Question: Technical problems associated with the internal rate of return include: a. the possibility of multiple IRRs, which rarely present practical difficulties b. the assumption that

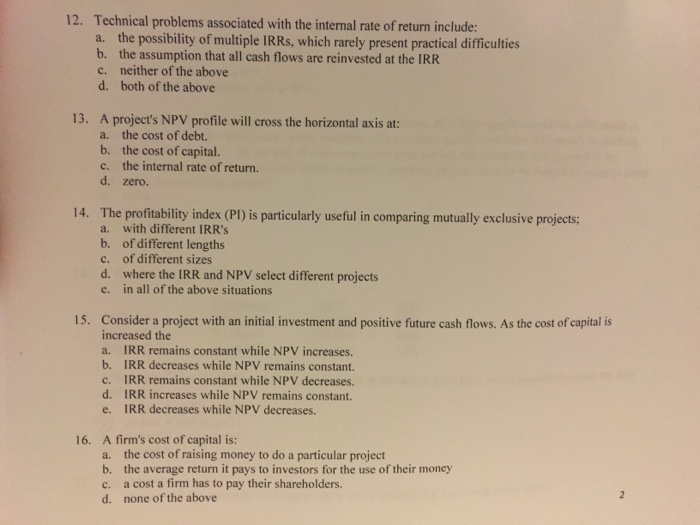

Technical problems associated with the internal rate of return include: a. the possibility of multiple IRRs, which rarely present practical difficulties b. the assumption that all cash flows arc reinvested at the IRR c. neither of the above d. both of the above 13. A project's NPV profile will cross the horizontal axis at: a. the cost of debt. b. the cost of capital. c. the internal rate of return. d. zero. 14. The profitability index (PI) is particularly useful in comparing mutually exclusive projects: a. with different IRR's b. of different lengths c. of different sizes d. where the IRR and NPV select different projects e. in all of the above situations 15. Consider a project with an initial investment and positive future cash flows. As the cost of capital increased the a. IRR remains constant while NPV increases. b. IRR decreases while NPV remains constant. c. IRR remains constant while NPV decreases. d. IRR increases while NPV remains constant. e. IRR decreases while NPV decreases. 16. A firm's cost of capital is: a. the cost of raising money to do a particular project b. the average return it pays to investors for the use of their money c. a cost a firm has to pay their shareholders. d. none of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts