Question: Technical Assignment #3 Due December 2, 2021 Champex Inc. is a Canadian public company that manufactures solvents used in manufacturing processes. In June 2020, in

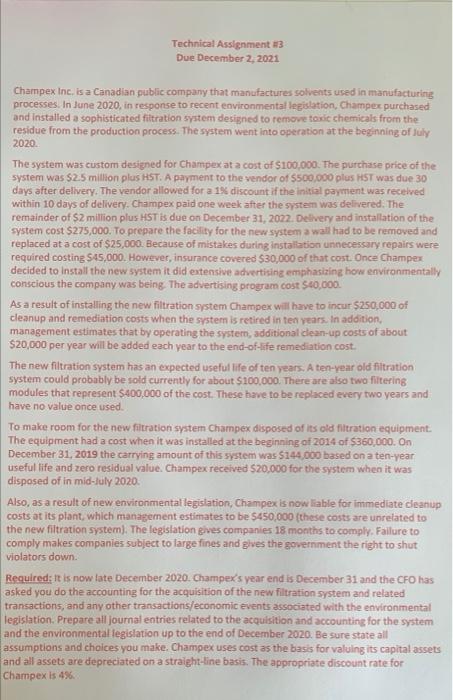

Technical Assignment #3 Due December 2, 2021 Champex Inc. is a Canadian public company that manufactures solvents used in manufacturing processes. In June 2020, in response to recent environmental legislation, Champex purchased and installed a sophisticated filtration system designed to remove toxic chemicals from the residue from the production process. The system went into operation at the beginning of July 2020 The system was custom designed for Champex at a cost of $100,000. The purchase price of the system was $2.5 million plus HST. A payment to the vendor of $500,000 plas HST was due 30 days after delivery. The vendor allowed for a 1% discount if the initial payment was received within 10 days of delivery. Champex paid one week after the system was delivered. The remainder of S2 million plus HST is due on December 31, 2022. Delivery and installation of the system cost $275,000. To prepare the facility for the new system a wall had to be removed and replaced at a cost of $25,000. Because of mistakes during installation unnecessary repairs were required costing $45,000. However, insurance covered $30,000 of that cost. Once Champex decided to install the new system it did extensive advertising emphasizing how environmentally conscious the company was being. The advertising program cost $40.000 As a result of installing the new filtration system Champex will have to incur $250,000 of cleanup and remediation costs when the system is retired in ten years. In addition, management estimates that by operating the system, additional clean-up costs of about $20,000 per year will be added each year to the end-of-ife remediation cost. The new filtration system has an expected useful life of ten years. A ten-year old filtration system could probably be sold currently for about $100,000. There are also two filtering modules that represent $400,000 of the cost. These have to be replaced every two years and have no value once used To make room for the new filtration system Champex disposed of its old filtration equipment. The equipment had a cost when it was installed at the beginning of 2014 of $360,000. On December 31, 2019 the carrying amount of this system was 5144,000 based on a ten-year useful life and zero residual value. Champex received $20,000 for the system when it was disposed of in mid-July 2020 Also, as a result of new environmental legislation, Champex is now liable for immediate cleanup costs at its plant, which management estimates to be $450,000 (these costs are unrelated to the new filtration system). The legislation gives companies 18 months to comply. Failure to comply makes companies subject to large fines and gives the government the right to shut violators down Required: It is now late December 2020. Champex's year end is December 31 and the CFO has asked you do the accounting for the acquisition of the new filtration system and related transactions, and any other transactions/economic events associated with the environmental legislation. Prepare all journal entries related to the acquisition and accounting for the system and the environmental legislation up to the end of December 2020. Be sure state all assumptions and choices you make. Champex uses cost as the basis for valuing its capital assets and all assets are depreciated on a straight-line basis. The appropriate discount rate for Champex is 4% Technical Assignment #3 Due December 2, 2021 Champex Inc. is a Canadian public company that manufactures solvents used in manufacturing processes. In June 2020, in response to recent environmental legislation, Champex purchased and installed a sophisticated filtration system designed to remove toxic chemicals from the residue from the production process. The system went into operation at the beginning of July 2020 The system was custom designed for Champex at a cost of $100,000. The purchase price of the system was $2.5 million plus HST. A payment to the vendor of $500,000 plas HST was due 30 days after delivery. The vendor allowed for a 1% discount if the initial payment was received within 10 days of delivery. Champex paid one week after the system was delivered. The remainder of S2 million plus HST is due on December 31, 2022. Delivery and installation of the system cost $275,000. To prepare the facility for the new system a wall had to be removed and replaced at a cost of $25,000. Because of mistakes during installation unnecessary repairs were required costing $45,000. However, insurance covered $30,000 of that cost. Once Champex decided to install the new system it did extensive advertising emphasizing how environmentally conscious the company was being. The advertising program cost $40.000 As a result of installing the new filtration system Champex will have to incur $250,000 of cleanup and remediation costs when the system is retired in ten years. In addition, management estimates that by operating the system, additional clean-up costs of about $20,000 per year will be added each year to the end-of-ife remediation cost. The new filtration system has an expected useful life of ten years. A ten-year old filtration system could probably be sold currently for about $100,000. There are also two filtering modules that represent $400,000 of the cost. These have to be replaced every two years and have no value once used To make room for the new filtration system Champex disposed of its old filtration equipment. The equipment had a cost when it was installed at the beginning of 2014 of $360,000. On December 31, 2019 the carrying amount of this system was 5144,000 based on a ten-year useful life and zero residual value. Champex received $20,000 for the system when it was disposed of in mid-July 2020 Also, as a result of new environmental legislation, Champex is now liable for immediate cleanup costs at its plant, which management estimates to be $450,000 (these costs are unrelated to the new filtration system). The legislation gives companies 18 months to comply. Failure to comply makes companies subject to large fines and gives the government the right to shut violators down Required: It is now late December 2020. Champex's year end is December 31 and the CFO has asked you do the accounting for the acquisition of the new filtration system and related transactions, and any other transactions/economic events associated with the environmental legislation. Prepare all journal entries related to the acquisition and accounting for the system and the environmental legislation up to the end of December 2020. Be sure state all assumptions and choices you make. Champex uses cost as the basis for valuing its capital assets and all assets are depreciated on a straight-line basis. The appropriate discount rate for Champex is 4%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts