Question: . Technoid Ino sells computer systems. Technoid lenses computers to Lone Star Company on January 1, 2021. The manufacturing cost of the computers was $20

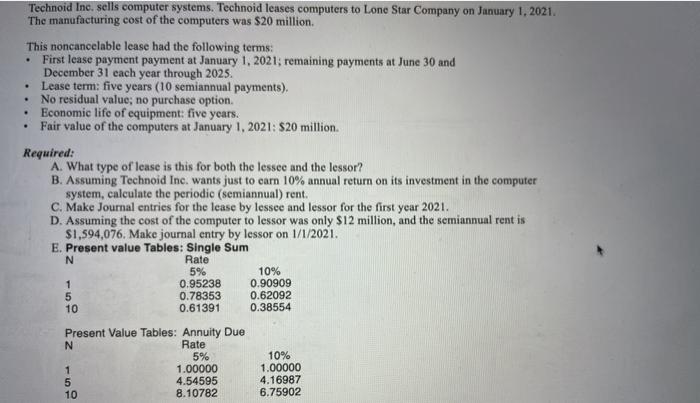

. Technoid Ino sells computer systems. Technoid lenses computers to Lone Star Company on January 1, 2021. The manufacturing cost of the computers was $20 million This noncancelable lease had the following terms: First lease payment payment at January 1, 2021; remaining payments at June 30 and December 31 each year through 2025. Lease term: five years (10 semiannual payments). No residual value, no purchase option Economic life of equipment: five years. Fair value of the computers at January 1, 2021: $20 million Required: A. What type of lease is this for both the lessee and the lessor? B. Assuming Technoid Inc. wants just to earn 10% annual return on its investment in the computer system, calculate the periodic (semiannual) rent. C. Make Journal entries for the lease by lessee and lessor for the first year 2021. D. Assuming the cost of the computer to lessor was only $12 million, and the semiannual rent is $1,594,076. Make journal entry by lessor on 1/1/2021. E. Present value Tables: Single Sum Rate 5% 10% 0.95238 0.90909 5 0.78353 0.62092 0.61391 0.38554 N 1 10 Present Value Tables: Annuity Due N Rate 5% 1 1.00000 5 4.54595 10 8.10782 10% 1.00000 4.16987 6.75902

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts