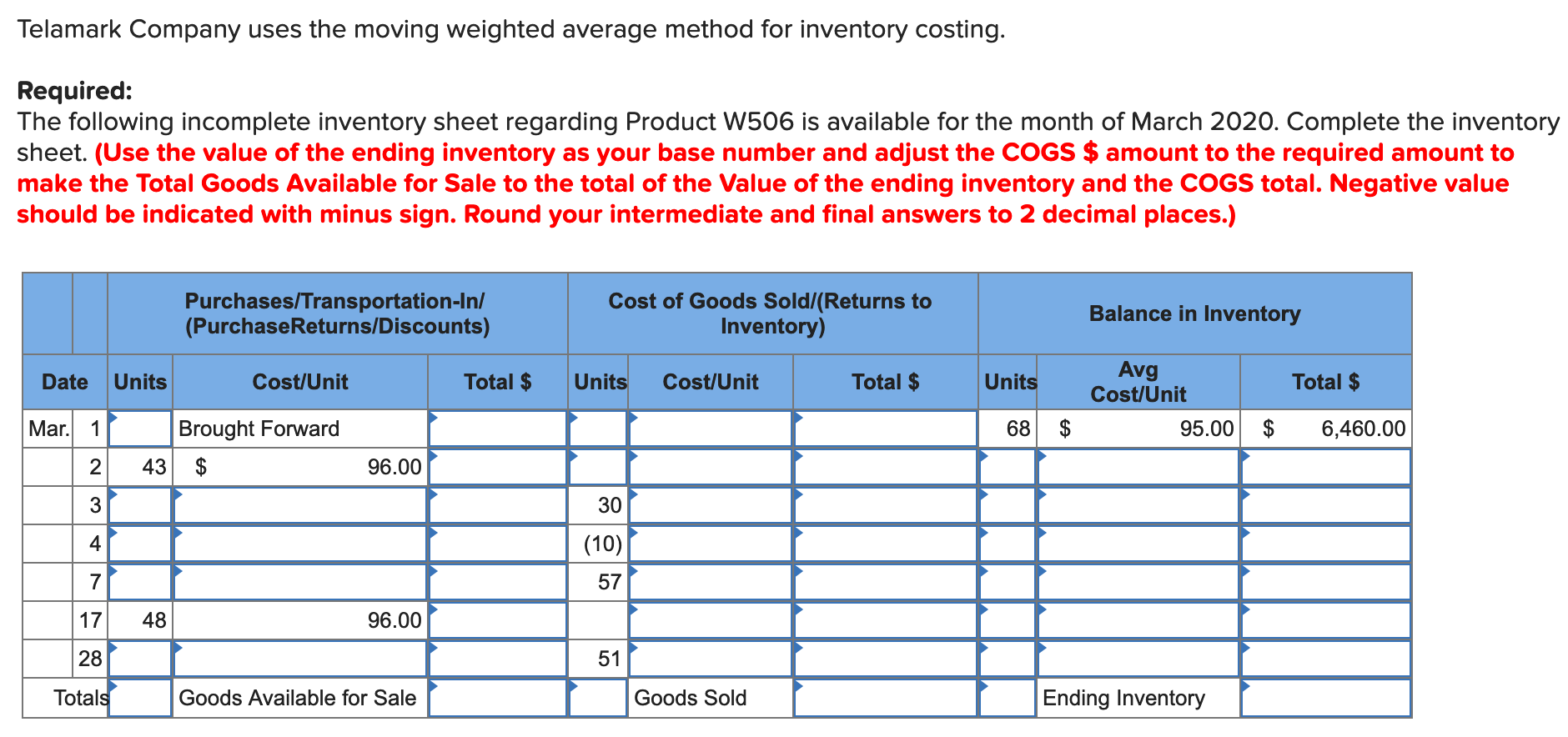

Question: Telamark Company uses the moving weighted average method for inventory costing. Required: The following incomplete inventory sheet regarding Product W506 is available for the month

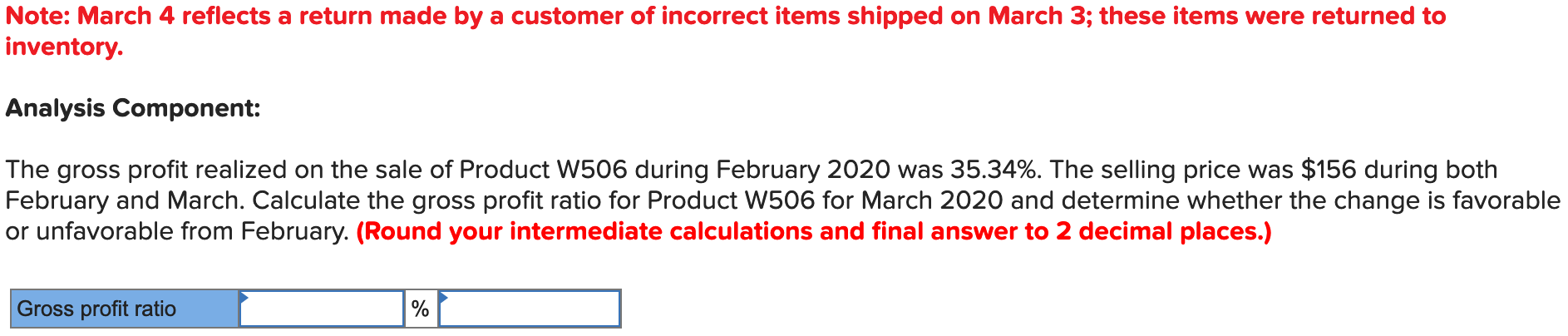

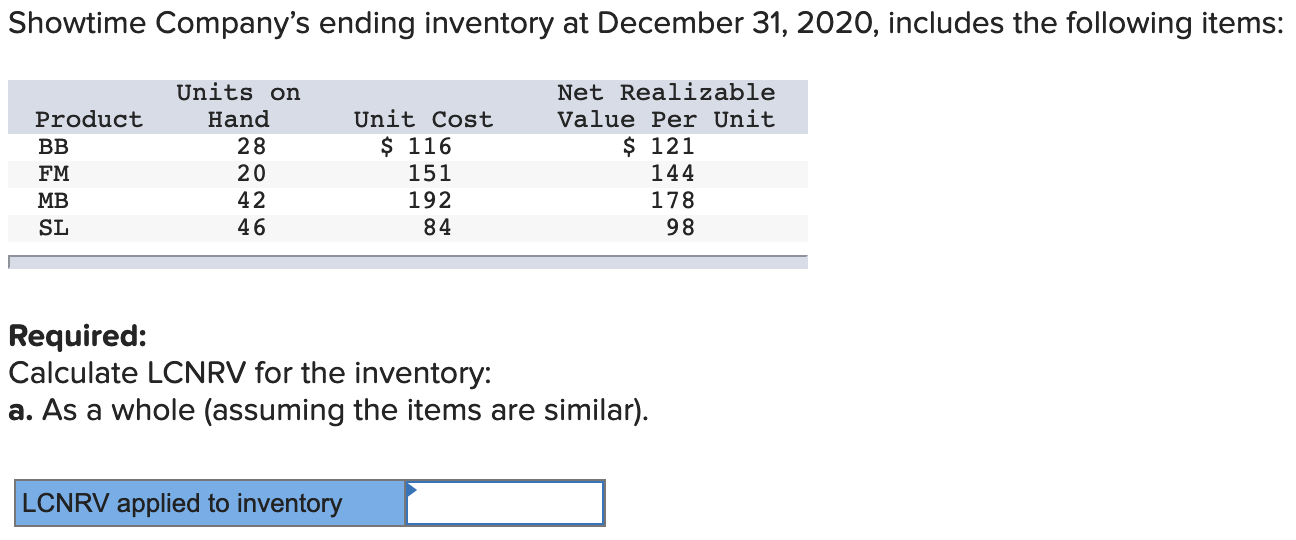

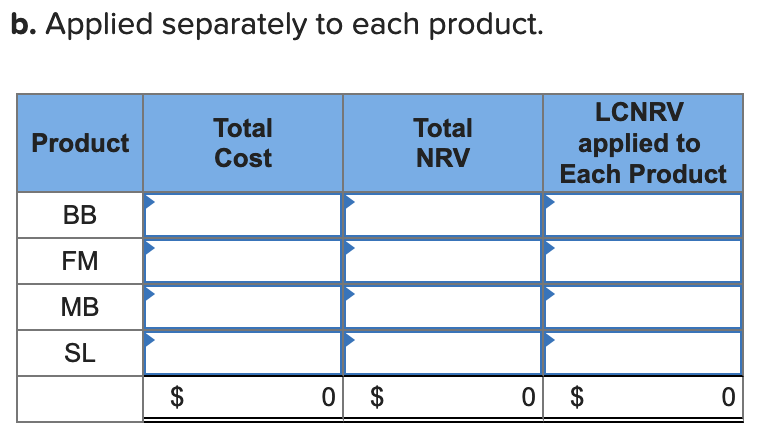

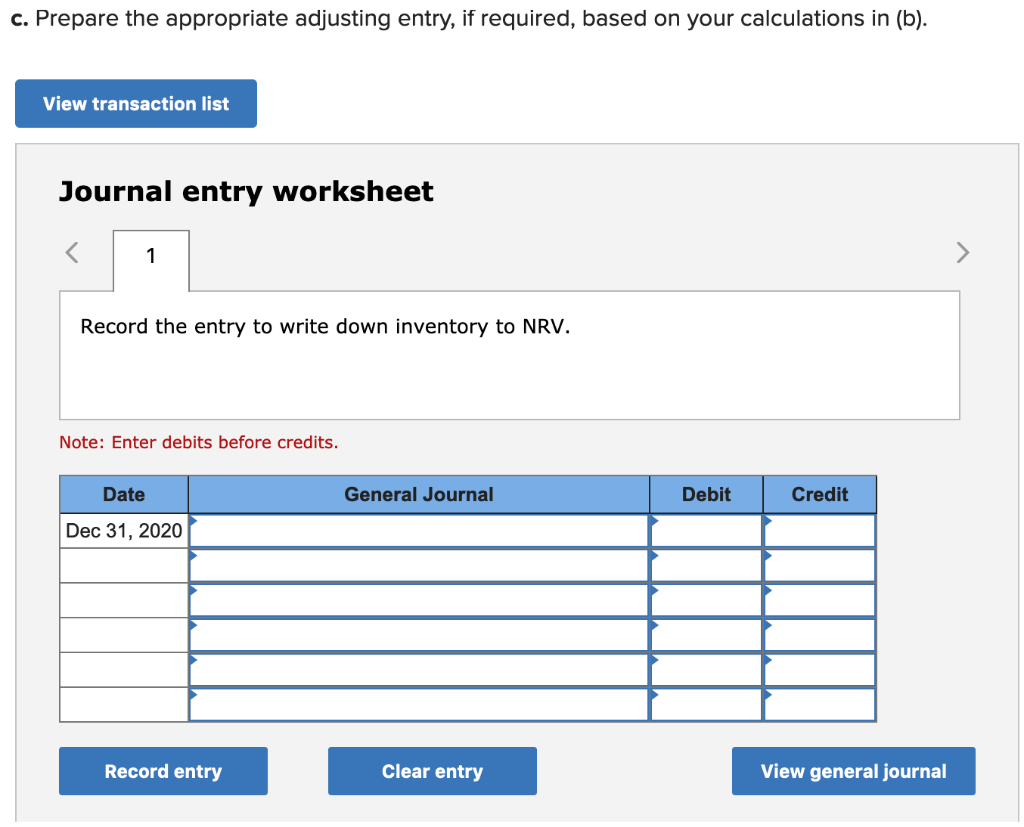

Telamark Company uses the moving weighted average method for inventory costing. Required: The following incomplete inventory sheet regarding Product W506 is available for the month of March 2020. Complete the inventory sheet. (Use the value of the ending inventory as your base number and adjust the COGS $ amount to the required amount to make the Total Goods Available for Sale to the total of the Value of the ending inventory and the COGS total. Negative value should be indicated with minus sign. Round your intermediate and final answers to 2 decimal places.) Purchases/Transportation-In/ (Purchase Returns/Discounts) Cost of Goods Sold/(Returns to Inventory) Balance in Inventory Date Units Cost/Unit Total $ Units Cost/Unit Total $ Units Avg Cost/Unit Total $ Mar. 1 68 $ 95.00 $ 6,460.00 Brought Forward 43 $ 2 96.00 3 30 4 (10) 7 57 17 48 96.00 28 51 Totals Goods Available for Sale Goods Sold Ending Inventory Note: March 4 reflects a return made by a customer of incorrect items shipped on March 3; these items were returned to inventory. Analysis Component: The gross profit realized on the sale of Product W506 during February 2020 was 35.34%. The selling price was $156 during both February and March. Calculate the gross profit ratio for Product W506 for March 2020 and determine whether the change is favorable or unfavorable from February. (Round your intermediate calculations and final answer to 2 decimal places.) Gross profit ratio % Showtime Company's ending inventory at December 31, 2020, includes the following items: Product BB FM MB SL Units on Hand 28 20 42 46 Unit Cost $ 116 151 192 84 Net Realizable Value Per Unit $ 121 144 178 98 Required: Calculate LCNRV for the inventory: a. As a whole (assuming the items are similar). LCNRV applied to inventory c. Prepare the appropriate adjusting entry, if required, based on your calculations in (b). View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts