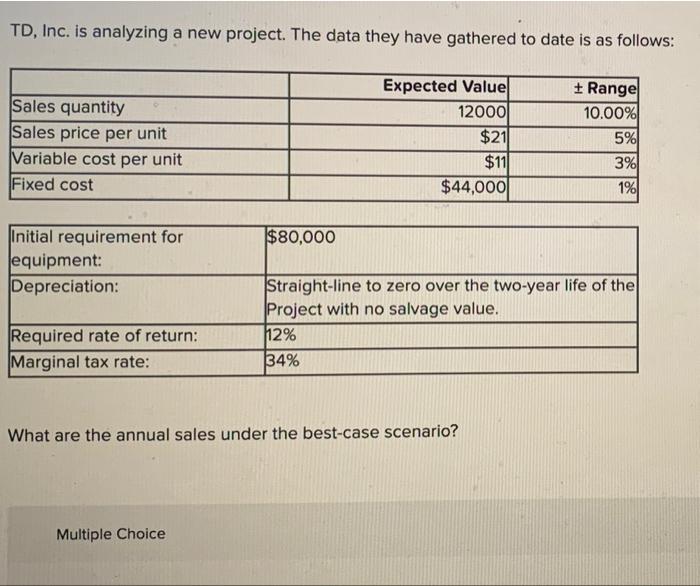

Question: TD, Inc. is analyzing a new project. The data they have gathered to date is as follows: Sales quantity Sales price per unit Variable cost

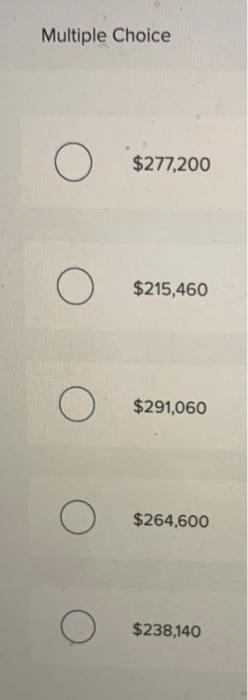

TD, Inc. is analyzing a new project. The data they have gathered to date is as follows: Sales quantity Sales price per unit Variable cost per unit Fixed cost Expected Value 12000 $211 $11 $44,000 + Range 10.00% 5% 3% 1% $80,000 Initial requirement for equipment: Depreciation: Straight-line to zero over the two-year life of the Project with no salvage value. 12% 34% Required rate of return: Marginal tax rate: What are the annual sales under the best-case scenario? Multiple Choice Multiple Choice O $277,200 O $215,460 O $291,060 O $264,600 $238,140

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts