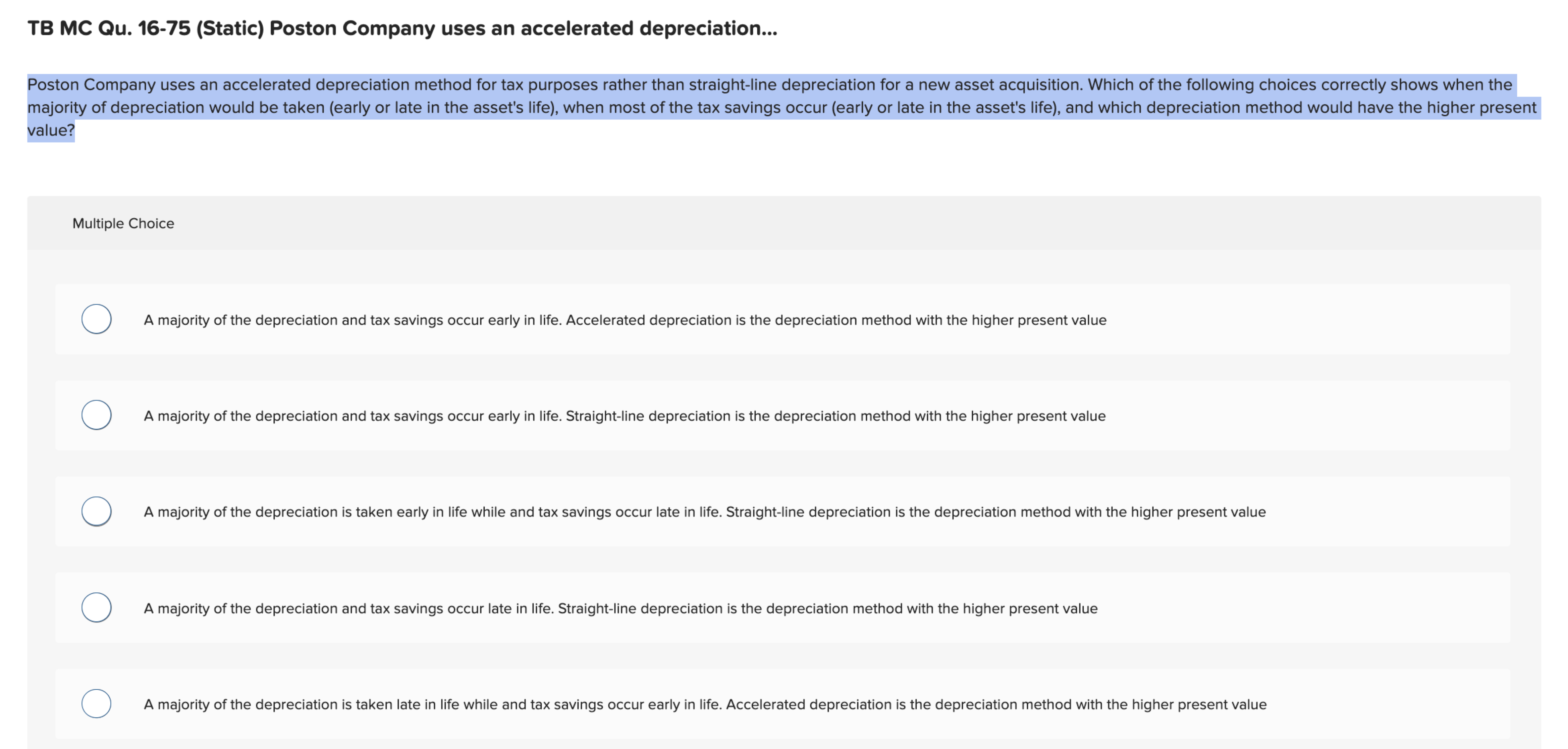

Poston Company uses an accelerated depreciation method for tax purposes rather than straightline depreciation for a new asset acquisition. Which of the following choices correctly shows when the

majority of depreciation would be taken early or late in the asset's life when most of the tax savings occur early or late in the asset's life and which depreciation method would have the higher present

value?

Multiple Choice

A majority of the depreciation and tax savings occur early in life. Accelerated depreciation is the depreciation method with the higher present value

A majority of the depreciation and tax savings occur early in life. Straightline depreciation is the depreciation method with the higher present value

A majority of the depreciation is taken early in life while and tax savings occur late in life. Straightline depreciation is the depreciation method with the higher present value

A majority of the depreciation and tax savings occur late in life. Straightline depreciation is the depreciation method with the higher present value

A majority of the depreciation is taken late in life while and tax savings occur early in life. Accelerated depreciation is the depreciation method with the higher present value

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock