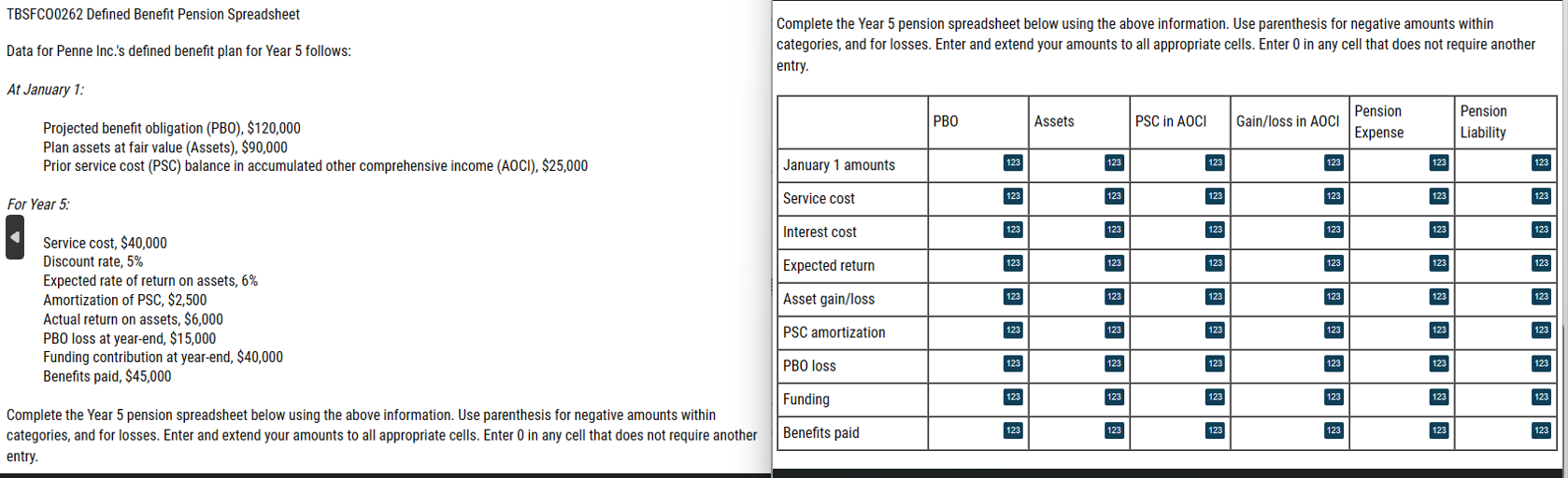

Question: TBSFC 0 0 2 6 2 Defined Benefit Pension Spreadsheet Data for Penne Inc. ' s defined benefit plan for Year 5 follows: At January

TBSFC Defined Benefit Pension Spreadsheet

Data for Penne Inc.s defined benefit plan for Year follows:

At January :

Projected benefit obligation PB $

Plan assets at fair value Assets $

Prior service cost PSC balance in accumulated other comprehensive income AOCI $

For Year :

Service cost, $

Discount rate,

Expected rate of return on assets,

Amortization of PSC $

Actual return on assets, $

PBO loss at yearend, $

Funding contribution at yearend, $

Benefits paid, $

Complete the Year pension spreadsheet below using the above information. Use parenthesis for negative amounts within

categories, and for losses. Enter and extend your amounts to all appropriate cells. Enter in any cell that does not require another

entry.

Complete the Year pension spreadsheet below using the above information. Use parenthesis for negative amounts within

categories, and for losses. Enter and extend your amounts to all appropriate cells. Enter in any cell that does not require another

entry.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock