Question: Tech Helpers Company prepares a variable costing income statement for internal management and an absorption costing income statement for its bank. Tech Helpers provides a

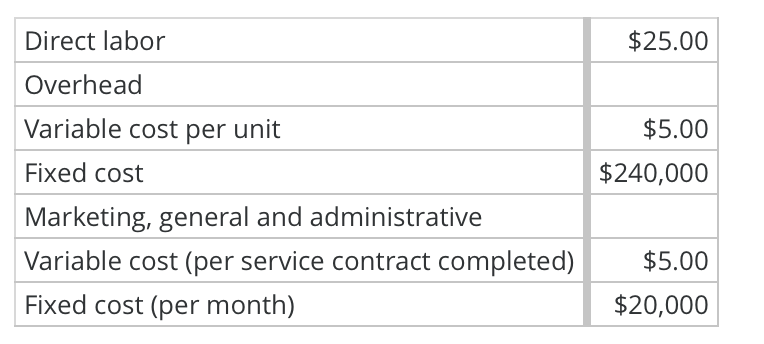

Tech Helpers Company prepares a variable costing income statement for internal management and an absorption costing income statement for its bank. Tech Helpers provides a personal computer maintenance service that is sold for $100. The variable and fixed cost data are as follows:

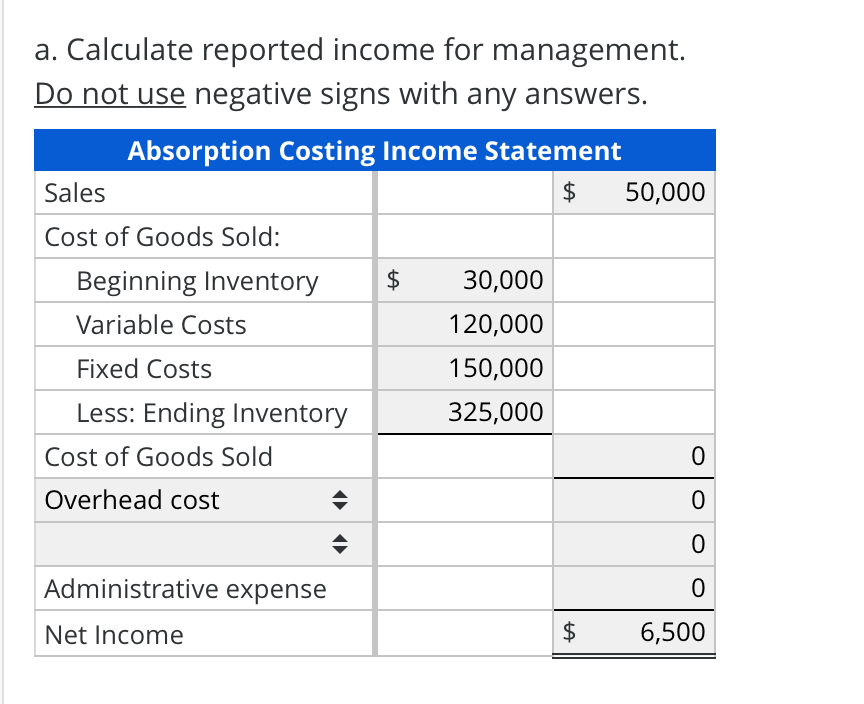

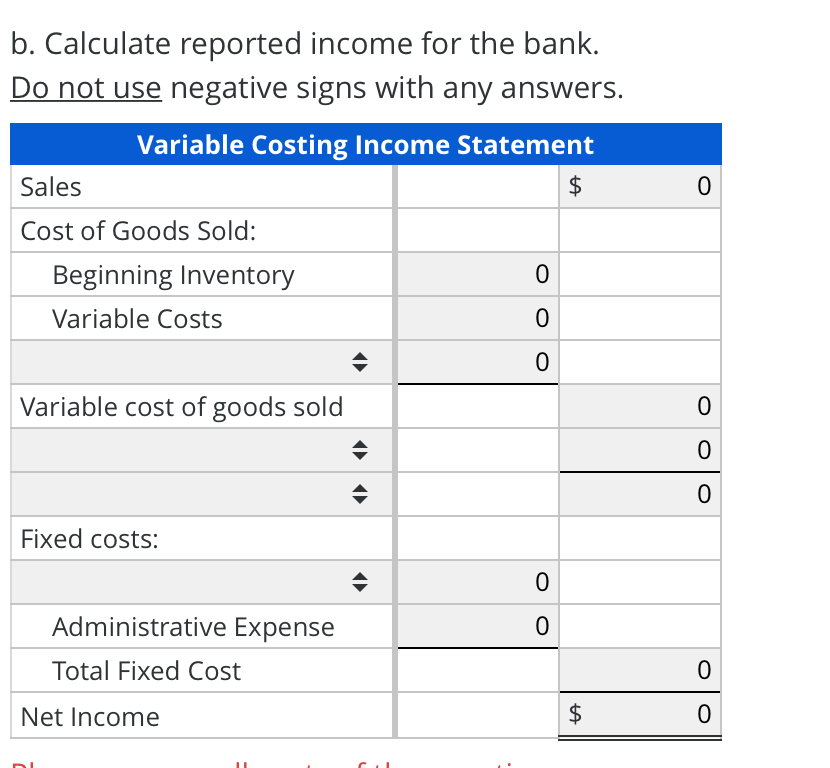

During 2015, 4,000 service contracts were started and 5,000 service contracts were completed. At the beginning of 2016, Tech Helpers had 1,000 service contracts in process at a per-unit cost of $90 in beginning work-in-process inventory.

$25.00 Direct labor Overhead Variable cost per unit $5.00 $240,000 Fixed cost Marketing, general and administrative Variable cost (per service contract completed) Fixed cost (per month) $5.00 $20,000 a. Calculate reported income for management. Do not use negative signs with any answers. Absorption Costing Income Statement Sales $ 50,000 Cost of Goods Sold: $ Beginning Inventory Variable Costs 30,000 120,000 150,000 325,000 Fixed Costs Less: Ending Inventory Cost of Goods Sold Overhead cost 010 Administrative expense Net Income $ 6,500 b. Calculate reported income for the bank. Do not use negative signs with any answers. Variable Costing Income Statement Sales Cost of Goods Sold: Beginning Inventory Variable Costs Variable cost of goods sold Fixed costs: Administrative Expense Total Fixed Cost Net Income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts