Question: Technical Problem #1 relates to chapter 2 - The Accounting Information System. It requires you to complete a problem involving three separate steps in the

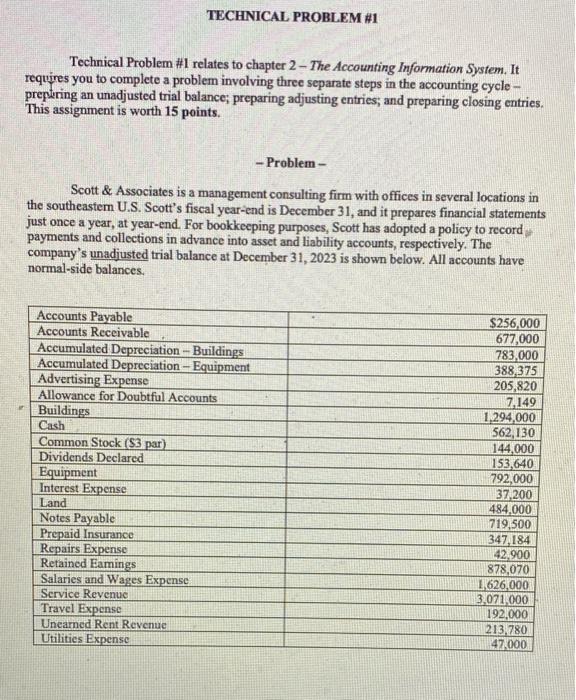

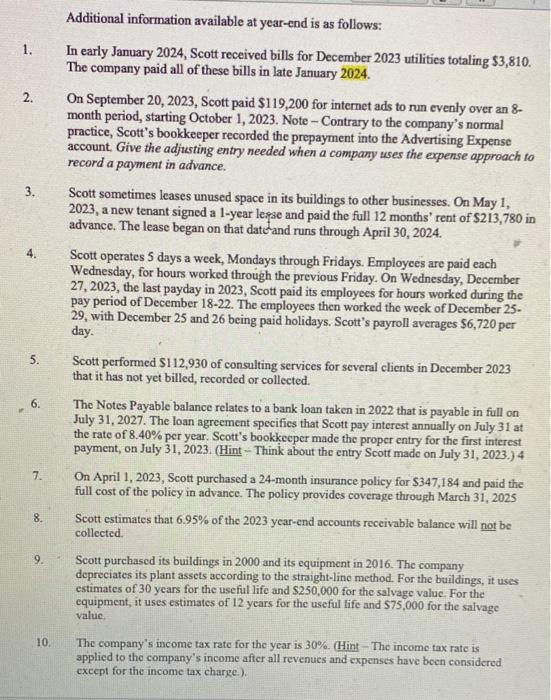

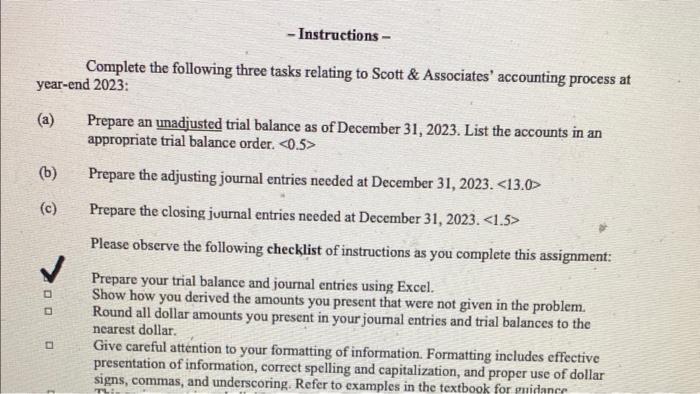

Technical Problem \#1 relates to chapter 2 - The Accounting Information System. It requires you to complete a problem involving three separate steps in the accounting cycle preptring an unadjusted trial balance; preparing adjusting entries; and preparing closing entries. This assignment is worth 15 points. - Problem - Scott \& Associates is a management consulting firm with offices in several locations in the southeastem U.S. Scott's fiscal year-end is December 31, and it prepares financial statements just once a year, at year-end. For bookkeeping purposes, Scott has adopted a policy to record payments and collections in advance into asset and liability accounts, respectively. The company's unadjusted trial balance at December 31,2023 is shown below. All accounts have normal-side balances. Additional information available at year-end is as follows: 1. In early January 2024, Scott received bills for December 2023 utilities totaling $3,810. The company paid all of these bills in late January 2024. 2. On September 20,2023 , Scott paid $119,200 for intemet ads to run evenly over an 8month period, starting October 1, 2023. Note - Contrary to the company's normal practice, Scott's bookkeeper recorded the prepayment into the Advertising Expense account. Give the adjusting entry needed when a company uses the expense approach to record a payment in advance. 3. Scott sometimes leases unused space in its buildings to other businesses. On May 1, 2023, a new tenant signed a 1-year lesse and paid the full 12 months' rent of $213,780 in advance. The lease began on that date and runs through April 30, 2024. 4. Scott operates 5 days a week, Mondays through Fridays. Employees are paid each Wednesday, for hours worked through the previous Friday. On Wednesday, December 27, 2023, the last payday in 2023, Scott paid its employees for hours worked duning the pay period of December 18-22. The employees then worked the week of December 25 . 29 , with December 25 and 26 being paid holidays. Scott's payroll averages $6,720 per day. 5. Scott performed $112,930 of consulting services for several clients in December 2023 that it has not yet billed, recorded or collected. 6. The Notes Payable balance relates to a bank loan taken in 2022 that is payable in full on July 31, 2027. The loan agreement specifies that Scott pay interest annually on July 31 at the rate of 8.40% per year. Scott's bookkeeper made the proper entry for the first interest payment, on July 31, 2023. (Hint - Think about the entry Scott made on July 31, 2023.) 4 7. On April 1, 2023, Scott purchased a 24-month insurance policy for $347,184 and paid the full cost of the policy in advance. The policy provides coverage through March 31, 2025 8. Scott estimates that 6.95% of the 2023 year-end accounts receivable balance will not be collected. 9. Scott purchased its buildings in 2000 and its equipment in 2016. The company depreciates its plant assets according to the straight-line method. For the buildings, it uses estimates of 30 years for the useful life and $250,000 for the salvage value. For the equipment, it uses estimates of 12 years for the useful life and 575,000 for the salvage value. 10. The company's income tax rate for the year is 30%. (Hint - The income tax rate is applied to the company's income after all revenues and expenses have been considered except for the income tax charge.). - Instructions - Complete the following three tasks relating to Scott \& Associates' accounting process at year-end 2023: (a) Prepare an unadjusted trial balance as of December 31, 2023. List the accounts in an appropriate trial balance order. (b) Prepare the adjusting journal entries needed at December 31, 2023. (c) Prepare the closing juurnal entries needed at December 31,2023. Please observe the following checklist of instructions as you complete this assignment: Prepare your trial balance and journal entries using Excel. Show how you derived the amounts you present that were not given in the problem. Round all dollar amounts you present in your joumal entries and trial balances to the nearest dollar. Give careful attention to your formatting of information. Formatting includes effective presentation of information, correct spelling and capitalization, and proper use of dollar signs, commas, and underscoring. Refer to examples in the textbook for guidance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts