Question: Teletech Case Analysis Please note there should be an Excel Workbook available as part of the e-book which contains the case exhibits. This will save

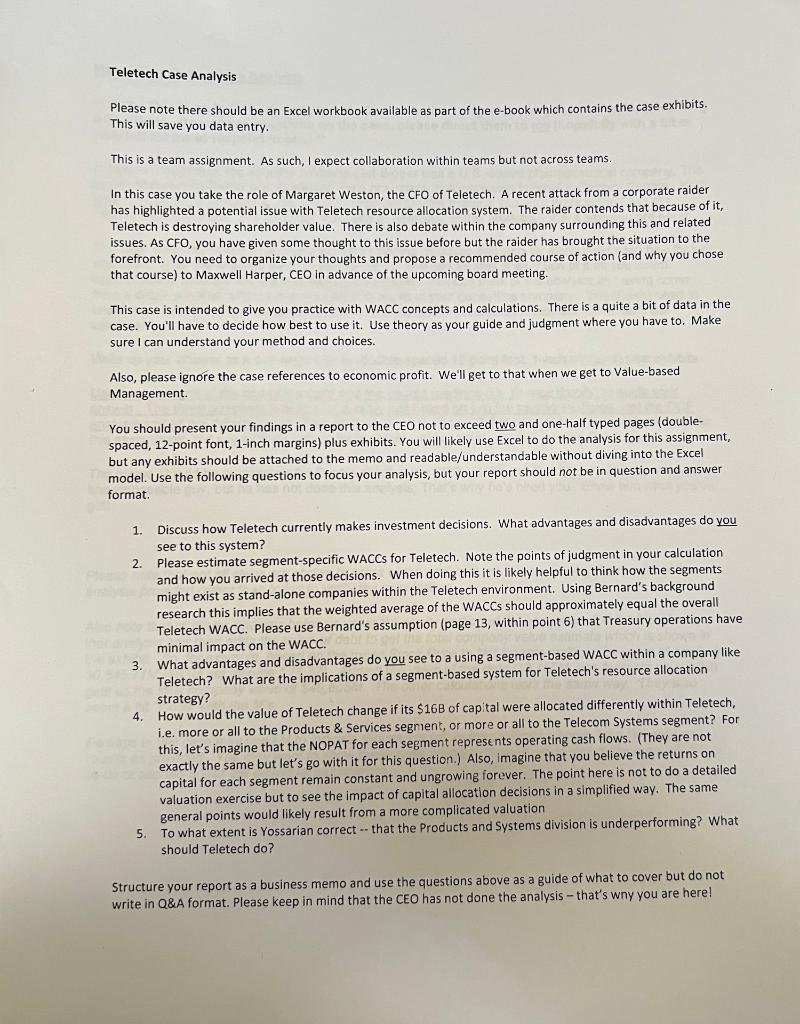

Teletech Case Analysis Please note there should be an Excel Workbook available as part of the e-book which contains the case exhibits. This will save you data entry. This is a team assignment. As such, I expect collaboration within teams but not across teams. In this case you take the role of Margaret Weston, the CFO of Teletech. A recent attack from a corporate raider has highlighted a potential issue with Teletech resource allocation system. The raider contends that because of it, Teletech is destroying shareholder value. There is also debate within the company surrounding this and related issues. As CFO, you have given some thought to this issue before but the raider has brought the situation to the forefront. You need to organize your thoughts and propose a recommended course of action (and why you chose that course) to Maxwell Harper, CEO in advance of the upcoming board meeting. This case is intended to give you practice with WACC concepts and calculations. There is a quite a bit of data in the case. You'll have to decide how best to use it. Use theory as your guide and judgment where you have to. Make sure I can understand your method and choices. Also, please ignore the case references to economic profit. We'll get to that when we get to Value-based Management. You should present your findings in a report to the CEO not to exceed two and one-half typed pages (double- spaced, 12-point font, 1-inch margins) plus exhibits. You will likely use Excel to do the analysis for this assignment, but any exhibits should be attached to the memo and readable/understandable without diving into the Excel model. Use the following questions to focus your analysis, but your report should not be in question and answer format. 1 Discuss how Teletech currently makes investment decisions. What advantages and disadvantages do you see to this system? 2. Please estimate segment-specific WACCs for Teletech. Note the points of judgment in your calculation and how you arrived at those decisions. When doing this it is likely helpful to think how the segments might exist as stand-alone companies within the Teletech environment. Using Bernard's background research this implies that the weighted average of the WACCs should approximately equal the overall Teletech WACC. Please use Bernard's assumption (page 13, within point 6) that Treasury operations have minimal impact on the WACC. 3. What advantages and disadvantages do you see to a using a segment-based WACC within a company like Teletech? What are the implications of a segment-based system for Teletech's resource allocation strategy? 4. How would the value of Teletech change if its $16B of capital were allocated differently within Teletech, i.e. more or all to the Products & Services segment, or more or all to the Telecom Systems segment? For this, let's imagine that the NOPAT for each segment represents operating cash flows. (They are not exactly the same but let's go with it for this question.) Also, imagine that you believe the returns on capital for each segment remain constant and ungrowing forever. The point here is not to do a detailed valuation exercise but to see the impact of capital allocation decisions in a simplified way. The same general points would likely result from a more complicated valuation 5. To what extent is Yossarian correct -- that the Products and Systems division is underperforming? What should Teletech do? Structure your report as a business memo and use the questions above as a guide of what to cover but do not write in Q&A format. Please keep in mind that the CEO has not done the analysis - that's wny you are here! Teletech Case Analysis Please note there should be an Excel Workbook available as part of the e-book which contains the case exhibits. This will save you data entry. This is a team assignment. As such, I expect collaboration within teams but not across teams. In this case you take the role of Margaret Weston, the CFO of Teletech. A recent attack from a corporate raider has highlighted a potential issue with Teletech resource allocation system. The raider contends that because of it, Teletech is destroying shareholder value. There is also debate within the company surrounding this and related issues. As CFO, you have given some thought to this issue before but the raider has brought the situation to the forefront. You need to organize your thoughts and propose a recommended course of action (and why you chose that course) to Maxwell Harper, CEO in advance of the upcoming board meeting. This case is intended to give you practice with WACC concepts and calculations. There is a quite a bit of data in the case. You'll have to decide how best to use it. Use theory as your guide and judgment where you have to. Make sure I can understand your method and choices. Also, please ignore the case references to economic profit. We'll get to that when we get to Value-based Management. You should present your findings in a report to the CEO not to exceed two and one-half typed pages (double- spaced, 12-point font, 1-inch margins) plus exhibits. You will likely use Excel to do the analysis for this assignment, but any exhibits should be attached to the memo and readable/understandable without diving into the Excel model. Use the following questions to focus your analysis, but your report should not be in question and answer format. 1 Discuss how Teletech currently makes investment decisions. What advantages and disadvantages do you see to this system? 2. Please estimate segment-specific WACCs for Teletech. Note the points of judgment in your calculation and how you arrived at those decisions. When doing this it is likely helpful to think how the segments might exist as stand-alone companies within the Teletech environment. Using Bernard's background research this implies that the weighted average of the WACCs should approximately equal the overall Teletech WACC. Please use Bernard's assumption (page 13, within point 6) that Treasury operations have minimal impact on the WACC. 3. What advantages and disadvantages do you see to a using a segment-based WACC within a company like Teletech? What are the implications of a segment-based system for Teletech's resource allocation strategy? 4. How would the value of Teletech change if its $16B of capital were allocated differently within Teletech, i.e. more or all to the Products & Services segment, or more or all to the Telecom Systems segment? For this, let's imagine that the NOPAT for each segment represents operating cash flows. (They are not exactly the same but let's go with it for this question.) Also, imagine that you believe the returns on capital for each segment remain constant and ungrowing forever. The point here is not to do a detailed valuation exercise but to see the impact of capital allocation decisions in a simplified way. The same general points would likely result from a more complicated valuation 5. To what extent is Yossarian correct -- that the Products and Systems division is underperforming? What should Teletech do? Structure your report as a business memo and use the questions above as a guide of what to cover but do not write in Q&A format. Please keep in mind that the CEO has not done the analysis - that's wny you are here

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts