Question: TB Problem 1 6 - 1 4 6 ( Algo ) Two independent situations are described... Two independent situations are described below. Each involves future

TB Problem Algo Two independent situations are described...

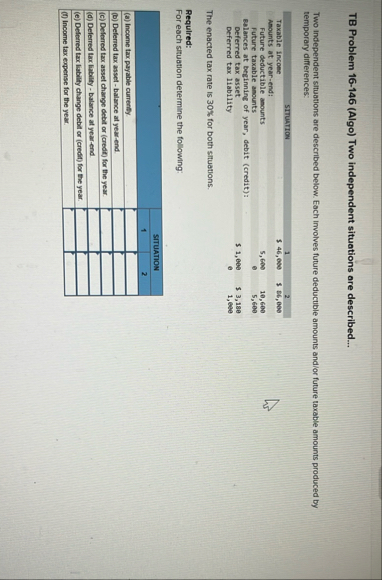

Two independent situations are described below. Each involves future deductible amounts andor future taxable amounts produced by temporary differences:

tableSITUATIONTaxable income,$ $ Amounts at yearend:Future deductible anounts,Future taxable amounts,eealances at beginning of year, debit credit:Deferred tax asset,$ eed,$ eDeferred tax liability,eee

The enacted tax rate is for both situations.

Required:

For each situation determine the following:

tableSTUATIONa Income tax payable currently.,,b Deferred tax asset balance at yearend.,,c Deferred tax asset change debit or credif for the year.,,d Delerred tax liability balance at yearend.,,e Deferred tax liability change debit or credit for the year.,,f Income tax expense for the year.,,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock