Question: TEE > A A1 fr Towne, Inc., a calendar year 5 corporation, holds AAA of $180,000 at the beginning of the y E Towne, Inc.,

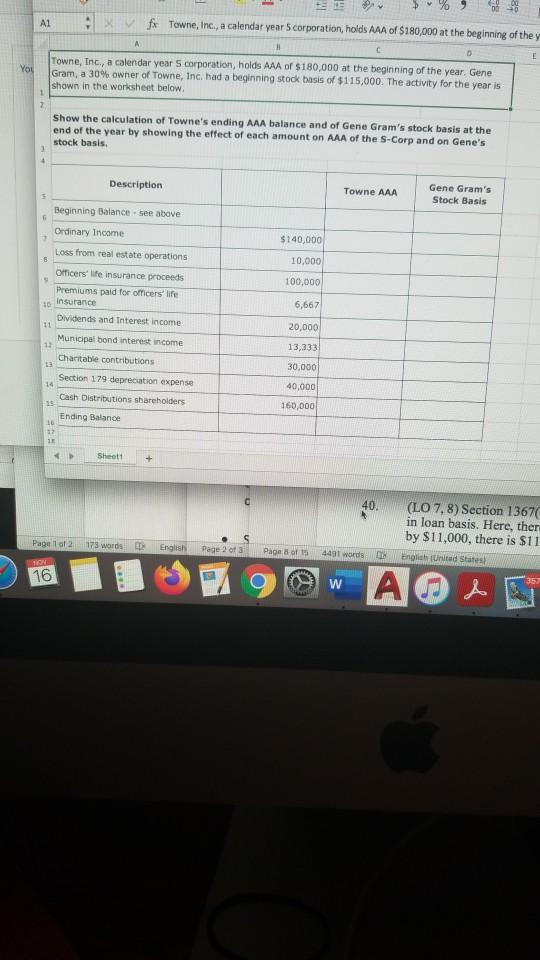

TEE > A A1 fr Towne, Inc., a calendar year 5 corporation, holds AAA of $180,000 at the beginning of the y E Towne, Inc., a calendar years corporation, holds AAA of $180,000 at the beginning of the year. Gene Gram, a 30% owner of Towne, Inc. had a beginning stock basis of $115,000. The activity for the year is shown in the worksheet below. D You 1 2 Show the calculation of Towne's ending AAA balance and of Gene Gram's stock basis at the end of the year by showing the effect of each amount on AAA of the S-Corp and on Gene's stock basis Description Towne AAA Gene Gram's Stock Basis Beginning Balance see above $140,000 10,000 100,000 6,667 Ordinary Income 7 Loss from real estate operations 8 Officers' life insurance proceeds Premiums paid for omers' life 16 Insurance Dividends and Interest income Municipal bond interest income 11 Charitable contributions 33 Section 179 depreciation expense 14 Cash Distributions shareholders 15 Ending Balance 20,000 13,333 30,000 40,000 160,000 11 Sheet1 + 40 (LO 7, 8) Section 1367 in loan basis. Here, there by $11,000, there is $11 English (United States Page 1 of 2 173 words English Page 2 of 3 Page of is 4491 words 16 W AOA

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock