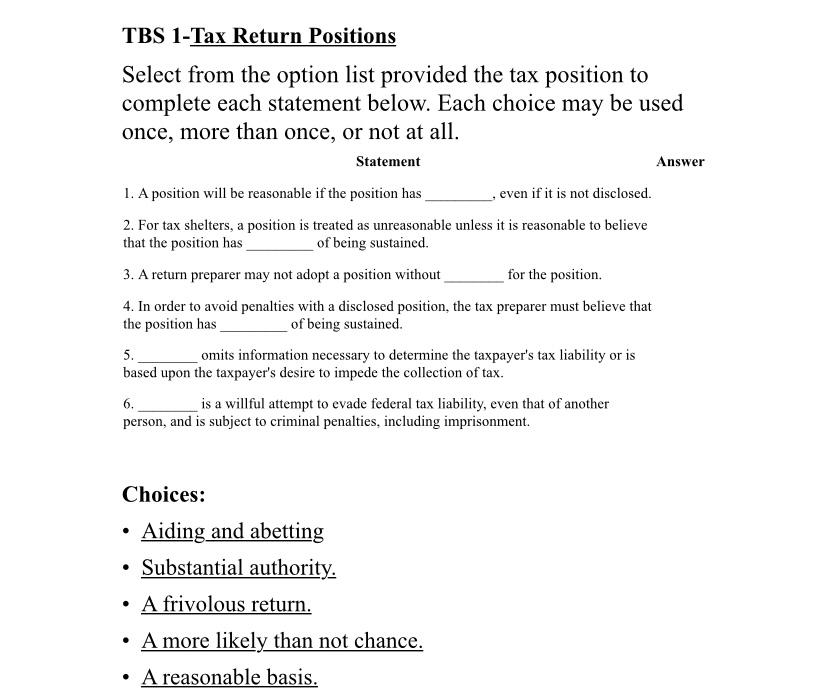

Question: TBS 1-Tax Return Positions Select from the option list provided the tax position to complete each statement below. Each choice may be used once, more

TBS 1-Tax Return Positions Select from the option list provided the tax position to complete each statement below. Each choice may be used once, more than once, or not at all. Statement Answer 1. A position will be reasonable if the position has _, even if it is not disclosed. 2. For tax shelters, a position is treated as unreasonable unless it is reasonable to believe that the position has of being sustained. 3. A return preparer may not adopt a position without for the position. 4. In order to avoid penalties with a disclosed position, the tax preparer must believe that the position has of being sustained. 5. omits information necessary to determine the taxpayer's tax liability or is based upon the taxpayer's desire to impede the collection of tax. 6. is a willful attempt to evade federal tax liability, even that of another person, and is subject to criminal penalties, including imprisonment. Choices: Aiding and abetting Substantial authority. A frivolous return. A more likely than not chance. A reasonable basis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts