Question: Template B is a table shown below. Regarding to page 155, if you can't see the pdf here's a snap of it. This is page

Template B is a table shown below.

Regarding to page 155, if you can't see the pdf here's a snap of it. This is page 155-157

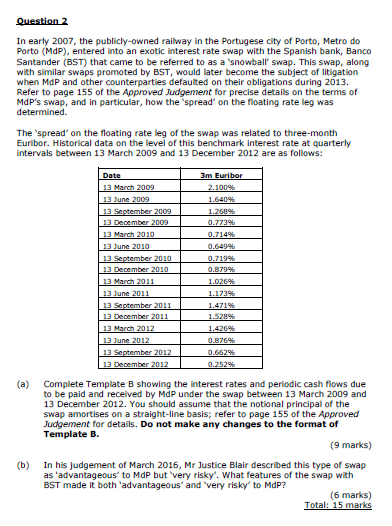

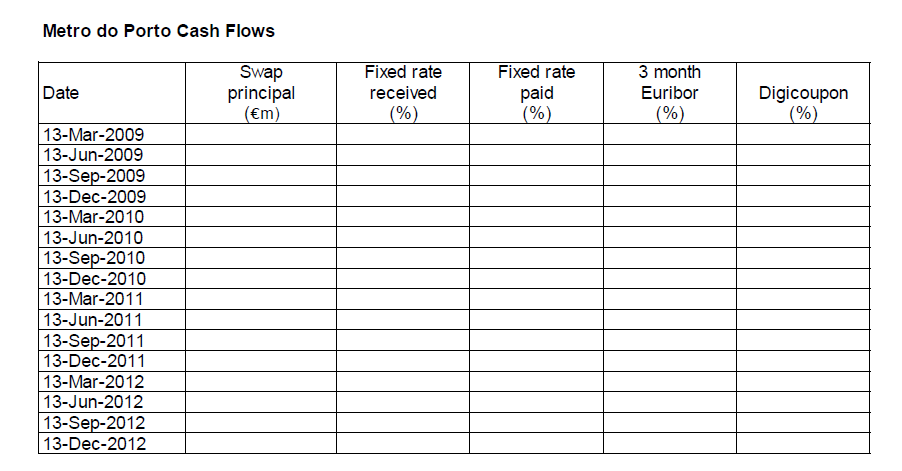

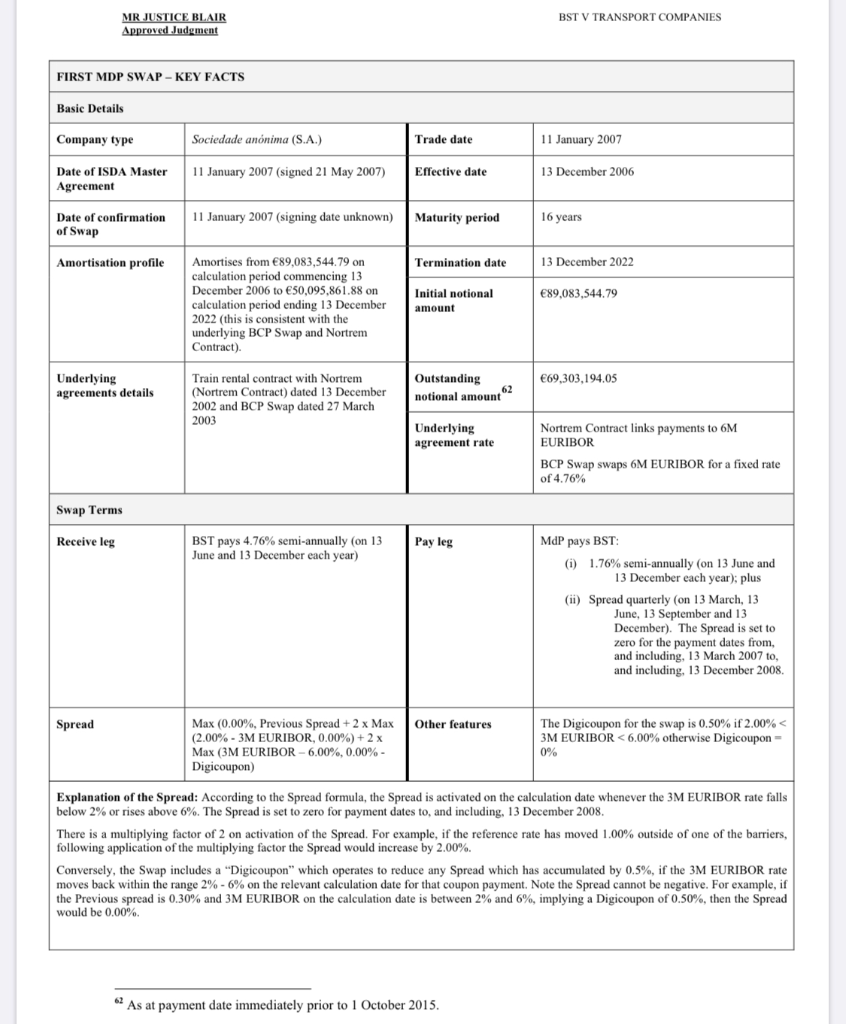

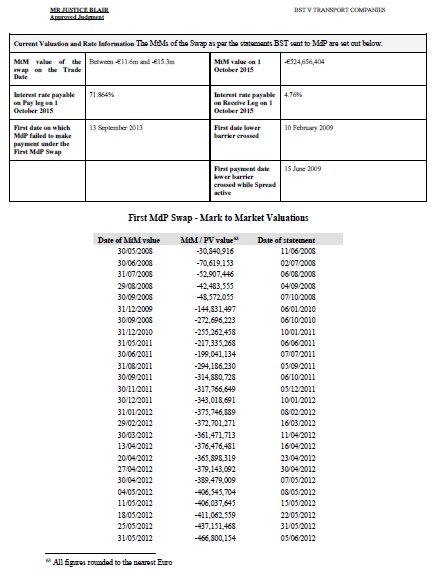

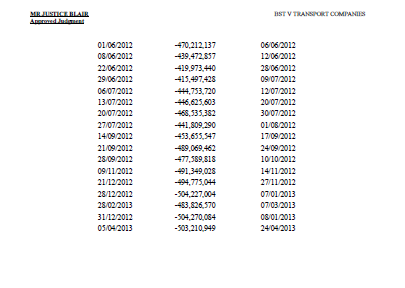

Question 2 In early 2007, the publicly-owned railway in the Portugese city of Porto, Metro do Porto (MdP), entered into an exotic interest rate swap with the Spanish bank, Banco Santander (BST) that came to be referred to as a snowball swap. This swap, along with similar swaps promoted by BST, would later become the subject of litigation when MdP and other counterparties defaulted on their obligations during 2013 Refer to page 155 of the Approved Judgement for precise details on the terms of MdP's swap, and in particular, how the spread on the floating rate leg was determined The spread on the floating rate leg of the swap was related to three month Euribor. Historical data on the level of this benchmark interest rate at quarterly intervals between 13 March 2009 and 13 December 2012 are as follows: 3m Euribor 2.1009 13 March 2009 13 June 2009 13 September 2009 13 December 2009 13 March 2010 13 June 2010 13 September 2010 13 December 2010 1.2699 0.773% 0.714% 0.879% 13 March 2011 1.026% 13 June 2011 1.1739 1.471% 1.52% 13 September 2011 13 December 2011 13 March 2012 13 2012 13 September 2012 13 December 2012 Complete Template B showing the interest rates and periodic cash flows due to be paid and received by MdP under the swap between 13 March 2009 and 13 December 2012. You should assume that the notional principal of the swap amortises on a straight-line basis, refer to page 155 of the Approved Judgement for details. Do not make any changes to the format of Template B. (9 marks) (b) In his judgement of March 2016, Mr Justice Blair described this type of swap as 'advantageous to MdP but very risky. What features of the swap with BST made it both 'advantageous and very risky to MdP? (6 marks) Total: 15 marks Metro do Porto Cash Flows Swap Fixed rate Date principal (m) Fixed rate received (%) paid 3 month Euribor (%) Digicoupon (%) (%) 13-Mar-2009 13-Jun-2009 13-Sep-2009 13-Dec-2009 13-Mar-2010 13-Jun-2010 13-Sep-2010 13-Dec-2010 13-Mar-2011 13-Jun-2011 13-Sep-2011 13-Dec-2011 13-Mar-2012 13-Jun-2012 13-Sep-2012 13-Dec-2012 BST V TRANSPORT COMPANIES MR JUSTICE BLAIR Approved Judgment FIRST MDP SWAP-KEY FACTS Basic Details Company type Sociedade annima (S.A.) Trade date 11 January 2007 Date of ISDA Master Agreement 11 January 2007 (signed 21 May 2007) Effective date 13 December 2006 Date of confirmation of Swap 11 January 2007 (signing date unknown) Maturity period 16 years Amortisation profile Termination date 13 December 2022 Amortises from 89,083,544.79 on calculation period commencing 13 December 2006 to 50,095,861.88 on calculation period ending 13 December 2022 (this is consistent with the underlying BCP Swap and Nortrem Contract) Initial notional amount 89,083,544.79 Underlying agreements details 69,303,194.05 Train rental contract with Nortrem (Nortrem Contract) dated 13 December 2002 and BCP Swap dated 27 March 2003 Outstanding notional amount Underlying agreement rate Nortrem Contract links payments to 6M EURIBOR BCP Swap swaps 6M EURIBOR for a fixed rate of 4.76% Swap Terms Receive leg BST pays 4.76% semi-annually (on 13 June and 13 December each year) Pay leg MdP pays BST (i) 1.76% semi-annually (on 13 June and 13 December each year); plus (ii) Spread quarterly (on 13 March, 13 June, 13 September and 13 December). The Spread is set to zero for the payment dates from, and including, 13 March 2007 to, and including, 13 December 2008 Spread Other features Max (0.00%, Previous Spread + 2 x Max (2.00% - 3M EURIBOR, 0.00%) + 2 x Max (3M EURIBOR - 6.00%, 0.00%- Digicoupon) The Digicoupon for the swap is 0.50% if 2.00% 3M EURIBOR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts