Question: Temporary difference; determine deferred tax amount for three years; balance sheet classification [LO16-2, 16-8] Times-Roman Publishing Company reports the following amounts in its first three

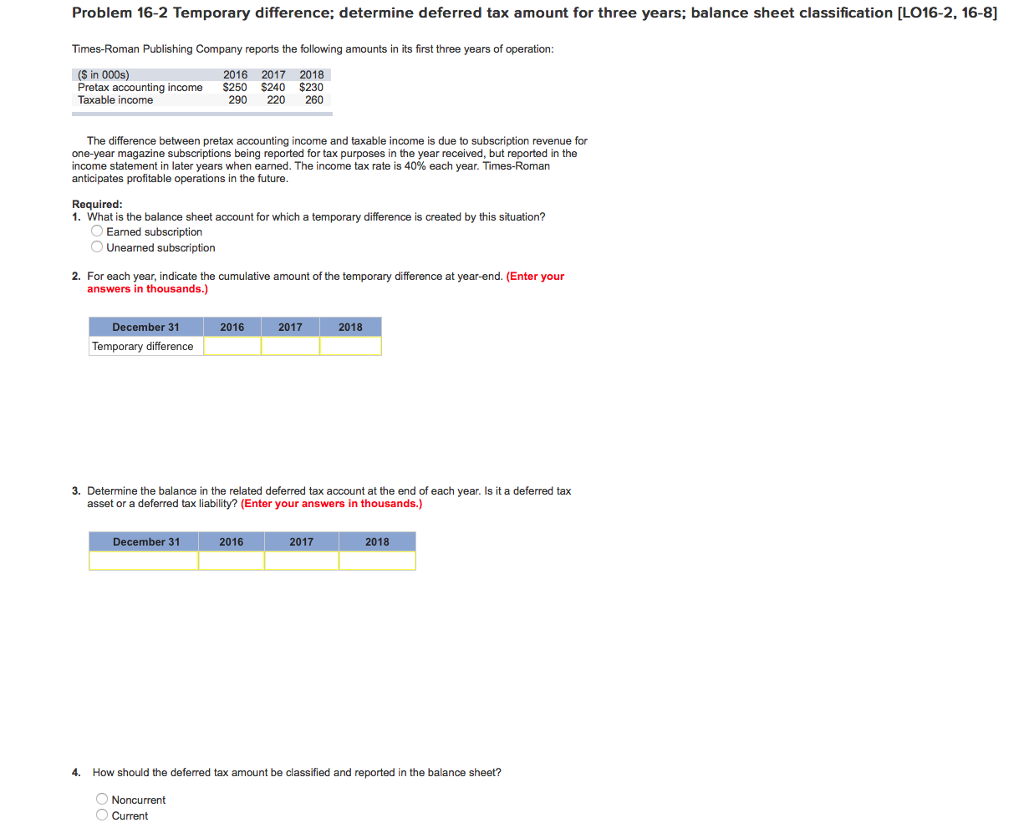

Temporary difference; determine deferred tax amount for three years; balance sheet classification [LO16-2, 16-8] Times-Roman Publishing Company reports the following amounts in its first three years of operation: The difference between pretax accounting income and taxable income is due to subscription revenue for one-year magazine subscriptions being reported for tax purposes in the year received, but reported in the income statement in later years when earned. The income tax rate is 40% each year. Times-Roman anticipates profitable operations in the future. What is the balance sheet account for which a temporary difference is created by this situation? Earned subscription Unearned subscription For each year, indicate the cumulative amount of the temporary difference at year-end. Determine the balance in the related deferred tax account at the end of each year, Is it a deferred tax asset or a deferred tax liability? How should the deferred tax amount be classified and reported in the balance sheet? Noncurrent Current

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts