Question: Teaching Tool 17 - Portfolio Attribution Example Personal Finance: Another Perspective Following is an example of Performance Attribution for a multiple asset benchmark and portfolio.

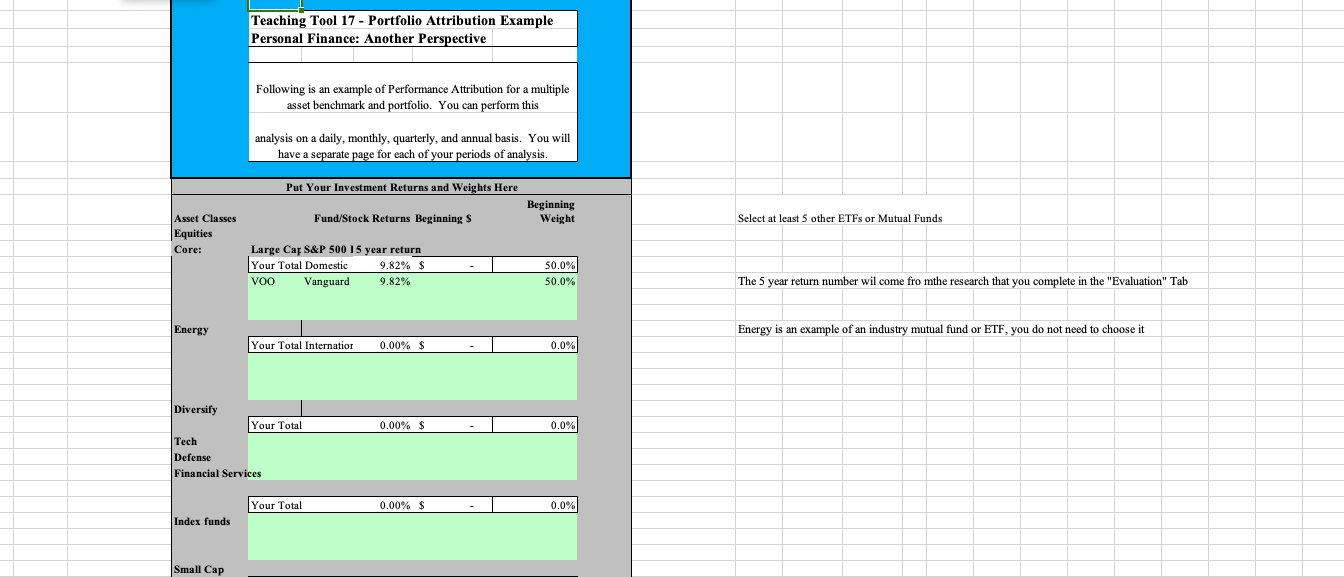

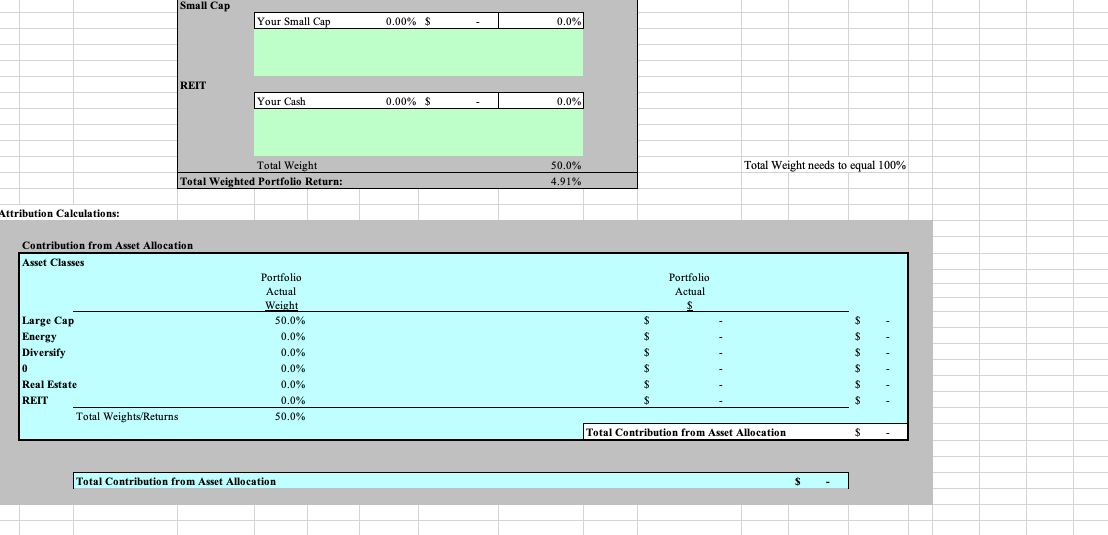

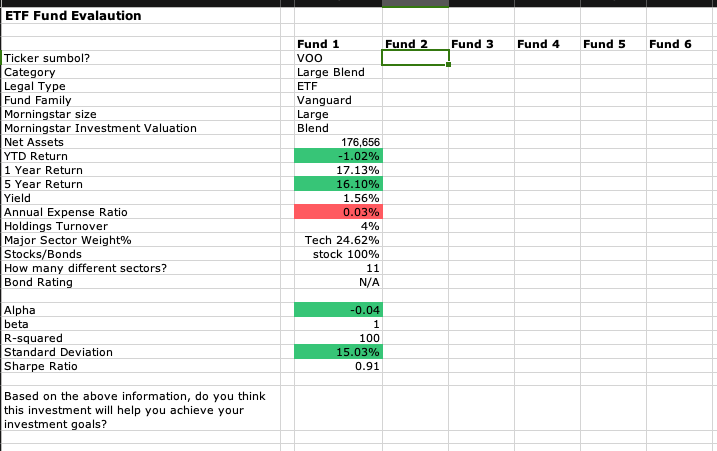

Teaching Tool 17 - Portfolio Attribution Example Personal Finance: Another Perspective Following is an example of Performance Attribution for a multiple asset benchmark and portfolio. You can perform this analysis on a daily, monthly, quarterly, and annual basis. You will have a separate page for each of your periods of analysis. Put Your Investment Returns and Weights Here Fund/Stock Returns Beginning $ Beginning Weight Select at least 5 other ETFs or Mutual Funds Asset Classes Equities Core: Large Cap S&P 500 15 year return Your Total Domestic 9.82% $ VOO Vanguard 9.82% 50.0% 50.0% The 5 year return number wil come fromthe research that you complete in the "Evaluation" Tab Energy Energy is an example of an industry mutual fund or ETF, you do not need to choose it Your Total Internation 0.00% $ 0.0% 0.00% $ 0.0% Diversify Your Total Tech Defense Financial Services Your Total 0.00% S 0.0% Index funds Small Cap Small Cap Your Small Cap 0.00% $ 0.0% REIT Your Cash 0.00% $ 0.0% Total Weight Total Weighted Portfolio Return: 50.0% 4.91% Total Weight needs to equal 100% Attribution Calculations: Contribution from Asset Allocation Asset Classes Portfolio Actual Portfolio Actual Weight 50.0% 0.0% 0.0% Large Cap Energy Diversify lo Real Estate REIT Total Weights/Returns 0.0% 0.0% 0.0% 50.0% Total Contribution from Asset Allocation Total Contribution from Asset Allocation ETF Fund Evalaution Fund 3 Fund 4 Fund 5 Fund 6 Ticker sumbol? Category Legal Type Fund Family Morningstar size Morningstar Investment Valuation Net Assets YTD Return 1 Year Return 5 Year Return Yield Annual Expense Ratio Holdings Turnover Major Sector Weight% Stocks/Bonds How many different sectors? Bond Rating Fund 1 Fund 2 voo Large Blend ETF Vanguard Large Blend 176,656 -1.02% 17.13% 16.10% 1.56% 0.03% 4% Tech 24.62% stock 100% 11 N/A Alpha beta R-squared Standard Deviation Sharpe Ratio -0.04 1 100 15.03% 0.91 Based on the above information, do you think this investment will help you achieve your investment goals? Teaching Tool 17 - Portfolio Attribution Example Personal Finance: Another Perspective Following is an example of Performance Attribution for a multiple asset benchmark and portfolio. You can perform this analysis on a daily, monthly, quarterly, and annual basis. You will have a separate page for each of your periods of analysis. Put Your Investment Returns and Weights Here Fund/Stock Returns Beginning $ Beginning Weight Select at least 5 other ETFs or Mutual Funds Asset Classes Equities Core: Large Cap S&P 500 15 year return Your Total Domestic 9.82% $ VOO Vanguard 9.82% 50.0% 50.0% The 5 year return number wil come fromthe research that you complete in the "Evaluation" Tab Energy Energy is an example of an industry mutual fund or ETF, you do not need to choose it Your Total Internation 0.00% $ 0.0% 0.00% $ 0.0% Diversify Your Total Tech Defense Financial Services Your Total 0.00% S 0.0% Index funds Small Cap Small Cap Your Small Cap 0.00% $ 0.0% REIT Your Cash 0.00% $ 0.0% Total Weight Total Weighted Portfolio Return: 50.0% 4.91% Total Weight needs to equal 100% Attribution Calculations: Contribution from Asset Allocation Asset Classes Portfolio Actual Portfolio Actual Weight 50.0% 0.0% 0.0% Large Cap Energy Diversify lo Real Estate REIT Total Weights/Returns 0.0% 0.0% 0.0% 50.0% Total Contribution from Asset Allocation Total Contribution from Asset Allocation ETF Fund Evalaution Fund 3 Fund 4 Fund 5 Fund 6 Ticker sumbol? Category Legal Type Fund Family Morningstar size Morningstar Investment Valuation Net Assets YTD Return 1 Year Return 5 Year Return Yield Annual Expense Ratio Holdings Turnover Major Sector Weight% Stocks/Bonds How many different sectors? Bond Rating Fund 1 Fund 2 voo Large Blend ETF Vanguard Large Blend 176,656 -1.02% 17.13% 16.10% 1.56% 0.03% 4% Tech 24.62% stock 100% 11 N/A Alpha beta R-squared Standard Deviation Sharpe Ratio -0.04 1 100 15.03% 0.91 Based on the above information, do you think this investment will help you achieve your investment goals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts