Question: TdPad this document's format. Some content might be missing or displayed improperly. 2.1.1 .1.1.2.1.3:1.4.1.5.1.6 1.7 1.8 1.9 1.10 .11. 12 113 114 115 116 Question

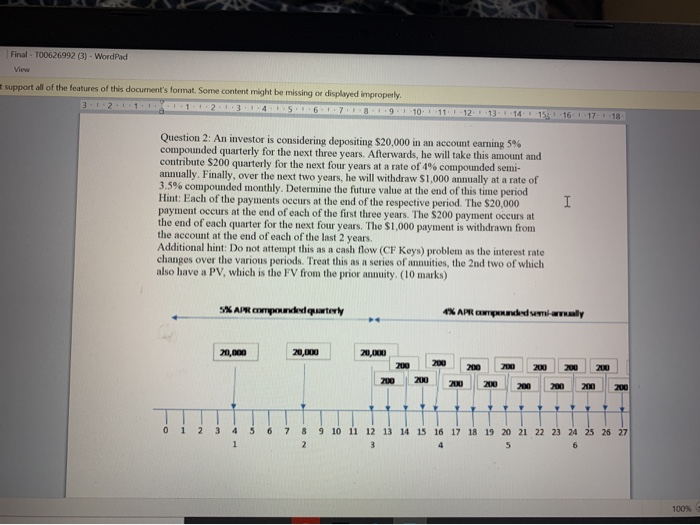

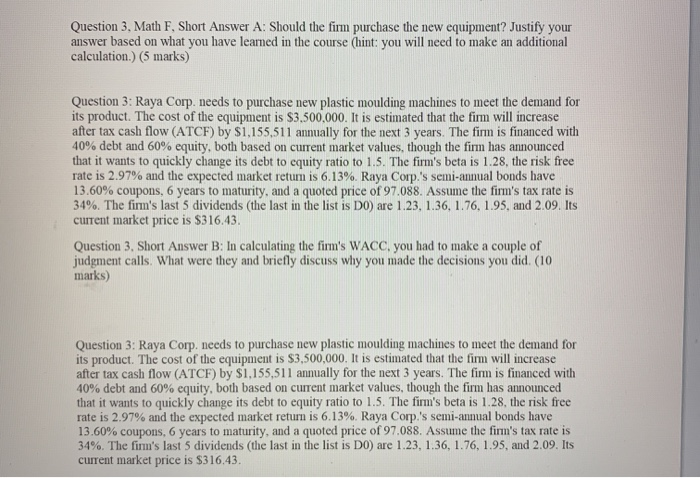

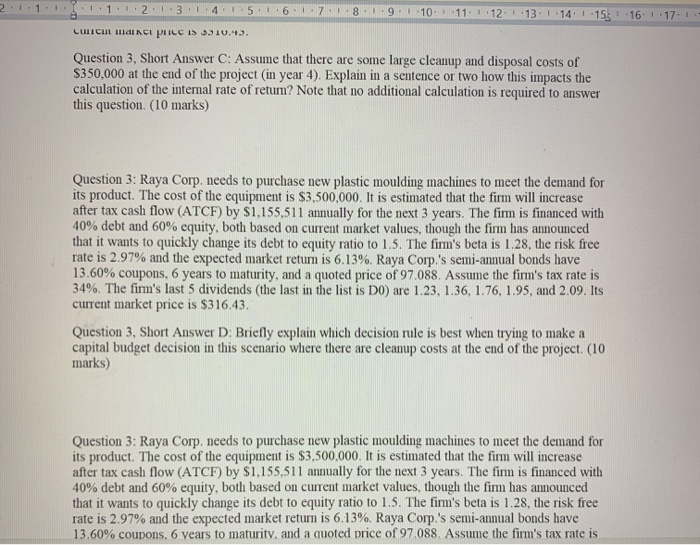

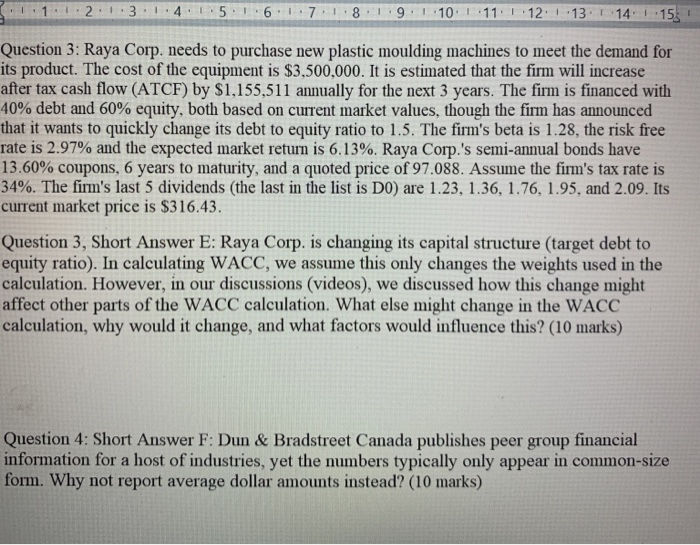

TdPad this document's format. Some content might be missing or displayed improperly. 2.1.1 .1.1.2.1.3:1.4.1.5.1.6 1.7 1.8 1.9 1.10 .11. 12 113 114 115 116 Question 1: You want to buy a house that costs $960,851.89, but all you can afford to pay on a bi-monthly mortgage for the house is $4,783.62 twice a month for 10 years. The bank quoted you a mortgage rate of 3.93%. To buy this house without putting any money down or having a balance owing at the end of the mortgage, you would have get the bank to lend you money at a lower rate. What rate would they have to quote you to make this work? (10 Marks) Final - T00626992 (3) - WordPad support all of the features of this document's format. Some content might be missing or displayed improperly. 3 .1.2 .1.1.1.3.1.1.1.2 .1.3 . 4 .5. 6.1.7.1.B.1.9.1 10.1.1 .1.12 .13.1.14 15 16 17 18 Question 2: An investor is considering depositing $20,000 in an account earning 5% compounded quarterly for the next three years. Afterwards, he will take this amount and contribute S200 quarterly for the next four years at a rate of 1% compounded semi- annually. Finally, over the next two years, he will withdraw $1,000 annually at a rate of 3.5% compounded monthly. Determine the future value at the end of this time period Hint: Each of the payments occurs at the end of the respective period. The $20,000 payment occurs at the end of each of the first three years. The $200 payment occurs at the end of each quarter for the next four years. The $1.000 payment is withdrawn from the account at the end of each of the last 2 years. Additional hint: Do not attempt this as a cash flow (CF Keys) problem as the interest rate changes over the various periods. Treat this as a series of annuities, the 2nd two of which also have a PV, which is the FV from the prior annuity. (10 marks) 5% APR wampone quarterly 4% APR paded mily 20,000 20,000 200 WY 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 5 100% Question 3: Note that this question has 10 parts, 5 short math questions, 4 short answer questions, and 1 question that requires both a math answer and a short-written answer explaining your reasoning. The information needed to answer these questions will be repeated at the top of each page for your convenience. Raya Corp. needs to purchase new plastic moulding machines to meet the demand for its product. The cost of the equipment is $3,500,000. It is estimated that the firm will increase after tax cash flow (ATCF) by $1,155,511 annually for the next 3 years. The firm is financed with 40% debt and 60% equity, both based on current market values, though the firm has announced that it wants to quickly change its debt to equity ratio to 1.5. The firm's beta is 1.28, the risk free rate is 2.97% and the expected market retum is 6.13%. Raya Corp.'s semi-annual bonds have 13.60% coupons, 6 years to maturity, and a quoted price of 97.088. Assume the firm's tax rate is 34%. The firm's last 5 dividends (the last in the list is DO) are 1.23. 1.36, 1.76, 1.95, and 2.09. Its current market price is $316.43 Question 3. Math A: What is Raya Corp.'s historic rate of dividend growth based on the last 5 dividends? (5 marks) Question 3 Math B: What is the firm's required return on equity based on the DDM model? (5 marks) Question 3: Raya Corp. needs to purchase new plastic moulding machines to meet the demand for its product. The cost of the equipment is $3,500,000. It is estimated that the firm will increase after tax cash flow (ATCF) by $1,155,511 annually for the next 3 years. The firm is financed with 40% debt and 60% equity, both based on current market values, though the firm has announced IJ 14 15 16 17 Question 3: Raya Corp. needs to purchase new plastic moulding machines to meet the demand for its product. The cost of the equipment is $3,500,000. It is estimated that the firm will increase after tax cash flow (ATCF) by $1.155,511 annually for the next 3 years. The firm is financed with 40% debt and 60% equity, both based on current market values, though the firm has announced that it wants to quickly change its debt to equity ratio to 1.5. The firm's beta is 1.28. the risk free rate is 2.97% and the expected market return is 6.13%. Raya Corp.'s semi-annual bonds have 13.60% coupons, 6 years to maturity, and a quoted price of 97.088. Assume the firm's tax rate is 34%. The firm's last 5 dividends (the last in the list is DO) are 1.23. 1.36, 1.76, 1.95, and 2.09. Its current market price is $316.43. Question 3, Math C: What is the firm's required return in equity based on the CAPM? (5 marks) Question 3: Math D: What is the firm's after-tax cost of debt? (5 marks) Question 3: Raya Corp. needs to purchase new plastic moulding machines to meet the demand for its product. The cost of the equipment is $3,500,000. It is estimated that the firm will increase after tax cash flow (ATCF) by $1,155,511 annually for the next 3 years. The firm is financed with 40% debt and 60% equity, both based on current market values, though the firm has announced that it wants to quickly change its debt to equity ratio to 1.5. The firm's beta is 1.28, the risk free rate is 2.97% and the expected market return is 6.13%. Raya Corp.'s semi-annual bonds have 13.60% coupons, 6 years to maturity, and a quoted price of 97.088. Assume the firm's tax rate is 34%. The firm's last 5 dividends (the last in the list is DO) are 1.23, 1.36, 1.76, 1.95, and 2.09. Its current market price is $316.43. Question 3, Math E: What is the firm's WACC? (5 marks) Question 3, Math F, Short Answer A: Should the firm purchase the new equipment? Justify your answer based on what you have learned in the course (hint: you will need to make an additional calculation.) (5 marks) Question 3: Raya Corp. needs to purchase new plastic moulding machines to meet the demand for its product. The cost of the equipment is $3,500,000. It is estimated that the firm will increase after tax cash flow (ATCF) by $1,155,511 annually for the next 3 years. The firm is financed with 40% debt and 60% equity, both based on current market values, thought that it wants to quickly change its debt to equity ratio to 1.5. The firm's beta is 1.28, the risk free rate is 2.97% and the expected market retum is 6.13%. Raya Corp.'s semi-annual bonds have 13.60% coupons, 6 years to maturity, and a quoted price of 97.088. Assume the firm's tax rate is 34%. The firm's last 5 dividends (the last in the list is DO) are 1.23, 1.36, 1.76, 1.95, and 2.09. Its current market price is $316.43 Question 3. Short Answer B: In calculating the firm's WACC. you had to make a couple of judgment calls. What were they and briefly discuss why you made the decisions you did. (10 marks) Question 3: Raya Corp. needs to purchase new plastic moulding machines to meet the demand for its product. The cost of the equipment is $3,500,000. It is estimated that the firm will increase after tax cash flow (ATCF) by $1,155,511 annually for the next 3 years. The fimm is financed with 40% debt and 60% equity, both based on current market values, though the firm has announced that it wants to quickly change its debt to equity ratio to 1.5. The firm's beta is 1.28. the risk free rate is 2.97% and the expected market return is 6.13%. Raya Corp.'s semi-annual bonds have 13.60% coupons, 6 years to maturity, and a quoted price of 97.088. Assume the firm's tax rate is 34%. The firm's last 5 dividends (the last in the list is DO) are 1.23, 1.36, 1.76, 1.95, and 2.09. Its current market price is $316.43. 1.1 .1.1.1.2.1.3. 14. 15. 16. 17. 18. 1.9.! 10 11 12 113 114 115 116 1171 CLICHIL ISICI PILC IS 310.3. Question 3, Short Answer C: Assume that there are some large cleanup and disposal costs of $350,000 at the end of the project in year 4). Explain in a sentence or two how this impacts the calculation of the internal rate of return? Note that no additional calculation is required to answer this question. (10 marks) Question 3: Raya Corp. needs to purchase new plastic moulding machines to meet the demand for its product. The cost of the equipment is $3,500,000. It is estimated that the firm will increase after tax cash flow (ATCF) by $1,155,511 annually for the next 3 years. The firm is financed with 40% debt and 60% equity, both based on current market values, though the firm has announced that it wants to quickly change its debt to equity ratio to 1.5. The firm's beta is 1.28, the risk free rate is 2.97% and the expected market retum is 6.13%. Raya Corp.'s semi-annual bonds have 13.60% coupons, 6 years to maturity, and a quoted price of 97.088. Assume the firm's tax rate is 34%. The firm's last 5 dividends (the last in the list is DO) are 1.23, 1.36, 1.76, 1.95, and 2.09. Its current market price is $316.43. Question 3, Short Answer D: Briefly explain which decision rule is best when trying to make a capital budget decision in this scenario where there are cleanup costs at the end of the project. (10 marks) Question 3: Raya Corp. needs to purchase new plastic moulding machines to meet the demand for its product. The cost of the equipment is $3,500,000. It is estimated that the firm will increase after tax cash flow (ATCF) by $1,155,511 annually for the next 3 years. The firm is financed with 40% debt and 60% equity, both based on current market values, though the firm has announced that it wants to quickly change its debt to equity ratio to 1.5. The firm's beta is 1.28, the risk free rate is 2.97% and the expected market return is 6.13%. Raya Corp's semi-annual bonds have 13.60% coupons. 6 years to maturity, and a quoted price of 97.088. Assume the firm's tax rate is 1.1.1.2.1:31:41:51.6.1.7.1.8.1.9. 1.10 1.11: 112: 1.131 141 15. Question 3: Raya Corp. needs to purchase new plastic moulding machines to meet the demand for its product. The cost of the equipment is $3,500,000. It is estimated that the firm will increase after tax cash flow (ATCF) by $1,155,511 annually for the next 3 years. The firm is financed with 40% debt and 60% equity, both based on current market values, though the firm has announced that it wants to quickly change its debt to equity ratio to 1.5. The firm's beta is 1.28, the risk free rate is 2.97% and the expected market return is 6.13%. Raya Corp.'s semi-annual bonds have 13.60% coupons, 6 years to maturity, and a quoted price of 97.088. Assume the firm's tax rate is 34%. The firm's last 5 dividends (the last in the list is DO) are 1.23. 1.36, 1.76, 1.95, and 2.09. Its current market price is $316.43. Question 3, Short Answer E: Raya Corp. is changing its capital structure (target debt to equity ratio). In calculating WACC, we assume this only changes the weights used in the calculation. However, in our discussions (videos), we discussed how this change might affect other parts of the WACC calculation. What else might change in the WACC calculation, why would it change, and what factors would influence this? (10 marks) Question 4: Short Answer F: Dun & Bradstreet Canada publishes peer group financial information for a host of industries, yet the numbers typically only appear in common-size form. Why not report average dollar amounts instead? (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts