Question: tell me the answer which i did wrong please. Wildhorse's Cycle Booth Ltd. had the following transactions involving current liabilities in its first year of

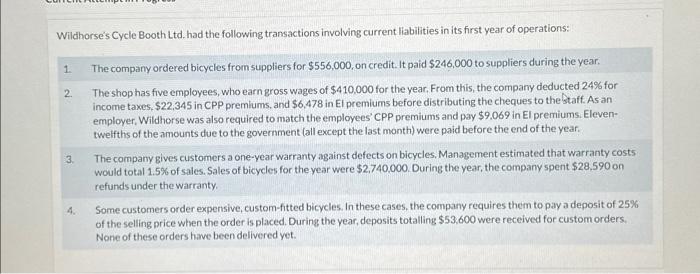

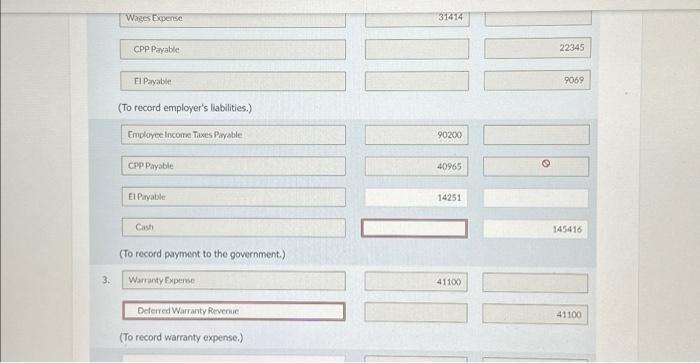

Wildhorse's Cycle Booth Ltd. had the following transactions involving current liabilities in its first year of operations: 1. The company ordered bicycles from suppliers for $556,000, on credit. It paid $246,000 to suppliers during the year. 2. The shop has five employees, who earn gross wages of $410,000 for the year. From this, the company deducted 24% for income taxes, $22,345 in CPP premlums, and $6,478 in El premiums before distributing the cheques to the Staff. As an employer, Wildhorse was also required to match the employees' CPP premiums and pay $9.069 in El premiums. Eleventwelfths of the amounts due to the government (all except the last month) were paid before the end of the year. 3. The company gives customers a one-year warranty against defects on bicycles. Management estimated that warranty costs would total 1.5% of sales. Sales of bicycles for the year were $2,740,000. During the year, the company spent $28,590 on refunds under the warranty. 4. Some customers order expensive, custom-fitted bicycles. In these cases, the company requires them to pay a deposit of 25% of the selling price when the order is placed. During the year, deposits totalling $53,600 were received for custom orders. None of these orders have been delivered yet. Wages Expense 31414 CPPParable: \begin{tabular}{r} \hline 22345 \\ \hline 9069 \\ \hline \end{tabular} EPayable (To record employer's liabilities.) Embloyce Income Taxes Payble \begin{tabular}{|c|c|} \hline 90200 & \\ \hline & \\ \hline 40965 & Q \\ \hline 14251 & \\ \hline & \\ \hline & 145416 \\ \hline \end{tabular} Cash (To record payment to the government.) 3. Warranty Experse 41100 Detered Warranty Reverue 41100 (To record warranty expense.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts