Question: teach not just solve Consider an asset pricing model that allows an individual to invest in / risky assets with returns Ritti for j =

teach not just solve

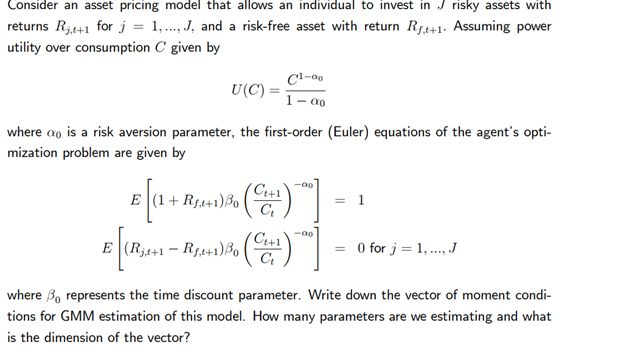

Consider an asset pricing model that allows an individual to invest in / risky assets with returns Ritti for j = 1,..,J, and a risk-free asset with return Ry #+1. Assuming power utility over consumption C given by U(C) = 1 - do where on is a risk aversion parameter, the first-order (Euler) equations of the agent's opti- mization problem are given by E (1 + RS,#+1) Bo = 1 Ct E (Ritti - Ry.+1) Bo = 0 for j = 1, ..., J Ct where Do represents the time discount parameter. Write down the vector of moment condi- tions for GMM estimation of this model. How many parameters are we estimating and what is the dimension of the vector

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock