Question: TEMPLATE Chapter 5, Level Cash Flows Example 5.9. Example 5.16: net worth. Bill Gates Annuity - level stream of cash flows that continue for a

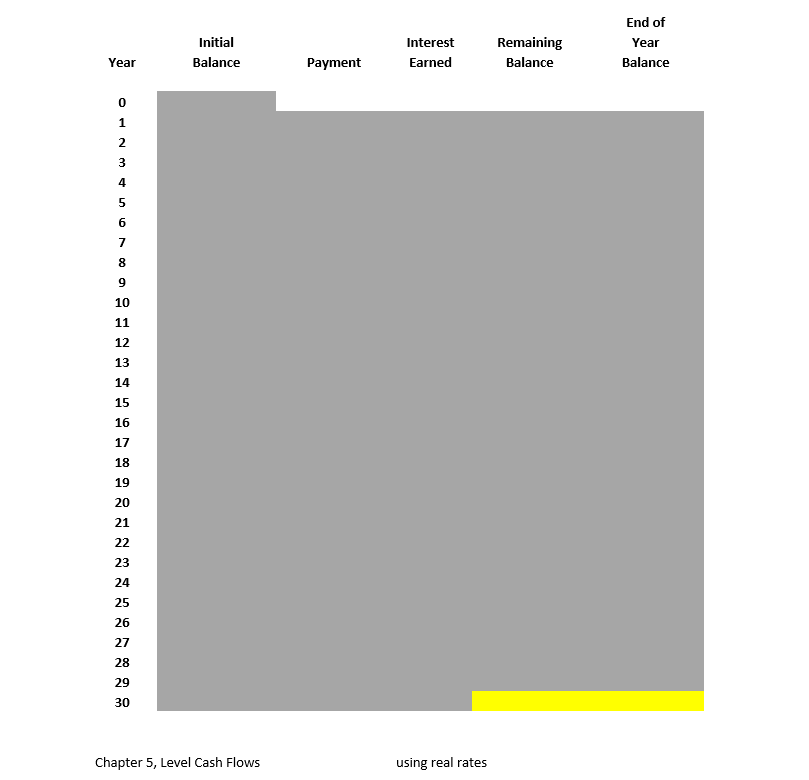

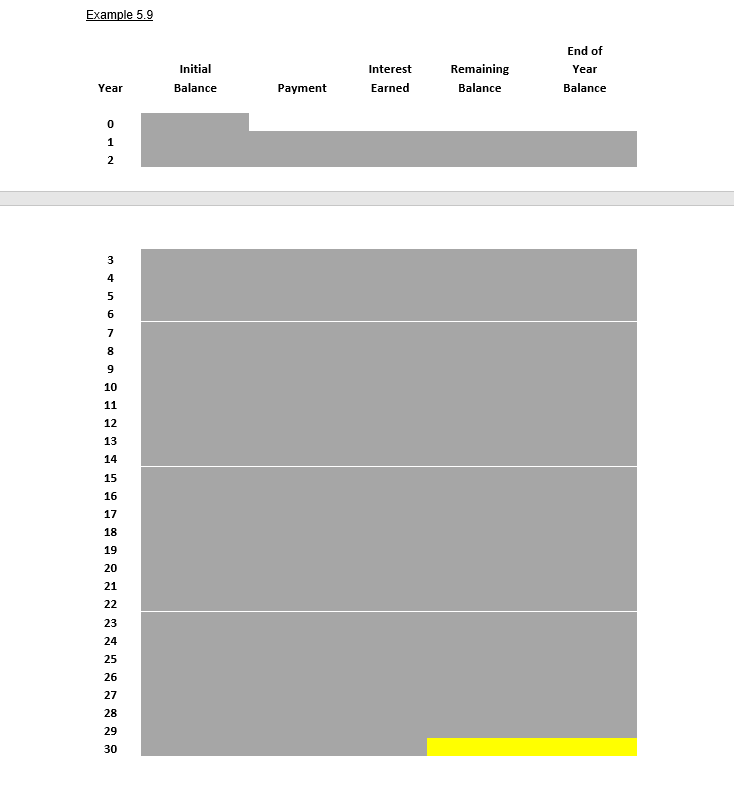

TEMPLATE Chapter 5, Level Cash Flows Example 5.9. Example 5.16: net worth. Bill Gates Annuity - level stream of cash flows that continue for a specific number of years r= interest rate; t= time periods; c dollars a year. present value of t year annuity =C[1/r1/(r(1+r)t)] nominal interest, r periods (years), t= cash flow, annual, C= solve for this? present value (t=0)= net worth in 2022 check annuity factor based on nominal interest rate annual spending stream of cash flows, 1 payment at end of year, for 30 years \$\#\#\#\#\# billion a year for 30 years Example 5.9. Example 5.16: net worth. Bill Gates long run inflation rate = assumption (1+ real interest rate )(1+ inflation rate )=(1+ nominal interest rate ) real interest = periods (years), t= annuity factor annual spending present value (t=0)= check based on real interest rate based on 2022 dollars net worth in 2022 stream of cash flows, 1 payment at end of year, for 30 years \$\#.\#\#\# billion a year for 30 years Chapter 5, Level Cash Flows Example 5.9 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 TEMPLATE Chapter 5, Level Cash Flows Example 5.9. Example 5.16: net worth. Bill Gates Annuity - level stream of cash flows that continue for a specific number of years r= interest rate; t= time periods; c dollars a year. present value of t year annuity =C[1/r1/(r(1+r)t)] nominal interest, r periods (years), t= cash flow, annual, C= solve for this? present value (t=0)= net worth in 2022 check annuity factor based on nominal interest rate annual spending stream of cash flows, 1 payment at end of year, for 30 years \$\#\#\#\#\# billion a year for 30 years Example 5.9. Example 5.16: net worth. Bill Gates long run inflation rate = assumption (1+ real interest rate )(1+ inflation rate )=(1+ nominal interest rate ) real interest = periods (years), t= annuity factor annual spending present value (t=0)= check based on real interest rate based on 2022 dollars net worth in 2022 stream of cash flows, 1 payment at end of year, for 30 years \$\#.\#\#\# billion a year for 30 years Chapter 5, Level Cash Flows Example 5.9 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts